Sterling weakens against Dollar and Euro today after the UK Supreme Court ruled that Prime Minister Theresa May must get approval from Parliament before triggering Article 50 for Brexit negotiations. Nonetheless, a government spokesman noted that the ruling won’t change the schedule and May would still trigger Article 50 by the end of March. Opposition Labour leader Jeremy Corbyn also said they wouldn’t block the move. Instead, the Labour would seek to influence on the shape of the deal and seek "full, tariff-free access to the single market". May outlined the plan for hard Brexit earlier this month with emphasize of immigration control over single market access. Also from UK, public sector net borrowing dropped to GBP 6.4b in December.

Eurozone PMI manufacturing rose to 55.1 in January, above expectation of 54.8. Eurozone PMI services dropped to 53.6, below expectation of 53.9. Germany PMI manufacturing rose to 56.5, above expectation of 55.4. Germany PMI services dropped to 53.2 versus expectation of 54.5. France PMI manufacturing dropped to 53.4, in line with consensus. France PMI services rose to 53.9, above expectation of 53.1. Markit noted that "the euro zone economy has started 2017 on a strong note. The January flash PMI is signalling respectable quarterly GDP growth of 0.4 percent with a broad-based expansion across both manufacturing and services." And, "firms’ expectations about the year ahead are running at the highest for at least four-and-a-half years, highlighting how political risk continues to be widely eschewed, with companies focusing instead on expanding their sales in the coming year."

Released from Japan, PMI manufacturing rose to 52.8 in January, above expectation of 52.3. That’s the highest reading in nearly three years since March 2014. IHS Markit economist noted that "manufacturing conditions improved at the strongest rate in nearly three years, helped by solid expansions in both output and new orders." And, "the rise in total incoming new orders was driven in part by a sharp increase in international demand, as new export orders rose at the quickest rate in over a year."

GBP/USD Mid-Day Outlook

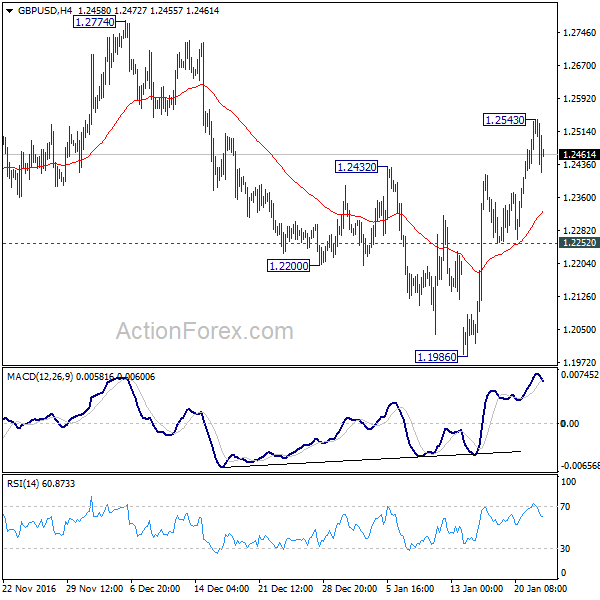

Daily Pivots: (S1) 1.2422; (P) 1.2480; (R1) 1.2591; More…

Intraday bias in GBP/USD is turned neutral again with 4 hour MACD turned below signal line. Overall, rise from 1.1986 is seen as the third leg of the consolidation pattern from 1.1946. Above 1.2543 will extend the rebound but we’d expect strong resistance at 1.2774 to limit upside and bring down trend resumption eventually. On the downside, below 1.2252 minor support will turn bias to the downside for retesting 1.1946 low.

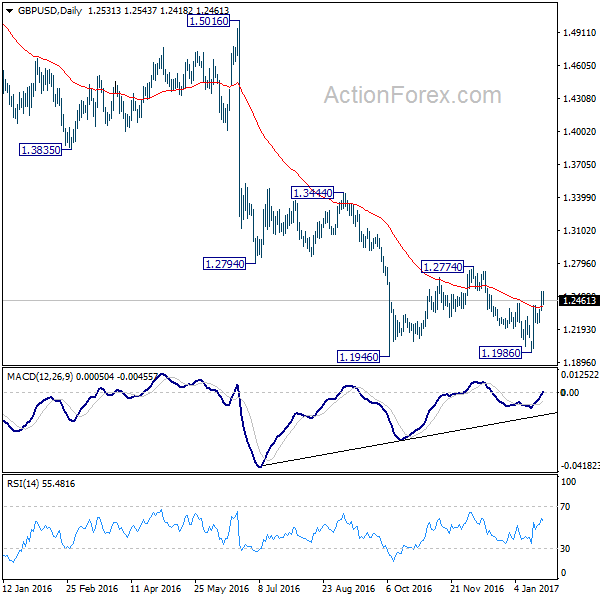

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term bottoming yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | JPY | PMI Manufacturing Jan P | 52.8 | 52.3 | 52.4 | |

| 8:00 | EUR | France Manufacturing PMI Jan P | 53.4 | 53.4 | 53.5 | |

| 8:00 | EUR | France Services PMI Jan P | 53.9 | 53.1 | 52.9 | |

| 8:30 | EUR | Germany Manufacturing PMI Jan P | 56.5 | 55.4 | 55.6 | |

| 8:30 | EUR | Germany Services PMI Jan P | 53.2 | 54.5 | 54.3 | |

| 9:00 | EUR | Eurozone Manufacturing PMI Jan P | 55.1 | 54.8 | 54.9 | |

| 9:00 | EUR | Eurozone Services PMI Jan P | 53.6 | 53.9 | 53.7 | |

| 9:30 | GBP | Public Sector Net Borrowing (GBP) Dec | 6.4B | 6.7B | 12.2B | 10.8B |

| 15:00 | USD | Existing Home Sales Dec | 5.54M | 5.61M |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box