The biggest development last week was the sharp selloff in the British Pound on surging uncertainty over the election in June. FTSE 100 jumped to record high, riding on Sterling weakness. It was believed that the Conservative Party would have a landslide victory back in April when Prime Minster Theresa May called for a snap election. Back then, the Conservative had over 20 points lead over Labour. However, according to the latest YouGov poll showed that the margin narrowed sharply to just 5pts. The news sent GBP/USD to as low as 1.2774 before closing at 1.2794, comparing to 1.3047 high in May. EUR/GBP jumped to as high as 0.8750 before closing at 0.8725, comparing to this month’s low at 0.8383. GBP/JPY also dropped sharply to as low as 142.11 before closing at 142.44, comparing to this month’s high at 148.09.

Voting intention: Conservative 43 vs Labour 38

There are a few points to note regarding the polls. According to the voting intention poll on May 24-25, 43% would vote for Conservative, 38% for labour. Comparing to the same poll on May 18-19, support for Conservative dropped 1% while support for Labour rose 3%. That is, in a matter of one week, the lead has narrowed from 9% to 5%. The trend is indeed rather worrisome for Theresa May, considering that it was once over 20%.

Favourability rating: Labour once overtook Conservative

According to favourability ratings poll, the favourability ratings for Theresa May and Conservative dropped sharply from +10 and +2 on April 19-20, to -8 and -13 on May 22. Favourability ratings for Jeremy Corbyn and Labour bounced sharply from -42 and -28 on April 19-20, to -11 and -5 on May 22. That is, on May 22, Theresa May only had 3 pt favourability lead over Corbyn. And indeed, favourability of Labour has surpassed that of Conservative, with 8 pt lead.

But reversed after Manchester attack

However, situations have changed after the terrorist attack in Manchester. favourability of May jumped back to +1 while that of Corbyn dropped back to -16. May now had 17 pt favourability lead over Corbyn. The position of Conservative and Labour also reversed again with Conservative at -7, Labour at -8. It’s possible that the dip in form of Conservative was past the trough already. But it remains to be proven by more data.

Markets seriously considering different election outcome

But after all, the markets are now seriously looking at different possible outcomes of the election on June 8. A less than overwhelming win for Theresa May and Conservative, which now seems likely, will weaken May’s hand in Brexit negotiation with EU. But investors are also likely looking beyond the negotiation itself. A hung government will definitely make the transition period for UK very difficult. Also, a Labour led coalition, with Lib Dem, could mean cabinet reshuffle, and Brexit preparation work could be started over again. And, there were criticism that Labour’s manifesto means ramping up spending and debt. Brexit transition could also be much more chaotic.

FTSE at record on sterling weakness

In any case, Sterling will remain vulnerable in the coming two weeks due the uncertainties while FTSE 100 will follow negatively. FTSE’s pull back from March high at 7447.00 was contained at 7096.83 and the rise from 5499.50 then resumed. The strong support from 7093.56 maintained medium term bullishness Also, the break of long term channel resistance indicates upside acceleration. FTSE could now be heading to 100% projection of 4791.01 to 7112.74 from 5499.50 at 7831.24. Based on current correlations, this should be inspired by deeper selloff in Sterling.

A look at GBP/USD, EUR/GBP, GBP/JPY and GBP/CHF

Looking at the British Pound, GBP/USD’s sharp decline last week argues that rise from 1.2108 has completed at 1.3047 already. Deeper fall could be seen back to 1.2614 resistance turned support first. Break there should also confirm completion of whole corrective pattern from 1.1946. In that case, the larger down trend should resume through 1.1946 low. This will be the favored case as long as 1.2926 minor resistance holds.

EUR/GBP’s break of the short term falling trend line also indicates solid upside momentum. Further rise should be seen in near term to 0.8786/8851 resistance zone. The strong support seen at 0.8303 and 0.8312 suggests that the fall from 0.9304 has completed. Decisive break of 0.8786/8851 would pave the way back to 0.9304. This will be the favored case as long as 0.8602 support holds.

The sharp fall in GBP/JPY also indicates completion of rise from 135.58 at 148.09. But the medium term outlook is not as bearish as the above two. Hence, while further decline is expected as long as 145.43 resistance holds. We’ll look for bottoming signal again below 61.8% retracement of 135.58 to 148.09 at 140.35 and above 135.58.

The steep decline in GBP/CHF and break of near term trend lie now argues that whole rise from 1.1635 has completed at 1.3067. Near term outlook will stay bearish as long as 1.2690 resistance holds, for 1.2213 support. More importantly, the structure of price actions from 1.1635 to 1.3067 argues that it’s a correction that completes ahead of 38.2% retracement of 1.5570 to 1.1635. Break of 1.2213 could then resume the down trend from 1.5570 through 1.1635 low.

