Commodities diverge as Oil settles near its recent highs ahead of tomorrow’s OPEC meeting, while Gold feels the pain of a stronger U.S. Dollar.

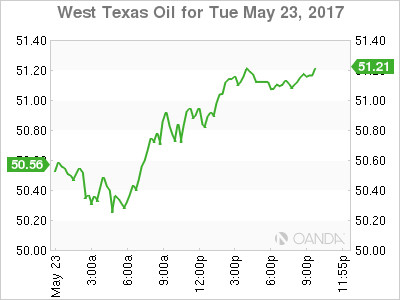

Crude recovered from its early losses overnight with both Brent and WTI finishing roughly unchanged as both contracts head into a pre-OPEC meeting holding pattern. President Trump’s proposal to sell half of the United States’ Strategic Petroleum Reserve had only a transitory effect, with guidance from various OPEC Ministers pointing to the likelihood of a six, and possibly nine-month extension, to the production cut arrangement.

As we head into tomorrow’s meeting, it does feel as if this has been priced into the both contracts for now raising the possibility of some profit taking once OPEC announces its decision. Attention will then turn to the rather forgotten U.S. Crude Inventory numbers out very late in the New York session.

Brent spot has opened at the top of its recent range in Asia at 54.15 but faces initial resistance just above, at 54.30 followed by 55.50. It is comfortably above its 100-day moving average and first support at 53.40 followed by 52.50.

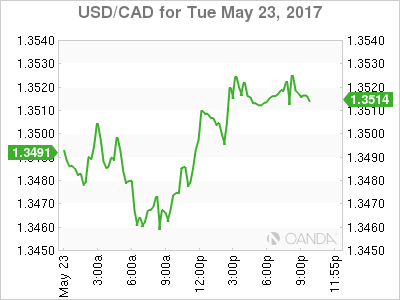

WTI spot trades at 51.25 near its overnight highs and initial resistance at 51.45. It is followed by the rather more formidable 52.00 level. More importantly, WTI has finally closed above its 100-day moving average and first support at 50.75 with the next support below this at 50.00.

GOLD

Gold fell some 14 dollars overnight giving up all of Monday’s gains to finish rather bearishly near its lows around 1251 where it trades in Asia this morning. A resurgent U.S. Dollar and equity markets along with dovish comments on the Euro by various ECB members seem to have taken the wind out of gold’s sails for now.

Gold could face more pain if tonight’s FOMC minutes shows that the Federal Reserve is still on course for two to three more rate hikes this year and a start to the balance sheet reduction. Any combination of the above most likely being bullish for U.S. Dollars, especially as post a June hike, the market has not priced this possibility in on its forward indicators.

Gold narrowly avoided breaking support overnight at 1250 followed by 1245, a daily double bottom and the 200-day moving average. This average has been a crucial pivot point in gold’s price action this year, a daily close below could signal a deeper correction.

Gold has resistance at the 1265 area initially followed by the more important 1271.25 double top.