Dollar reversed earlier loss and trades higher in early US session. Traders are turning their eyes from the unrests and protests regarding US president Donald Trump’s immigration ban executive orders. Instead the focuses are back on economic data and the anticipate of FOMC announcement later in the week. Released from US, personal income rose 0.3% in December while spending rose 0.5%. Headline PCE rose 0.2% mom, 1.6% yoy. Core PCE rose 0.1% mom, 1.7% yoy. In particular, the upward movement in core PCE should affirm the case for Fed to continue policy accommodation later this year.

ECB governing council member Ewald Nowotny said together that the central bank will have "better information" for making a decision about the end of the asset purchase program "in summer". There has been talk of stimulus exit recently. In particular, executive board member Sabine Lautenschlaeger said last week that she was "optimistic that we can soon turn to the question of an exit" and ECB must "get ready for better times."

Released from Eurozone, business climate dropped to 0.77 in January. Economic confidence rose to 108.2. Industrial confidence rose to 0.8. Services confidence rose to 13.5. Consumer confidence was finalized at -4.7. German CPI dropped -0.6% mom, rose 1.9% yoy in January, below expectation of -0.5% mom, 2.0% yoy. Also from Europe, Swiss KOF leading indicator dropped to 101.7 in January.

BoJ rate decision will be the main focus in upcoming Asian session. The central bank is expected to keep interest rate unchanged. It announced to increase purchases of 5-10 years bonds to JPY 450b, from JPY 410b previously, last week, under the yield curve control framework. Released earlier today, Japan retail sales rose 0.6% yoy in December, below expectation of 1.6% yoy. New Zealand trade deficit narrowed to NZD -41m in December.

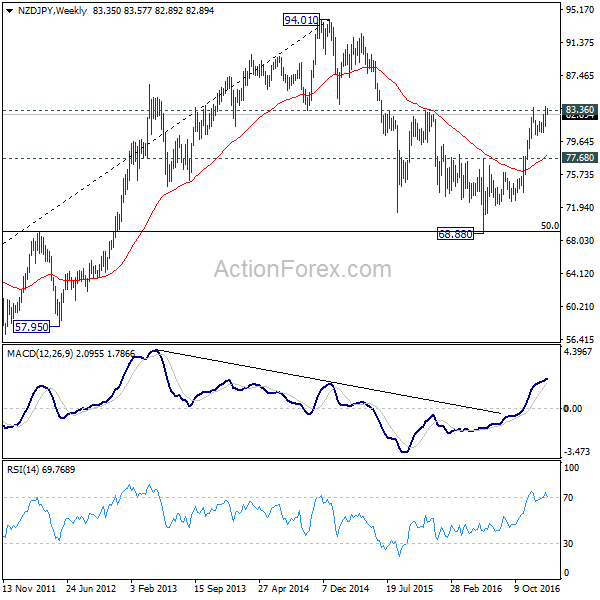

NZD/JPY faced some resistance from 83.36 in December in pulled back. The correction was held well above medium term support level at 77.68 and thus maintaining bullishness. The cross is indeed back pressing 83.36 resistance now. Overall, the correction from 94.01 (2014 high) was completed last year at 68.88. Rise from here is a medium term move at the same degree as the fall fro 94.01. Thus, sustained trading above 83.36 will target 94.01 high. We’ll stay medium term bullish in the cross as long as 77.68 holds.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0660; (P) 1.0693 (R1) 1.0727; More…..

