The financial markets are trading in mild risk averse mode today. European indices started the week lower, following -1.29% loss in Japanese Nikkei. And FTSE, DAX and CAC are all staying in red at the time of writing, despite paring some losses. US futures also point to mildly lower open. Meanwhile, Dollar remains pressured as recent selloff resumes. Sentiments seemed to be weighed down by US president Donald Trump’s protectionist tone in his inauguration speech. In addition, Trump has signaled renegotiation of the North American Free Trade Agreement and withdrawal from the Trans-Pacific Partnership trade pact. Meanwhile, he treated in US morning that it’s going to be a "busy week with a heavy focus on jobs and national security". Markets will stay focused on what Trump would deliver.

On the data front, Canada wholesale sales rose 0.2% mom in November. Japan all industry index rose 0.3% mom in November. Looking ahead, Q4 GDP report from UK and US will be the main focus of the week ahead. Dollar and Sterling are so far the weakest major currencies this month, for different reasons. Dollar is weighed down by uncertainties on Trump’s policies while Sterling is pressured by concern of hard Brexit. Traders will likely look pass the GDP data from both countries and stay cautious. Eurozone PMIs and German Ifo will also catch some attentions. Meanwhile, Australian CPI will also be closely watched. Aussie is so far the strongest major currency this month and would look into inflation reading for additional strength.

Here are some highlights for the week ahead:

- Monday: Japan all industry index; Canada wholesale sales; Eurozone consumer confidence

- Tuesday: Eurozone PMIs; UK public sector net borrowing; US existing home sales

- Wednesday: Japan trade balance; Australia CPI; Swiss UBS consumption; German Ifo; US house price index

- Thursday: New Zealand CPI; Swiss trade balance; German Gfk consumer sentiment; UK GDP; US jobless claims, trade balance, wholesale inventories, new home sales, leading indicators

- Friday: Japan CPI; Australia PPI, import prices; Eurozone M3 money supply; US GDP, durable goods

EUR/USD Mid-Day Outlook

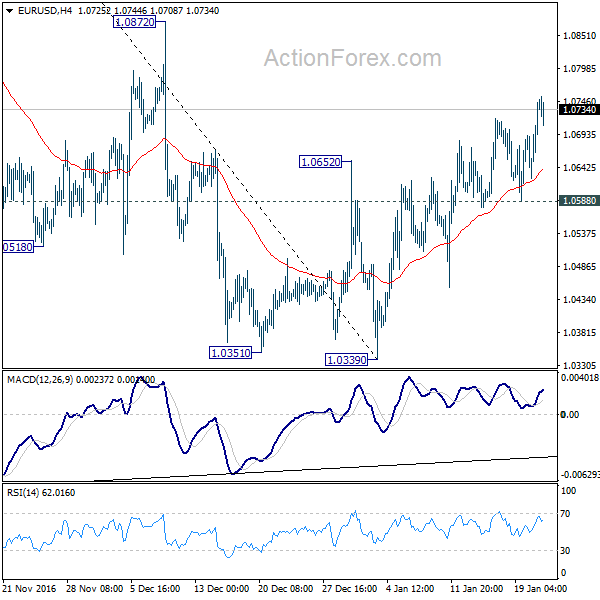

Daily Pivots: (S1) 1.0646; (P) 1.0677 (R1) 1.0731; More…..

Intraday bias in EUR/USD remains on the upside as choppy rise from 1.0339 continues. At this point, rise from 1.0339 is seen as a corrective move and should be limited by 1.0872 resistance. On the downside, below 1.0588 minor support will argue that it’s completed and turn bias back to the downside for 1.0339 support.

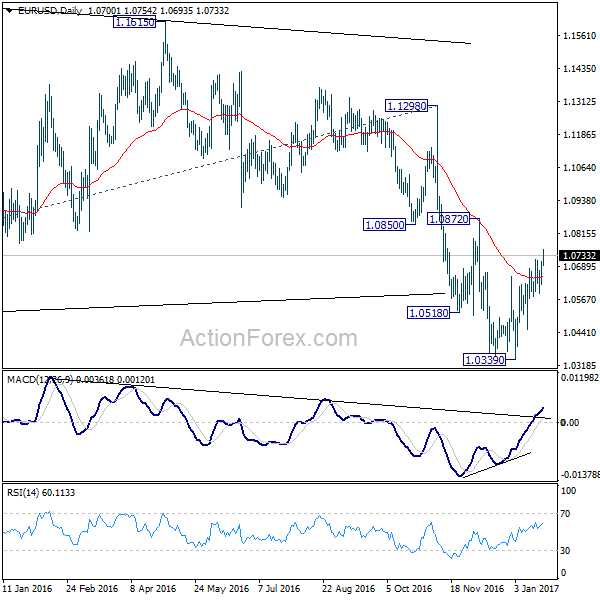

In the bigger picture, whole down trend from 1.6039 (2008 high) is in progress. Such down trend is expected to extend to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | All Industry Activity Index M/M Nov | 0.30% | 0.40% | 0.20% | 0.00% |

| 13:30 | CAD | Wholesale Sales M/M Nov | 0.20% | 0.60% | 1.10% | 1.30% |

| 15:00 | EUR | Eurozone Consumer Confidence Jan A | -4.8 | -5.1 |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box