Japanese Yen and Swiss Franc strike a strong come back today as markets are haunted by political developments. Spanish Prime Minister Mariano Rajoy announces to invoke the so called Article 155 of Constitution to suspend autonomy of Catalonia. That came after Catalan leader Carles Puigdemont refuses to withdraw the declaration of independence. Euro initially dipped against all major currencies after the news. But then, the common currency recovered strongly against all but Yen and Swiss Franc only. German DAX is trading down down more than -0.9% at the time of writing. US futures also point to a lower open.

But so far for the day, New Zealand dollar is the weakest one on political uncertainty after announcement of the new coalition government. Sterling is trading as the second weakest after terrible retail sales data. Yen and Swiss Franc are the stars today. Dollar is trading mixed.

US data positive, but no support to greenback

US initial jobless claims dropped -22K to 222K in the week ended October 14. That’s much better than expectation of 240k. Also it’s the lowest level since March 1973. Four week moving average of initial claims dropped -9.5K to 248.25K. Continuing claims dropped -16K to 1.89M, hitting a 44 year low. Philly Fed manufacturing index rose sharply to 27.9 in October, up from 23.8 and beat expectation of 22.0. That’s also the highest level in five months. But the data provides little inspiration to Dollar.

Released from UK, retail sales dropped sharply by -0.8% mom in September, versus expectation of -0.1% mom. Also from Europe, Swiss trade surplus widened to CHF 2.92B in September.

New Zealand Dollar dives on coalition news

With no single party being able to secure over half of the seats in the parliament in last month’s election, the right-wing, populist NZ First party has become a kingmaker. Its leader Winston Peters has just announced that his party would form a government with the Labour Party. Kiwi’s sell off after the announcement as the outcome has not been quite priced in. NZ First had cooperated with both National and Labour previously (National/ NZ First from 1996 to 1998, and Labour/ NZ First from 2005 to 2008). It did not show preference over a certain party. Uncertainty has not abated after the decision. Rather, it has increased as it would be the first time in 9 years for the Labour Party, as well as the Labour/NZ First coalition, to be the government. More in Kiwi Tumbles as Labour/NZ First Government Means Status Quo No More

Improving labor market could allow RBA to pare back stimulus

Australia NAB business condition index rose 2 pts to 15. But business confidence dropped 1 pt to 7 in Q3. NAB chief economists Alan Oster noted that overall results point to improvements in the economy. And, "a positive byproduct of that has been solid outcomes for hiring intentions and capex plans for the year ahead." Also, "there now seems to be sufficient evidence to suggest that the labour market will continue to improve enough to allow the RBA to pare back some of its emergency stimulus."

Separately released, employment grew 19.8K in September, above expectation of 15.0K. That’s also the 12 straight month of growth. Full time jobs grew 6.1K while part-time jobs grew 13.7K. Participation rate was unchanged at 65.2%. Unemployment rate dropped to 5.5%, below expectation of 5.6%. That’s also the lowest reading since May, which then was the lowest since early 2013.

Japan Abe likely to have solid victory in snap election

In Japan, according to a Kydo News survey released earlier this week. Prime Minister Shinzo Abe’s Liberal Democratic Party-Komeito coalition will pick up 310 seats, out of 465, in the upcoming election on Sunday. That should be enough to give the coalition a two-thirds absolute majority. It’s reported that Abe is already planning a special Diet session on November 1. And new Cabinet will be promptly formed afterwards. Then, Abe will be meeting with US President Donal Trump on November 5.

Japan trade surplus narrowed, with temporary slow down in exports

Japan trade surplus narrowed to JPY 0.24T in September. Export grew 14.1% yoy, lower than expectation of 14.9% yoy, and the first slowdown in three months. Nonetheless, the 18.1% yoy growth of export back in August was the fastest in nearly four years. It’s generally seen that the slowdown is temporary and recovery in global economy is still in place. Imports rose 12.0% yoy, also below expectation of 15.0% yoy. Also from Japan, all industry index rose 0.1% mom in August.

Updates on the twice-in-a-decade National Congress of the Chinese Communist Party

Predominantly the most important political event in China, the twice-in-a-decade National Congress of the Chinese Communist Party began on October 18. As a kick start, President Xi delivered a Party Work Report which reviewed the achievements in his first five years and outlined the challenges and goals for the next five years and beyond. Xi outlined his thoughts on the ‘new era of socialism with Chinese characteristics’.