US data to be watched this week, Dollar index vulnerable

Looking ahead, US data will be back in focus in the coming week with ISM manufacturing and non-farm payroll featured. FOMC minutes released last week affirmed markets’ expectation of a June Fed hike, no doubt. Policy path in US is basically set, three hikes in total this year and shrinking of balance sheet to start towards the end. Some extra inspiration is needed for Dollar index to start a U-turn. Strength was seen in US equities last week with S&P 500 and NASDAQ making new record high. DOW wasn’t too far behind. But there was no reaction in treasury yield and Dollar.

Technically, we’d like to point out again that fall from 103.82 in dollar index could be a medium term correction. That is the five wave sequence from 72.69 (2011 low) has completed at 103.82 last year. Next near term focus is 61.8% retracement of 91.91 to 103.82 at 94.46. Sustained break there should pull the index down to key long term cluster support at 91.91 (38.2% retracement of 72.69 to 103.82 at 91.93) before having solid support for rebound. And this will now be the slightly favored case as long as 98.49 near term resistance holds.

Trading strategies – Exit EUR/AUD long, hold USD/CAD short

Regarding trading strategy, we’d hold on to EUR/AUD long (bought at 1.4790, stop at 1.4850). The cross breached 1.5094 important resistance briefly but there was no follow through buying. Also, bearish divergence condition remained in 4 hour MACD and daily MACD has crossed below signal line. Risk of rejection from 1.5094 is increasing. Therefore, we will close out the EUR/AUD long at market this week to pocket the profits first.

We sold USD/CAD at open at 1.3510 last week. The pair dipped to 1.3387 but recovered since then. The anticipated strength in oil price didn’t happen. Instead, WTI tumbled after OPEC announced to extend production cut by 9 months as expected. Still, we’re holding on to the technical view that rise form 1.2968 is completed at 1.3793. And, there is chance of completion of whole medium term rise from 1.2460 too. Hence, we will hold on to USD/CAD short, and lower the stop to 1.3550.

For the week ahead, we’ll consider selling Sterling. But the decision on what to sell against is a bit difficult. Firstly, while we’re staying bearish in dollar index and bullish in EUR/USD, it should be noted that dollar index is close to 94.46 fibonacci level and EUR/USD close to 1.1298 resistance. Reversal is not expected but cannot be ruled out. EUR/CHF stays in near term consolidation from 1.0986 but that could end any time to resume rise from 1.0629. GBP/JPY is not that bearish comparing to other sterling pairs. We already have a CAD pair in USD/CAD already and Aussie is vulnerable to another decline. Hence, after all the nonsense, we’ll avoid adding position this week first and wait-and-see. And just keep USD/CAD short.

EUR/USD Weekly Outlook

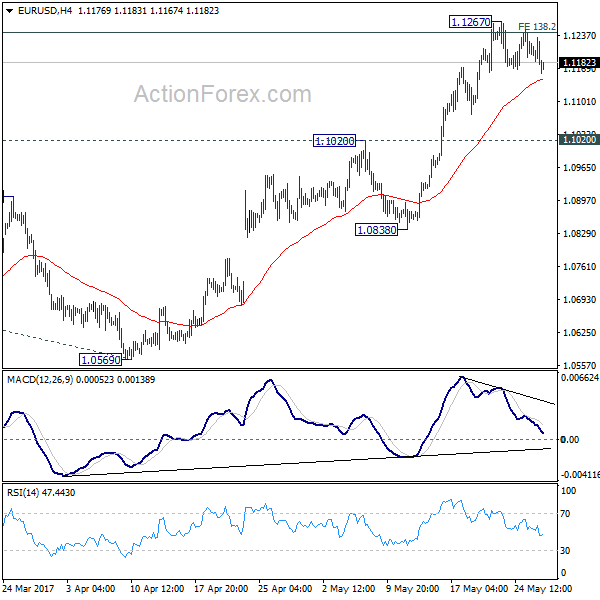

EUR/USD edged higher to 1.1267 last week but lost momentum after breaching 138.2% projection of 1.0339 to 1.0828 from 1.0569 at 1.1245. That was also close to 1.1298 key resistance. Initial bias remains neutral this week for consolidations first. At this point, remain cautious on strong resistance from 1.1245/98 to limit upside and bring reversal. But another rise will be in favor as long as 1.1020 resistance turned support holds. Decisive break of 1.1298 will carry larger bullish implication and target 1.1615 resistance next. On the downside, though, break of 1.1020 resistance turned support will indicate rejection from 1.1245/98 and turn bias to the downside for 1.0838 support first.

