Thursday July 20: Five things the markets are talking about

Investors are trying to calculate whether company earnings will be strong enough to warrant such lofty equity prices, and if their own domestic economies can handle higher interest rates.

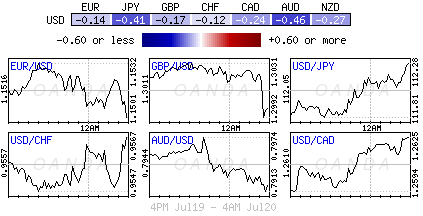

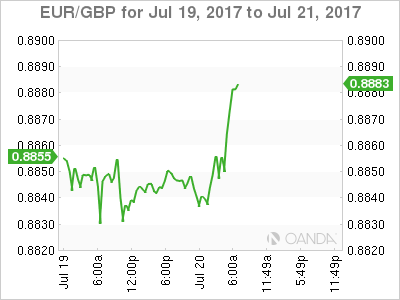

Overnight, the Bank of Japan (BoJ) pushed back its forecast for reaching +2% inflation while keeping its policy settings on hold (see below), further highlighting Japan’s struggle to achieve stable price growth. The next clues come from the ECB’s policy rate announcement this morning (07:45 am EST).

The market is not expecting any changes from the ECB interest rate policy, but is looking for any signs of the outlook for the bank’s quantitative easing (QE).

Its +€60B a month asset program expires at the end of the year and everyone wants to know what comes next. An announcement regarding the next steps is more likely in September when Euro policy makers will also release their new macro-economic projections, however, ECB’s Draghi may provide further insight at today’s press conference (08:30 am EST).

The not so ‘mighty’ dollar continues to trade atop of its 10-month low as the U.S health-care reform bill crashed this week, casting further doubt on President Trump’s policy agenda.

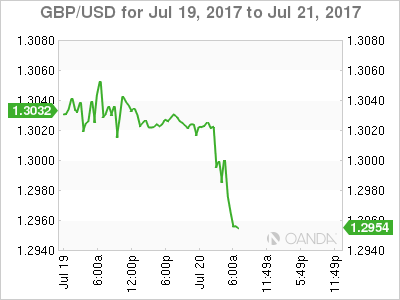

The pound is under pressure following this week’s demise on yesterday’s disappointing U.K inflation print, while the Aussie dollar strengthens on the go-to ‘carry’ trade and overnight job numbers (+14K). Global bond prices have weakened, while gold and oil trade lower.

1. Stocks get the green light

Stateside yesterday, stocks continued their rally; bypassing the markets concerns on timely implementation of U.S economic reform policies. The Nasdaq and S&P hit new all-time highs. This momentum was carried through to Asia and Europe.

Note: investor volume is lagging again for the NYSE, -17% below its three-month average, while the Nasdaq volumes remain in line. The VIX index continues to fall, dropping -2%, to 9.70 Wednesday.

In Japan, the Nikkei ended +0.6% higher, while the broader Topix rose +0.7%, its highest closing level since August 2015.

In Hong Kong, stocks finished higher for a ninth straight session, its longest winning streak since April 2015, as technology stocks powered through. The benchmark Hang Seng index ended up +0.3%, its highest level since June 2015. The Hang Seng China Enterprises Index was -0.1% lower.

In China, their major stock indexes rose for a third consecutive day, led by the blue-chip CSI300 index reaching a fresh 18-month high (+0.5%), with sentiment lifted by expectations of robust first-half corporate earnings. The Shanghai Composite Index added +0.4%.

In Europe, most indices trade modestly higher, led by the DAX. Corporate earnings and the ECB are expected to set the tone for their afternoon session.

U.S stocks are set to open little changed.

Indices: Stoxx600 +0.2% at 368, FTSE +0.4% at 7457, DAX +0.4% at 12506, CAC-40 +0.3% at 5233, IBEX-35 flat at 10590, FTSE MIB flat at 21481, SMI -0.1% at 9018, S&P 500 Futures flat

2. Oil steady after big drop in U.S. fuel stocks, gold lower

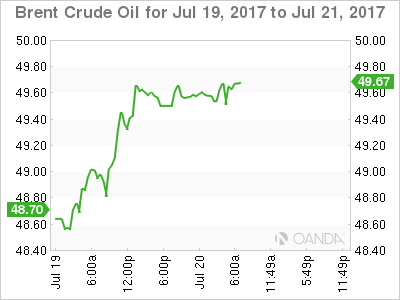

Oil prices are holding steady ahead of the U.S open, hanging on to yesterday’s gains when falling U.S crude inventories supported the market.

