Key Points:

- Selling Pressure is likely to resume in the near-term.

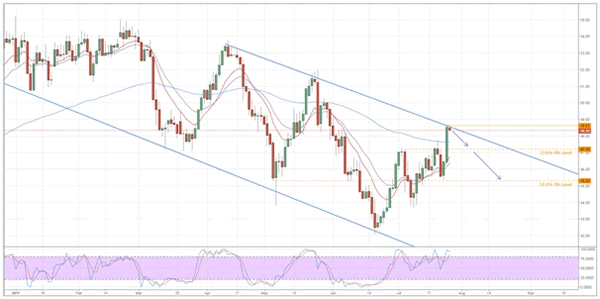

- Long-term downtrend remains intact despite recent upswing.

- Losses should be capped around the 47.20 or 45.32 handles.

Oil prices soared 4.50% higher overnight as a result of a 10.23M drawdown in the US API Crude Oil Stocks – the largest draw in 10 months. Due to this, much of the market will be bracing for another surge in buying pressure just in case the impending US Cushing Inventories data shows a similar outcome. Alternatively, the pessimists will be waiting on a reversal in the event that the next round of data proves disappointing. Whilst only time will truly tell who is in the right, a quick look at the technical bias certainly seems to suggest that the bears may be at a slight advantage.

Indeed, the recent surge has put oil prices into conflict with the upside of a long-term channel which could seriously hamstring further attempts to push oil prices higher. What’s more, a number of other technical readings are hinting that the upswing may be short-lived. For instance, stochastics have trended sharply into overbought territory which is likely to encourage a reversal away from resistance. However, we also can’t ignore the fact that the long-term trend is definitely slanted to the downside which will be putting pressure on the commodity regardless.

The main counter to a bearish technical biasis the fact that the EMA bias is clearly bullish. Nevertheless, I think this is more likely to act as a near term cap on downsides rather than be a driver of continued gains moving ahead. Specifically, the 100 day EMA should now be a source of dynamic support around the 23.6% Fibonacci level which could be where we now see oil retreat to. However, this is assuming that the next batch of US oil inventories data comes in broadly on target. If we instead see a less extreme draw or even a build, losses could smash back through this support and reach all the way back to the 45.32 handle.

Ultimately, it doesn’t appear that oil is going to be out of the woods anytime soon on the technical front. Moreover, the prevailing view that OPEC has failed in its mission to re-float prices is slowly but surely taking its toll on the commodity which is likely to see it travel reliably lower in coming weeks. As a result, our near-term view is that oil reverses and subsequently declines, however, exactly to where is not yet clear.