Mexican Peso falls by over 2% in Asia as a proxy for the Brazilain Real as the Brazilian President gets embroiled in a corruption scandal.

It seems that Washington D.C. isn’t the only centre of power to be enveloped in political scandals today, with President Michel Tenner apparently recorded endorsing bribes tosilence the now jailed former speaker, Eduardo Cunha, according to a story broken today by the O Globo newspaper. The tapes form part of a plea bargain arrangement by two of the owners of the world’s largest meatpacker, BJS; itself engulfed in a corruption scandal for bribing officials, allegedly, to turn a blind eye to the export of tainted meat. President Tenner has only recently assumed the presidency, having got the job following the impeachment of his predecessor, Dilma Rousseff. You really couldn’t make this up.

The story broke after North American markets had closed during the Asia morning. It has made those holding Brazilian assets or those wanting to short anything Brazilian’s life a bit difficult. Brazil has a closed capital account, and the Real (BRL) is only able to be traded off-shore via the Non-Deliverable Forward market.

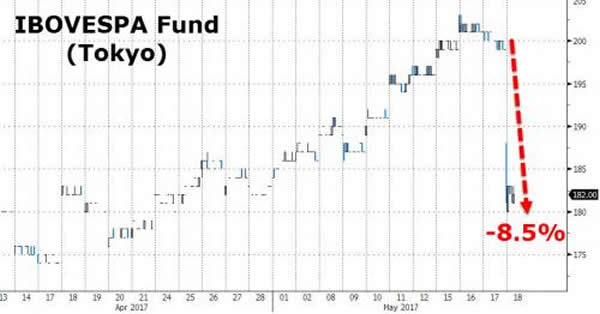

To put this in context to see just how seriously the street is taking these allegations, we need to look no further than the Next Funds Ibovespa Linked ETF which trades in Tokyo. It plunged 8.50% during the Tokyo trading day.

That leads us back to the Mexican Peso’s two percent plus fall against the U.S. Dollar. As I said, there is basically no off-shore market for the Brazilain Real outside of North American trading hours. And like any emerging market, it can be a market you can’t emerge from in an emergency. Traders have therefore reached for the nearest available currency that has some liquidity and can act as an approximate proxy for the Brazilian Real. Step forward the Mexican Peso.

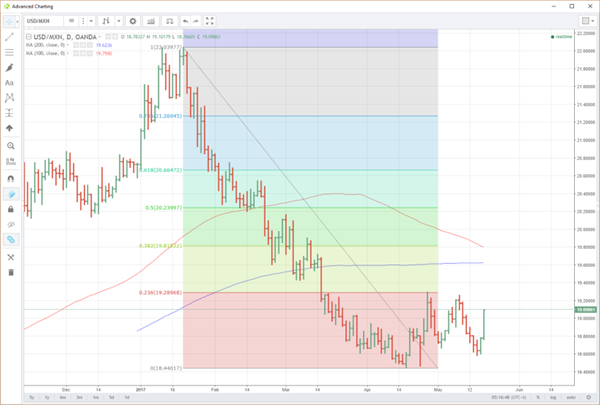

It does seem rather unfair on Mexica, but I guess it is on the same continent is closer than Canada and has a free floating currency. The USD/MXN flew higher from 18.7650 to 19.1000 and is trading just below this level as we speak at 19.0750. The fact that it has remained at these levels could imply that there is a lot of somewhat desperate interest still out there looking to mitigate Brazilian risk.

In the process, today’s USD/MXN rally has snapped a five-day cycle of MXN appreciation against the USD. The danger is of course that we could see a return to the mean, USD/MXN lower, once North American trading begins. Conversely, the USD/MXN rally could stay extended if liquidity does not appear in the U.S. session and interest remains one way. Investors may then also chose to buy the USD/South America NDF’s of its neighbours instead.

Looking at the technical picture, USD/MXN has initial resistance at the day’s highs of 19.1000. That is followed by the 26th of April high and also the 23.60% Fibonacci retracement at 19.29000. A break here, should it happen opens a move to the 19.6000/19.8000 region, the home of the 100 and 200-day moving averages.

Support is at the day’s lows around 18.7650 followed by 18.6000. Long-term support rests at the 18.4000 level.

The Mexican Peso has assumed the role of the poor man’s Real today following another alleged political scandal. It is perhaps a welcome break to be writing Sao Paolo instead of Washington D.C. As a proxy for the Real, the Peso maybe make back some of its losses once North America commences its day. However, should liquidity remain non-existent in the BRL, the Peso could remain under pressure along with its regional neighbours to the South as a proxy.