Today’s OPEC meeting will determine the direction of oil for the coming months with an extension of the production cut widely expected.

Anticipation is building in the oil market as the meeting of OPEC, and Non-Opec members get underway to discuss the joint production cut expiring at the end of the month. In the spirit of “future guidance,” various members of the grouping have signalled that an extension of six months is a done deal and could be as long as nine months.

Markets are certainly liking what they are hearing with both Brent and WTI up over one percent in Asia trading extending the fearsome bull run of the last week or so. OPEC is also being helped by the Americans for a change, with last nights Crude Inventory number coming in at -4.425 million barrels. Twice as high as the anticipated drop and the seventh drop in a row. Even more pleasing was that the gasoline and distillate inventories did not increase to offset it. America, it seems is consuming petroleum products faster then they are pumping them.

So what surprises could OPEC/Non-OPEC spring on us today? The markets seem rather complacent to my eyes and OPEC has proven it can surprise. Possible outcomes could be…

The meeting dissolves in acrimony with no extension. Unlikely to happen of course but this is OPEC. A worst case scenario which would not likely be positive for oil at all!

A six-month extension to the present deal. The baseline case and with oil having rallied so far so soon on it, this could bring profit taking to the market ahead of the weekend. Going forward as U.S. shale increases, it may not be enough to drain the glut, and both contracts have some serious resistance not too far above present levels.

A nine-month extension seems to be getting increasingly priced into crude. It may be bullish initially but could generate the same scenario as number 2 above.

An extension through to the end of 2018. Would most likely be construed as positive for oil and signals OPEC/Non-OPEC’s determination and dedication to removing supply imbalances.

An extension and an increase in the production cut. Very tough to achieve given the disparate group but would certainly give the most bang for its buck. Could likely be very bullish for oil prices as long as everyone complies, but that is another story.

Crude, of course, has continued its march higher from overnight, ahead of today’s OPEC meeting.

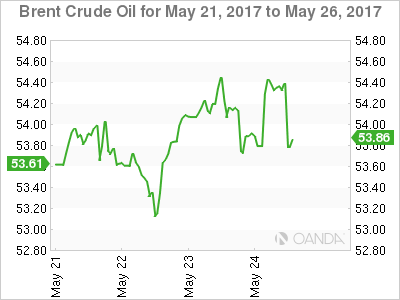

Brent

Brent spot opened at 53.80 and is trading near its overnight highs of 54.50 with a break through this level targeting 56.50 from a technical perspective. Lying in wait though is the 57.00 level which has capped all rallies in 2017. A daily close above could signal that OPEC has finally got it right. Support is found initially at the 100-day moving average at 53.40 and then 53.00.

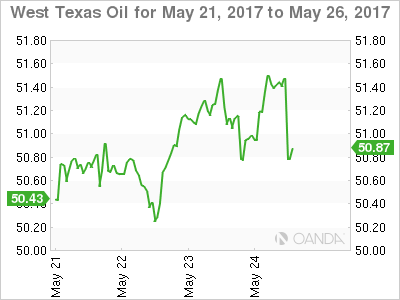

WTI

WTI spot opened at and traded 51.00 in early Asia and has traded up to its New York highs at 51.50 before easing 30 cents. A break above 51.50 targets 52.00. A daily close opening a potential of the 54.50 regions, which has capped WTI for all of 2017. Like Brent, a daily close above this level would be a Nirvana moment for OPEC.

Summary

We may be seeing a bit of position reduction and profit taking ahead of the result from Vienna today. The direction of oil is very much in OPEC and Non-OPEC’s hands now, but breaking 2017’s highs in Brent and WTI may require the grouping to deliver a crude missile of a surprise.