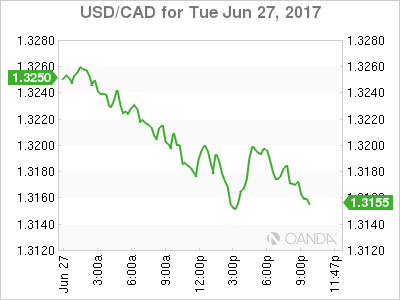

The Canadian dollar rose on Tuesday after oil prices rebounded from yesterday’s losses and the USD was lower on growth concerns. Central banks have taken the market reigns back from politicians as political risk has subsided following elections in France and the United Kingdom. The Trump administration will find it difficult to push its healthcare reform and has now pushed the vote back to after the Fourth of July. Rhetoric has been the monetary policy tool that has been used by all central banks with the Fed the only major body to go beyond words by raising rates by 25 basis points in June. The Bank of Canada (BoC) was a surprise addition with comments from Deputy Governor Carolyn Wilkins and Governor Stephen Poloz endorsing the growth of the Canadian economy and suggesting a reduction in stimulus would be forthcoming. The CAD has been trading above 1.32 since early March and is now below that level as US growth concerns rise.

European Central Bank (ECB) President Mario Draghi was confident that the current policies will bring back growth to the Euro zone. The bullish comments were part of annual central bank forum and pushed the EUR/USD to above 1.13 after the International Monetary Fund (IMF) downgraded US Growth in 2017 down to 2.1 percent. The disappointing durable goods data released on Monday continues to signal a disappointing second quarter and could put the Fed on hold despite the words from Fed speakers this week. The US central bank has said that their economic forecasts do not depend on the upcoming policies form the Administration and remain convinced that weak inflation is a temporary temporary issue.

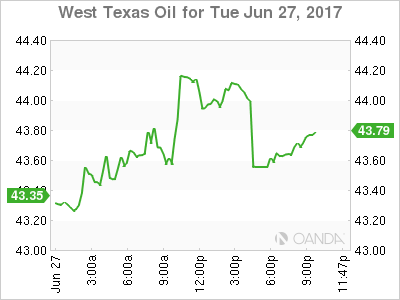

Oil prices rose ahead of US weekly inventories on Wednesday. West Texas Intermediate surged almost 2 percent and was trading at $44. Organization of the Petroleum Exporting Countries (OPEC) delegates said that they do not intend to rush into further cuts at this time. Members of the organization will meet with Russia in July where other strategies to stabilize prices might be discussed.

The USD/CAD lost 0.489 percent on Tuesday. The currency is trading at 1.3176 after political turmoil in the US once again is putting pressure on the greenback. Consumer confidence remains high reached a 16 year high in June, but once again the paradox between the survey and actual retail sales continues. Yesterday’s durable goods orders release was a blow to manufacturing forecasts and could signal a worse than expected second quarter GDP. The IMF downgrade of US growth is also weighing the dollar down. The CAD is rising on oil prices and a soft dollar ahead of the weekly crude inventories tomorrow.

The Bank of Canada (BoC) is not expected to change its monetary policy in July despite the hawkish comments from BoC policy makers, but a rate hike later this year is definitely on the table. The timing will not be totally decided by Governor Poloz as the economy and the rate moves by the U.S. Federal Reserve will finalize the decision from the BoC with the October central bank meeting a possibility with December and January also in the running. Comments from Poloz as part of the ECB Forum in Portugal could offer a continuation of the hawkish rhetoric that was first expressed in Winnipeg in a radio interview.

Oil rose 1.905 percent in the last 24 hours. West Texas Intermediate is trading at $44.08 ahead of the API and weekly US trading inventories with drawdowns in the 2 million barrel range expected. A meeting in Russia next month with OPEC delegate will also bring more insight into what major producers could do beyond their current production cut agreement to boost prices. Rising production in the US, Canada, Brazil and even OPEC members Libya, Iran and Nigeria have kept the market well supplied despite the cuts.

Market events to watch this week:

Wednesday, June 28

10:30 am USD Crude Oil Inventories

Thursday, June 29

8:30 am USD Final GDP q/q

8:30 am USD Unemployment Claims

Friday, June 30

4:30 am GBP Current Account

8:30 am CAD GDP m/m