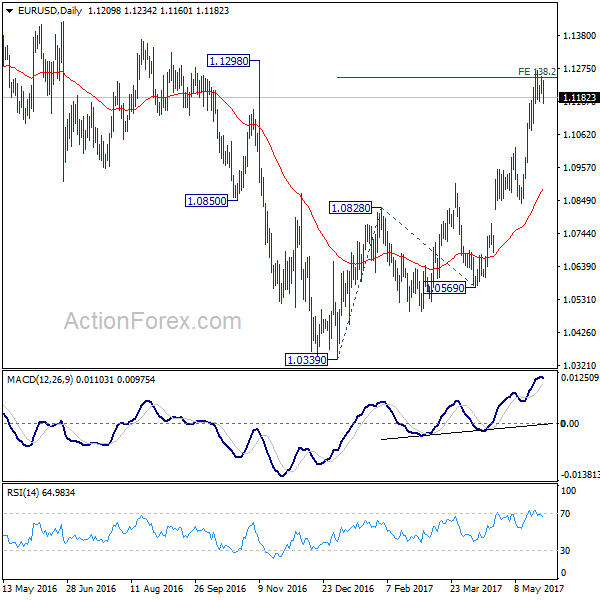

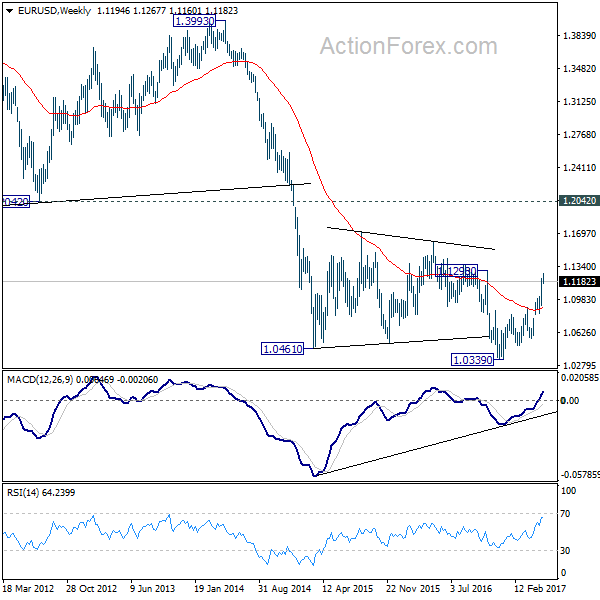

In the bigger picture, the case for medium term reversal continues to build up with EUR/USD staying far above 55 week EMA (now at 1.0888). Also, bullish convergence condition is seen in weekly MACD. Focus will now be on 1.1298 key resistance. Rejection from there will maintain medium term bearishness and would extend the whole down trend from 1.6039 (2008 high). However, firm break of 1.1298 will indicate reversal. In such case, further rally would be seen back to 1.2042 support turned resistance next.

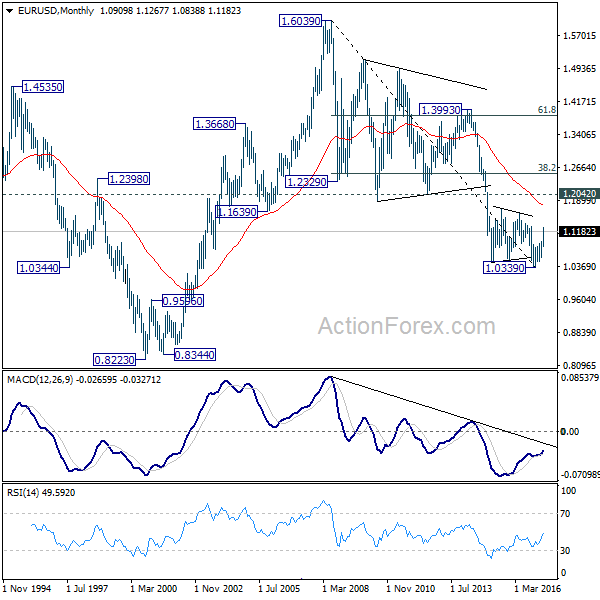

In the long term picture, the case for completion of down trend from 1.6039 (2008 high), and long term bottoming at 1.0339, is starting to build up. Decisive break of 1.1298 will bring rise back to 1.2042 as first resistance. And in that case, we should at least see rally back to 38.2% retracement of 1.6039 to 1.0339 at 1.2516.