The Canadian dollar depreciated versus the US dollar on Wednesday as the price of oil continued falling despite a higher than expected drawdown in weekly US crude inventories. U.S. Federal Reserve speakers continue to bolster the possibility of at least one more rate hike in 2017 and the start of its balance sheet reduction program, while the hawkish words of the Bank of Canada (BoC) policy makers are now lost in last week’s headlines.

Statistics Canada will release retail sales data on Thursday, June 22 at 8:30 am EDT. Analysts are forecasting a rise of 0.6 percent in the core reading after last month’s contraction. Adding the volatile auto sales that grew 3.2 percent in March the overall gain was 0.7 percent as clothing sales and convenience stores offset the gains in the auto sector. Economic indicators have been positive which lead the comments from the BoC about the growing momentum opening the possibility of a rate hike this year.

The USD was mixed against major pairs with most of the gains coming off versus commodity currencies affected by the fall in energy prices. The loonie was the most affect falling 0.42 percent, but followed closely by losses in the AUD and NZD. European pairs moved higher versus the greenback with only the JPY close to flat on Wednesday’s trading. The economic calendar does not offer much support for the USD outside of Fed speaker speeches that keep stoking the fire of a third rate raise in 2017.

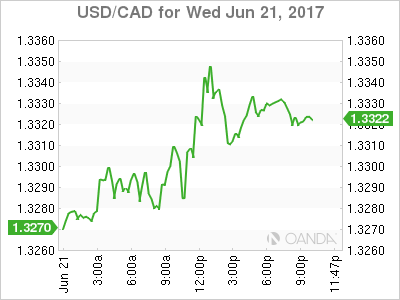

The USD/CAD gained 0.432 in the last 24 hours. The currency pair is trading at 1.3313 with the CAD failing to catch a break this week. Lower than expected inventories were not enough to convince markets oil should be priced higher. The changes in the Saudi hierarchy could spell an escalation of diplomatic and non-diplomatic tension between Iran and Saudi Arabia which could tear the Organization of the Petroleum Exporting Countries (OPEC) apart, specially after the action against Qatar. T

The high correlation with oil has put downward pressure on the loonie and most reports around NAFTA are hardly encouraging as the relationship with Canada’s largest trading partner could change if the US follows its America First doctrine. The CAD will have to depend on the retail sales data for direction as Fed speakers continue to prepare markets for an eventual rate hike later this year.

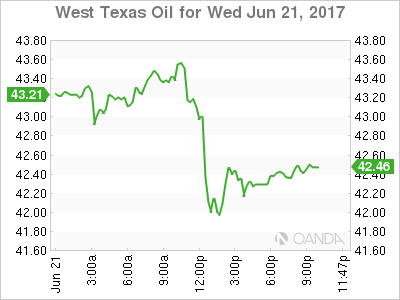

Oil price fell 2.261 percent in the last 24 hours. The price of WTI is trading at $42.29 as the market is full of supply concerns with rising animosity between OPEC partners offsetting the high compliance of the production cut agreement yet with few results to show for it. Iran hinted today that the group could be working on deeper cuts, only for those comments to be dismissed by other oil producers in the group. he Energy Information Administration (EIA) released a deeper than expected drawdown of 2.5 million barrels when 1.2 million were forecasted. Gasoline stocks surprised with a drawdown of 600,000 barrels but not enough to offset the reality of over production specially with Libya and Nigeria resuming their production at full force.

Saudi Arabia’s King Salman shook up the kingdom’s hierarchy as he put his son Mohammed bin Salman as next in line to succeed him. The 31 year old replaces his cousin and has been a rising star in Saudi politics and economy as he is also in charge of bringing the kingdom out of its dependancy to energy which is easier said than done. His appointment raises the stakes as to when a new confrontation will happen with Iran who sits in the other spectrum of OPEC membership. If the embargo on Qatar by other Arab states is any indication it could escalate rather quickly as Saudi Arabia wishes to have closer ties to the US and Russia.

The showdown between US shale producers and OPEC members continues and with stagnant demand for energy around the globe, prices have been caught in a tight range with only big supply disruptions having an impact, only to be cancelled once they get sorted.

Market events to watch this week:

Thursday, June 22

8:30 am CAD Core Retail Sales m/m

8:30 am USD Unemployment Claims

Friday, June 23

8:30 am CAD CPI m/m