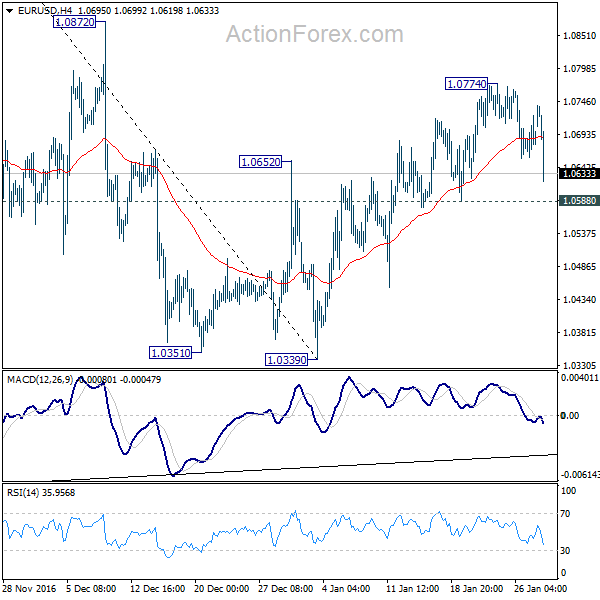

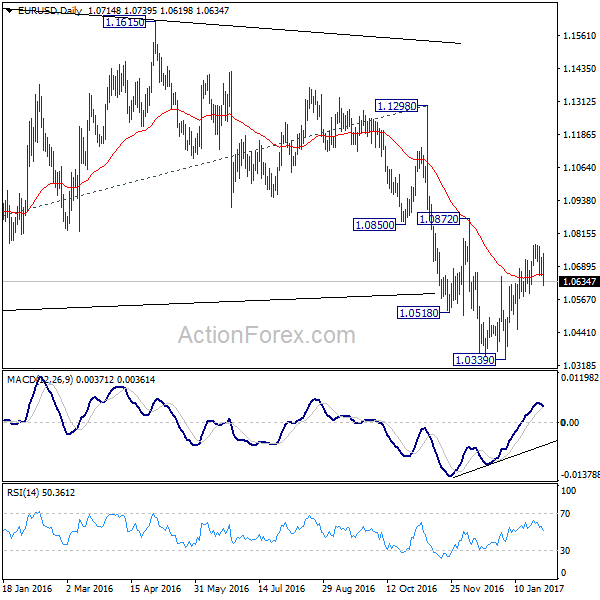

EUR/USD dips notably in early US session but stays above 1.0588 minor support so far. Intraday bias remains neutral at this point. Price actions from 1.0339 are seen as a corrective move. Break of 1.0588 will indicate that such rise is completed and turn bias to the downside for retesting 1.0339 low. In case of extension, upside should be limited by 1.0872 resistance.

In the bigger picture, whole down trend from 1.6039 (2008 high) is in progress. Such down trend is expected to extend to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Dec | -41M | -95M | -705M | -746M |

| 23:50 | JPY | Retail Trade Y/Y Dec | 0.60% | 1.60% | 1.70% | |

| 8:00 | CHF | KOF Leading Indicator Jan | 102.9 | 102.2 | ||

| 10:00 | EUR | Eurozone Business Climate Indicator Jan | 0.8 | 0.79 | ||

| 10:00 | EUR | Eurozone Economic Confidence Jan | 107.8 | 107.8 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Jan | 0.2 | 0.1 | ||

| 10:00 | EUR | Eurozone Services Confidence Jan | 12.7 | 12.9 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Jan F | -4.9 | -4.9 | ||

| 13:00 | EUR | German CPI M/M Jan P | -0.50% | 0.70% | ||

| 13:00 | EUR | German CPI Y/Y Jan P | 2.00% | 1.70% | ||

| 13:30 | USD | Personal Income Dec | 0.40% | 0.00% | ||

| 13:30 | USD | Personal Spending Dec | 0.50% | 0.20% | ||

| 13:30 | USD | PCE Deflator M/M Dec | 0.20% | 0.00% | ||

| 13:30 | USD | PCE Deflator Y/Y Dec | 1.70% | 1.40% | ||

| 13:30 | USD | PCE Core M/M Dec | 0.10% | 0.00% | ||

| 13:30 | USD | PCE Core Y/Y Dec | 1.70% | 1.60% | ||

| 15:00 | USD | Pending Home Sales M/M Dec | 1.10% | -2.50% |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box