Note: Crude oil prices are still capped below the psychological $50-per-barrel mark on concerns about high production from the OPEC despite its pledge to cut output along with some other producers.

Brent crude futures is at +$49.68 per barrel, just -2c down from yesterday’s close, while U.S West Texas Intermediate (WTI) crude futures are at +$47.09 per barrel, -3c below their last nights close.

Prices for both crudes jumped more than +1.5% in yesterday’s session after the EIA’s report showed U.S crude and fuel stocks fell last week.

Note: U.S crude inventories dropped by -4.7m barrels in the week to July 14, against the markets expectations for a decrease of -3.2m barrels. Inventories still remain near the upper half of the average for this time of the year.

Crude ‘bears’ believe that climbing U.S output and high inventories, as well as the increased production from some OPEC members, will prevent prices from rising much further.

Gold prices are a tad lower ahead of the ECB meeting; a stronger USD is weighing on the precious metal. Spot gold has fallen -0.2% to +$1,237.86 per ounce.

3. Yields back up to flatten some Central Bank Curves

The Bank of Japan (BoJ) left its policy steady (as expected). The Interest Rate on Excess Reserves (IOER) was unchanged at -0.10%. Governor Kuroda and fellow policy makers maintained their policy framework of ‘QQE with Yield Control (YCC) ‘ with 10-year JGB’s yield around +0% and annual pace of QE at ¥80T.

The vote again was 7-2 and their outlook had the BoJ again delaying reaching their desired +2% inflation target by another year, pushing it out to 2019 from 2018 – its now the sixth such delay in achieving the target.

Elsewhere, U.S Treasuries have lost some ground given the markets interest in equities. Yields have firmed across the U.S curve, which continues to flatten. The benchmark 10’s has backed up +1bps to +2.27%, with 30-year yield unchanged and the 10/30s spread flattening by -1bp to +58.

New supply is also providing some pressure this week – new government bond sales in Germany and the U.K, along with U.S corporate debt issuance have also put some selling pressure on Treasuries. Germany’s 10-year yield has rallied +1 bps to +0.55%, the first advance in a week, while U.K 10-year Gilt yield has backed up +2 bps to +1.212%.

4. Dollar direction depends on ECB rhetoric

EUR/USD (€1.1502) continues to hover near its recent high this week on hopes of an ECB tapering hint this morning, which could lay the groundwork for an autumn policy shift. The recent run-up in investors ‘long’ EUR currency positions will be scaled back aggressively if ECB’s Draghi is less hawkish than expected. First round of support appears at €1.1475 and then €1.1440.

GBP/USD (£1.2960) was soft ahead of U.K retail sales numbers this morning (see below) after yesterday’s lower than expected U.K inflation print. Despite sales rebounding in Q2, the pound has been unable to gain any traction. Sterling remains weak due to Brexit uncertainty.

Note: U.K data has been very volatile recently with +1-2% monthly rises and falls have become the new norm, making it difficult to determine an underlying trend.

USD/JPY (¥112.35) is fractionally higher following the BoJ’s post-rate decision press conference as Governor Kuroda again reiterated his pledged do more ‘easing’ if necessary.

5. U.K Retail Sales Rebounded in Q2

U.K retail sales rebounded in Q2, growing +1.5%, a gain that is expected to contribute an approximate +0.09% to Q2 GDP growth.

Note: Retail sales were a drag on growth in Q1, shrinking -1.4%.

Digging deeper, sales were driven by spending in drug stores and on computers, sporting equipment and furnishings; food stores saw sales volumes increase only modestly amid rising prices.

The market is expecting a stronger contribution to growth from business investment and exports as the U.K consumer struggles with higher inflation and inadequate wage growth.