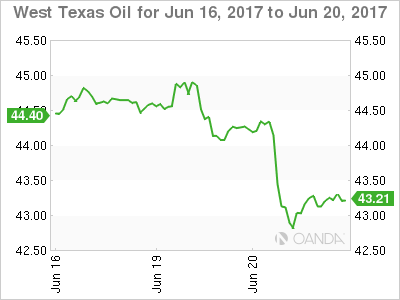

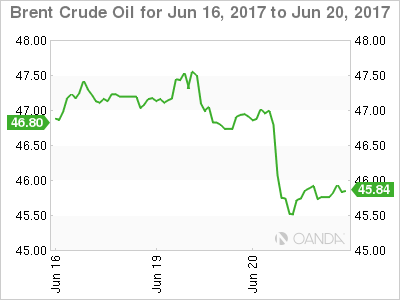

Oil gushed lower again overnight with both Brent and WTI taking out their early May panic liquidation lows and falling around 2 percent in the session.

This was despite OPEC/Non-OPEC’s compliance being announced at 106 percent and the American Petroleum Institute’s crude inventory draw coming in higher than expected at 2.72 million barrels. The inability of oil to stage even a modest dead cat bounce after these two data points must be a concern to producers although it may be that stop loss selling through the May lows overwhelmed both.

From a technical perspective, the picture continues to look ugly with the short end of the oil curve being overwhelmed by increased production from exempt Nigeria and Libya along with OPEC’s perpetual migraine, U.S. shale. Producers will be looking with some trepidation now at the official U.S. EIA Crude Inventory Report where the street is forecasting a 2 million barrel drawdown in crude and a gain of 0.1 million in gasoline inventories. A positive increase on either almost certainly seeing an uncapped leak of crude prices lower.

Brent spot trades at 45.85 this morning with resistance at 46.60 and 47.65. Support lies in the 45.10/45.30 region with a break of this area implying the slick could spread to the November lows of 43.00.

WTI spot trades at 43.25 this morning with resistance at 44.00 and 45.00. Interim support lies at the overnight low of 42.70 with the November low at 42.00 clearly in traders crosshairs.