The Canadian dollar appreciated slightly on Thursday as comments from Mexican officials gave more details surrounding the upcoming NAFTA renegotiation talks. The loonie is higher despite a setback in oil prices. After three weeks of weekly US drawdowns energy prices lost close to 1 percent. Canadian data due on Friday could reverse the CAD rally with inflation and retail sales setbacks forecasted.

NAFTA Details Shared

Canadian and Mexican diplomats met on Wednesday to discuss their collective strategy ahead of the NAFTA first round of talks scheduled for August 16. Mexican sources revealed the plan is to hold seven rounds of talks in three week intervals. The aggressive schedule is designed to end negotiations before the Mexican presidential elections and the US midterm elections which could encumber trade talks. The Mexican ambassador to the United States has said that the possibility of the Trump administration could back out of the talks remains.

Bare US Economic Calendar

Lack of economic data in the US and the cloud of uncertainty around the Trump administration have impaired the US dollar. The U.S. Federal Reserve appears to be turning dovish after a hawkish start of the year with two rate hikes. Inflation remains weak but the central bank estimates it to be a “temporary” set back.

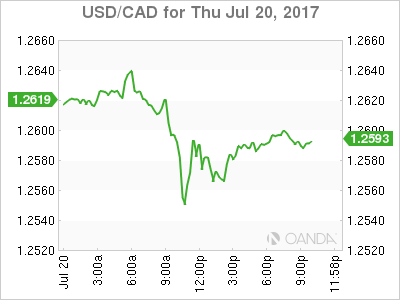

CAD Steady Ahead of Canadian Retail Sales and Inflation

The USD/CAD lost 0.131 in the last 24 hours. The currency pair is trading at 1.2575. The loonie is rising despite losses in energy prices as the US dollar weakness is the biggest trend in the market. The hawkish Bank of Canada (BoC) comments in June were followed by a rate hike in July and high probability of more to come before the end of the year. The CAD is closing the interest rate divergence with the USD as Canadian fundamentals have validated the actions of the central bank.

The next obstacle for the loonie will be the release of retail sales and consumer price index (CPI) data on Friday at 8:30 am EDT. The BoC faces a similar concern on soft inflation with other major central banks. Canadian inflation is expected to have slowed down by 0.1 percent last month. Retail sales are also estimated to have lost momentum by only gaining 0.3 percent and could be flat after removing the volatile auto sales.

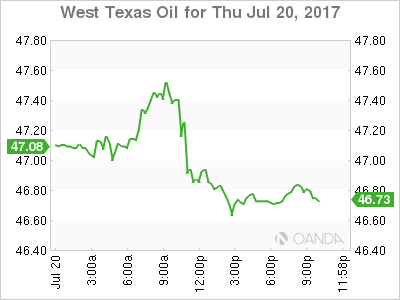

WTI Lower Ahead of Russia Summit

The price of energy lost 0.933 on Thursday. West Texas Intermediate was trading at $46.69 in anticipation of next week’s meeting between a select group of Organization of the Petroleum Exporting Countries (OPEC) and other major producers in Russia. The group will sit down to review compliance targets and there is a possibility for further measures or changes to the current agreement that runs until March of 2018.

The meeting between OPEC and Russia to discuss compliance later this month will open the door for the next steps for energy producers. A bigger cut in production after the agreed extension is in the cards, but there are some voice of dissent as current levels are causing distress for countries who depend on oil sales to balance their budget. Rising production in Nigeria and Libya as well as a higher rig count in the US have put downward pressure on energy prices despite the efforts of the OPEC and other major producers. Political infighting could fracture the OPEC with Saudi Arabia and Iran casting doubts on how unified the group will be going forward. Compliance with the production cut agreement has been stellar, but mostly on the efforts of Saudi Arabia, which could be entering a seasonal push for higher production along with comments from other OPEC members like Ecuador and Venezuela that want to increase production to balance their country’s budget.

Market events to watch this week:

Friday, July 21

8:30 am CAD CPI m/m

8:30 am CAD Core Retail Sales m/m