CAD appreciates on oil surge and continuing US political uncertainty

The Canadian dollar continues to strengthen versus the US dollar on Monday. The loonie has traded higher after the Bank of Canada (BoC) quickly went from neutral to hawkish in mid June with an interest rate hike in July to probe its change of stripes. The lack of quantitive easing program afforded the central bank the agility to make the shift and is now second only to the U.S. Federal Reserve in raising rates. Oil prices have jumped by more than 1 percent after comments from Saudi Arabia and Nigeria during the Organization of the Petroleum Exporting Countries (OPEC) compliance summit in Russia.

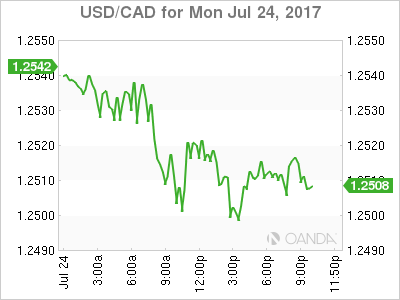

The CAD is trading near a two year high versus the dollar. The USD/CAD broke through the 1.25 price level briefly as political strife in Washington has sapped the USD from any momentum form the upcoming Federal Open Market Committee (FOMC) meeting. The Fed has hiked rates twice already, but inflation has stalled. The lack of economic indicator releases last week put too much emphasis on the ongoing Trump Administration’s Russian probe investigation. This week the highlight will be the FOMC statement which is not expected to bring major insights and the advanced estimate of the second quarter of US gross domestic product (GDP) to be released no Friday, July 28 at 8:30 am EDT.

Auto sales drove wholesale trade in May. Wholesale transactions rose 0.9 percent beating the 0.5 percent estimates and continue to show a consistent pace of growth for the Canadian economy. Monthly GDP figures will be released on Friday with an estimate of 0.2 percent growth matching the same pace reported last month, a slowdown from the positive 0.5 percent growth reported in May.

The USD/CAD lost 0.301 in the last 24 hours. The currency pair is trading at 1.2503 as the CAD got a boost from oil prices following the OPEC meeting in Russia. Positive wholesale trade numbers on a bare weekly economic calendar got the loonie off to a good start to the week.

Auto sales were also a highlight of the retail sales report published on Friday, helping sales beat the 0.2 percent forecast with a final figure of 0.6 percent. Removing sales of new and used automobiles told a less optimistic picture with a drop of 0.1 percent. Inflation also appears to be slowing down with a loss of 0.1 percent in June. Annual inflation was 1 percent and below the 2 percent target by the Bank of Canada (BoC).

Overall the positive retail sales validate the actions of the central bank who hiked rates earlier in the month by 25 basis points. The Canadian benchmark rate is now 0.75 percent and the BoC is not alone in moving ahead with tighter monetary policy despite low inflation. Forecasters still see a second interest rate hike before the end of the year, with October the most likely candidate.

Stable oil prices and US dollar weakness have amplified the positive effect of the Canadian rate hike for the loonie. The currency has appreciated touching an important psychological 80 cents versus the dollar. NAFTA negotiations are expected to kick off in August and so far there is optimism on the trade deal being tweaked instead of an intensive reworking. Elections in Mexico and the US also incentivize the two nations to expedite the talks.

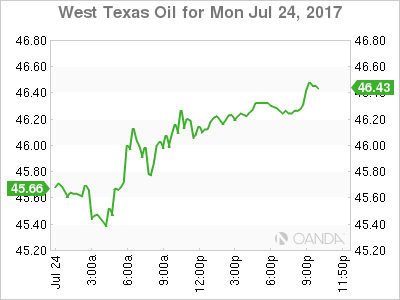

Energy prices surged 1.586 percent on Monday. The price of West Texas Intermediate is trading at $48.56 as OPEC member Saudi Arabia agreed to limit its output by around 1 million daily barrels and previously exempt producer Nigeria agreed to cap when its production reaches 1.8 million barrels a day, it currently ranges near 1.6 million.

The meeting between OPEC and Russia to discuss compliance will open the door for the next steps for energy producers. A bigger cut in production after the agreed extension is in the cards, but there are some voice of dissent as current levels are causing distress for countries who depend on oil sales to balance their budget.

Rising production in Nigeria and Libya as well as a higher rig count in the US have put downward pressure on energy prices despite the efforts of the OPEC and other major producers. Political infighting could fracture the OPEC with Saudi Arabia and Iran casting doubts on how unified the group will be going forward. Compliance with the production cut agreement has been stellar, but mostly on the efforts of Saudi Arabia, which could be entering a seasonal push for higher production along with comments from other OPEC members like Ecuador and Venezuela that want to increase production to balance their country’s budget.

Saudi Arabia has once again agreed to carry a bigger burden by cutting their production further, but Russia was very vocal that all countries need to implement the cuts in full. The words from Russian energy minister Alexander Novak could be aimed at Ecuador that has already said it needs to raise production targets, but in the grand scheme of things Ecuador is one of the smallest producers in the group and given the way its Chinese debt is structured it is the Asian giant that has a bigger say in production and probably something the OPEC members could work with.

Market events to watch this week:

Tuesday, July 25

10:00 am USD CB Consumer Confidence

9:30 pm AUD CPI q/q

9:30 pm AUD Trimmed Mean CPI q/q

Wednesday, July 26

4:30 am GBP Prelim GDP q/q

10:30 am USD Crude Oil Inventories

2:00 pm USD FOMC Statement

2:00 pm USD Federal Funds Rate

Thursday, July 27

8:30 am USD Core Durable Goods Orders m/m

8:30 am USD Unemployment Claims

Friday, July 28

8:30 am CAD GDP m/m

8:30 am USD Advance GDP q/q