The ECB is the 800-pound gorilla this week and Mario Draghi’s speech is on the centre stage for currency traders. The best case scenario for all the euro bulls would be if Draghi keeps his cards closer to his chest.

The big announcement which we are expecting is not at this event but at the Jackson Hole next month. There are chances that Draghi could actually end the euro rally abruptly if he comes out wearing his well known dovish cloak. The euro has surged enormously on the back of hopes that the ECB is going to start the process of shutting the door on loose monetary policy.

Forward Guidance

The ECB needs to be clear about its forward guidance and it should reinforce that in a subtle manner. Coming out of the gates too aggressively would create shock waves in the market therefore, they should make the ground smoother at this opportunity for the actual event which could be in September. In this manner shock to the bond markets along with other markets would be minimum.

This is no longer a secret that the bank cannot easily continue its process of owning more than 33 percent of any particular bond issued by one individual country. Thus the process of exiting out of this market would require that there is a clear plan how they would scale back from it. Thus, acknowledging that tapering is under discussion amid the policy members would send the signal that some plan could be announced in September.

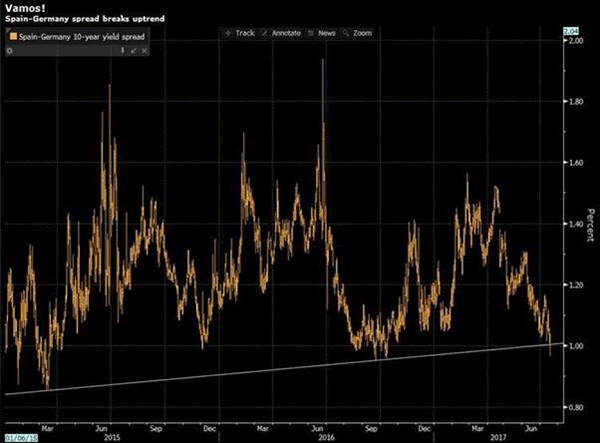

Bond Spreads Are Calm

I would expect mammoth panic in periphery market and it would suffer the most if there are any unwelcome surprises. Judging from the fact that the Spain-Germany 10-year sovereign spread is at its lowest since October, it looks likes the markets are anything but worried. Therefore, I expect the “no harm, no foul” mentality to prevail.

Draghi’s Comment To Create Opportunity in Euro And DAX

If the lower Euro was helping the export based economies and indices which are composed of export based companies then the strength in the euro is creating the contrary noise. With French political uncertainty out of the way, the inverse relationship between the euro and the DAX index is something which investors are going to bank on. Draghi dovish or hawkish comments could create more room for opportunity here.