A resurgent dollar in Asia sees oil and gold trade slightly lower, but they remain constructive in the larger technical picture ahead of event risk this week.

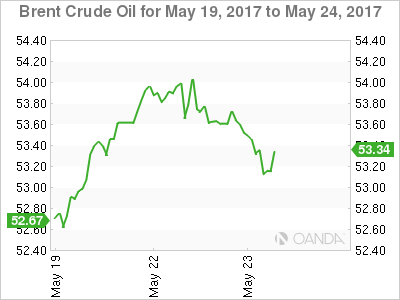

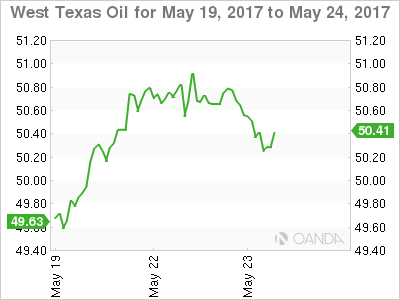

Oil had a steady night with an upward bias as traders chose to buy dips in prices during the New York session rather than chase the market to new highs. Both Brent and WTI contracts posted new monthly highs, at one stage up over one percent before drifting lower later in the session to mark a sideways day when all was said and done.

The OPEC/Non-OPEC production cut extension seems now fully priced in for Thursdays meeting and it will likely take either a surprise extension of the length of the deal or a larger than anticipated cut to give oil renewed topside impetus. However, a weaker dollar generally should ensure that barring any other news; crude remains bid on dips as we head into Thursday.

OIL

Brent spot trades at 53.30 and has fallen below its 100-day moving average at 53.40. It has initial support at 53.00 followed by 52.50. Resistance is at 54.25 with a break opening a possible move to 54.50.

WTI spot has failed to close above its 100-day moving average for the 2nd day in a row. It lies just above current levels at 50.80. The next resistance is the overnight high at 51.05 followed by 52.00. Intraday support is being tested as we speak at 50.40 and is followed by 49.50.

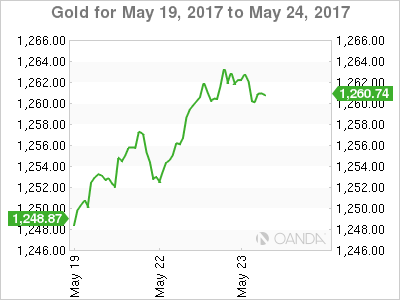

Gold

Gold continues to trade constructively as the U.S. Dollar fell overnight following Chancellor Merkel’s comments. Gold rallied from 1256 to close around 1260 before catching another tail wind in early Asia trading, moving higher to 1263. Nervousness ahead of Thursday’s OPEC meeting should see traders continue to hedge risk by buying gold on dips over the next few days.

Gold has initial resistance at Thursday’s high of 1265 and then at 1270. Support appears initially at 1251.80 and then the 200-day moving average and a daily double bottom at the 1245.70 area. Only a daily close below this level would suggest the technical picture for gold has changed.