Yen trades mildly higher in otherwise quiet markets today. The Japanese Cabinet Office upgraded assessment of the economy for the first time in 21 months. The office said in its December report that "the Japanese economy is on a moderate recovery, while delayed improvement in part can be seen." That compared to prior description that the economy was in a moderate recovery "while weakness can be seen recently." In particular, exports and private consumptions outlook are more upbeat, showing "movements of picking up". Nonetheless, improvement in business investment "appears to be pausing", same as prior assessment. Also, the government cautioned that "attention should be given to the uncertainty in overseas economies and the effects of fluctuations in the financial and capital markets."

The Japanese Yen remains the weakest major currency for the month. But downside momentum is diminishing. Yen crosses turned into sideway trading as USD/JPY, EUR/JPY and GBP/JPY made temporary tops at 118.65, 124.08 and 148.42 respectively. But near term outlook remains bullish as long as 114.76, 120.90, 142.98 support levels hold. CAD/JPY, which is the strongest pair this month, also made a temporary top at 88.90. Some consolidations would be seen in near term. But outlook will stay bullish as long as 85.59 minor support holds. Current rally from 75.80 is expect to head to 61.8% retracement of 106.48 to 74.80 at 94.37 next.

On the data front, UK public sector net borrowing rose to GBP 12.2b in November. Japan all industry index rose 0.2% mom in October. Australia Westpac leading index rose 0.0% mom in November. New Zealand trade deficit narrowed to NZD -705m in November.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 121.83; (P) 122.30; (R1) 122.90; More…

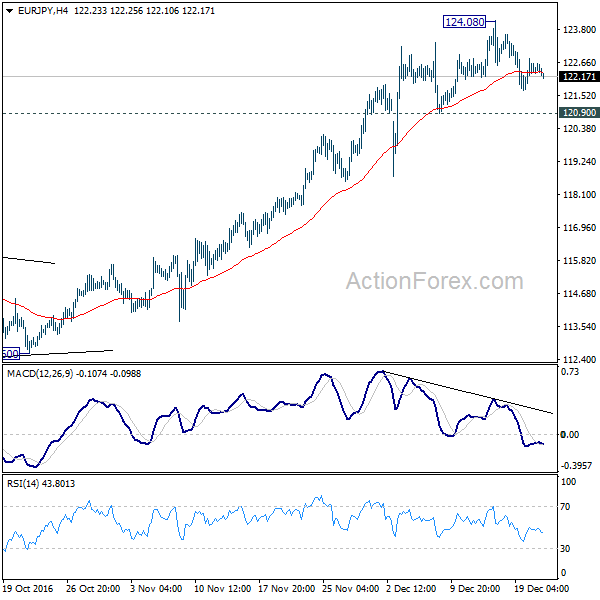

Intraday bias in EUR/JPY stays neutral for consolidation below 124.08 temporary top. As long as 120.90 support holds, further rally is expected in near term. Above 124.08 will target 126.09 key resistance next. Considering bearish divergence condition in 4 hours MACD, we’d be cautious on topping around 126.09. Meanwhile, break of 120.90 will indicate short term topping and turn bias to the downside for 55 days EMA (now at 118.56).

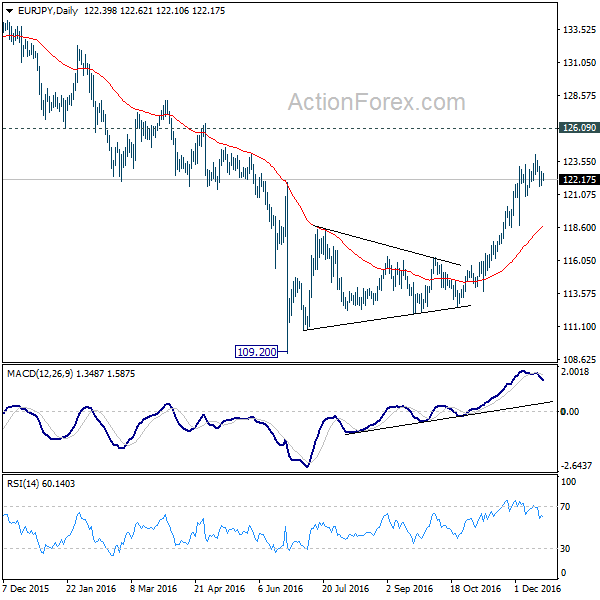

In the bigger picture, price actions from 109.20 medium term bottom are seen as correcting whole down trend from 149.76 to 109.20. There is prospect of another rise towards 126.09 key resistance level before completion. But even in that case, we’d expect strong resistance between 126.09 and 141.04 to limit upside, at least on first attempt.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Nov | -705M | -500M | -846M | -815M |

| 23:30 | AUD | Westpac Leading Index M/M Nov | 0.00% | 0.06% | ||

| 4:30 | JPY | All Industry Activity Index M/M Oct | 0.20% | 0.10% | 0.20% | 0.00% |

| 9:30 | GBP | Public Sector Net Borrowing (GBP) Nov | 12.2B | 11.5B | 4.3B | |

| 15:00 | EUR | Eurozone Consumer Confidence Dec A | -6 | -6.1 | ||

| 15:00 | USD | Existing Home Sales Nov | 5.52M | 5.60M | ||

| 15:30 | USD | Crude Oil Inventories | -2.6M |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box