US oil inventories, Bank of Canada and FOMC minutes to drive markets

The US dollar is higher against most major pairs after staging a recovery ahead of the release of the Federal Open Market Committee (FOMC) May meeting minutes on Wednesday, May 24 at 2:00 pm. The Fed hosted no press conference in May, leaving the market to wait for the minutes to gather insights into the views of the central bank on the path of rates for the reminder of the year. The CME FedWatch tool is showing a 83.1 percent probability of a rate hike based on futures fed funds prices. Fed speakers have issued mix rhetoric, but so far the rate hike remains firmly on the table for the meeting to be held on June 13 and 14.

The Bank of Canada (BoC) will release its rate statement on Wednesday, May 24 at 10:00 am EDT. The central bank is heavily expected to hold rates unchanged despite growing pressure from a heating up house market in major cities. The CAD has been caught between a falling loonie and the more aggressive tone of the US regarding the NAFTA renegotiation. The US has set in motion the process needed to renegotiate the deal in late August. BoC Governor Stephen Poloz is expected to address the household debt and real estate market with mentions about the upcoming trade negotiations.

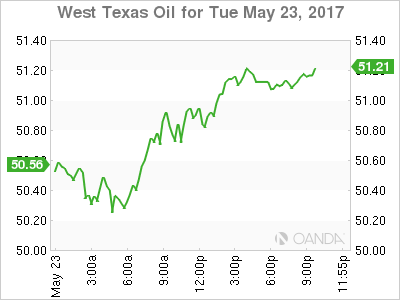

US weekly oil inventories will be release at 10:30 am EDT by the Energy Information Administration (EIA). The forecast calls for a 2.4 million barrel drawdown to make it 7 contractions in a row. Oil prices have been caught between the efforts of the Organization of the Petroleum Exporting Countries (OPEC) to limit global production with their production cut agreement and the US shale producers ramping up operations to take advantage of stable prices. The release of the weekly inventories one day before the OPEC meeting in Vienna anticipated to end with the announcement of a 6 to 9 month extension will impact commodity currencies.

The EUR/USD lost 0.396 percent in the last 24 hours. The single pair is trading at 1.1197 after the USD rebounded ahead of the release of the May’s FOMC meeting minutes. The turmoil the Trump Administration has found itself into after the firing of FBI Director James Comey has put downward pressure on the USD. The pro-growth policies expected at the beginning of Trump’s term have hit another wall as further divisions within the Republican party could emerge delaying them until the last quarter of the year, or maybe well into 2018.

Monetary policy divergence still favours the dollar. The U.S. Federal Reserve is set to hike in June to leave the benchmark rate in a range of 100 to 125 basis points. Investors will be looking at the notes from the central bank meeting to look for more details on the balance sheet wind down which is forecasted to take place in the second half of the year.

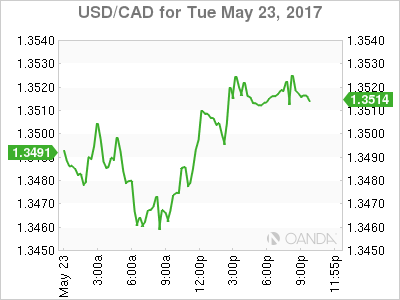

The USD/CAD gained 0.072 percent in the last 24 hours. The currency pair is trading at 1.3518 after the USD staged a comeback in the North American trading session. The pair went from a daily low of 1.3456 and quickly went above the 1.35 price level where it is currently trading. Oil prices boosted the loonie on Monday and early trading Tuesday coupled with a strong wholesale trade data in Canada but as traders booked their profits on a weak USD and repositioned for a slightly hawkish Fed minutes the greenback bounced back.

The Bank of Canada is forecasted to hold as the economy is still struggling to regain the momentum is lost with the drop in oil prices two years ago. With the Fed all set to hike rates in June, this will widen the interest rate gap between the two economies. Trade disputes and the more aggressive tactics by the US to solve them are also a concern as Canada exports two thirds of exports to its southern neighbour.

The price of oil gained 0.926 percent on Tuesday. The West Texas Intermediate is trading at $51.14 ahead of Wednesday’s release of the weekly US crude inventories. Another drawdown is awaited, marking 7 contractions in a row in US inventories. The US President Donald Trump proposed to sell half of the strategic oil reserve starting in October. Ironically the fund was started in 1975 to avoid a repeat of gas price surges during the Arab oil embargo. The Organization of the Petroleum Exporting Countries (OPEC) is now once again cutting production, but even with all the members and other influential producers such as Russia they can only keep the price stable. US production has grown to the point where it could justify the sale of the emergency stocks stored in Louisiana and Texas. Although it is hard for this to be approved by congress, specially now, but it does send a signal to OPEC ahead of their meeting on Thursday to extend their agreement to cut production.

Market events to watch this week:

Wednesday, May 24

- 8:45am EUR ECB President Draghi Speaks

- 10:00 am CAD BOC Rate Statement

- 10:00 am CAD Overnight Rate

- 10:30 am USD Crude Oil Inventories

- 2:00 pm USD FOMC Meeting Minutes

- 10:00pm NZD Annual Budget Release

Thursday, May 25

- 4:30 am GBP Second Estimate GDP q/q

- All Day ALL OPEC Meetings

- 8:30 am USD Unemployment Claims

Friday, May 26

- 8:30 am USD Core Durable Goods Orders m/m

- 8:30 am USD Prelim GDP q/q