On the economic reform, he suggested further developments in the "advanced manufacturing industry", which includes medium and high end consumption, green and low carbon industry, sharing economy, modern logistics and human capital services.

He has also pledged to deepen interest rate and exchange rate reforms, develop a comprehensive financial regulation system and reduce systematic financial risk. These are nothing new as the key aspects of the monetary and fiscal policies have already been lain down at the National Financial Work Conference in July.

More in The 19th CCP Congress – A Summit For Xi To Crown Himself

Also on China: China: Xi Jinping Lays Out Path of Further Reform and Opening

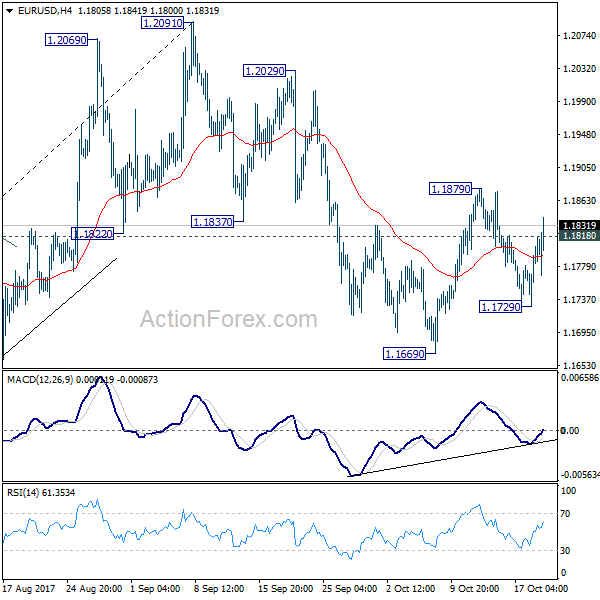

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1742; (P) 1.1773 (R1) 1.1818; More…

EUR/USD’s break of 1.1818 minor resistance suggests that pull back from 1.1879 is completed at 1.1729. And, rebound from 1.1669 is resuming. More importantly, it revives that case that corrective fall from 1.2091 has completed at 1.1669, ahead of 1.1661 support. Intraday bias is now back on the upside for 1.1879 first. Break will pave the way to retest 1.2091 high. On the downside, below 1.1729 will bring retest of 1.1669 instead.

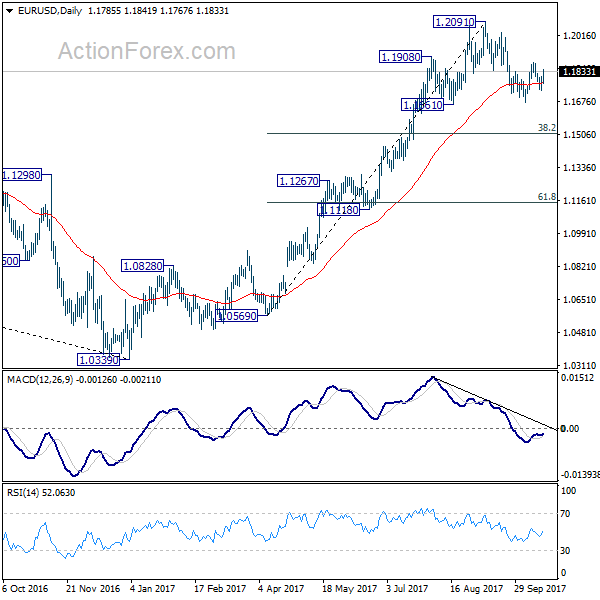

In the bigger picture, rise from medium term bottom at 1.0339 is not finished yet. It’s expected to continue after pull back from 1.2091 completes. And, next target will be 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. However, it should be noted that there is no confirmation of trend reversal yet. That is, such rebound from 1.0399 could be a correction. And the long term fall from 1.6039 (2008 high) could resume. Hence, we’d be cautious on strong resistance from 1.2516 to limit upside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance JPY Sep | 0.24T | 0.32T | 0.37T | 0.31T |

| 00:30 | AUD | NAB Business Confidence Q3 | 7 | 7 | 8 | |

| 00:30 | AUD | Employment Change Sep | 19.8k | 15.0k | 54.2k | 53.0k |

| 00:30 | AUD | Unemployment Rate Sep | 5.50% | 5.60% | 5.60% | |

| 02:00 | CNY | GDP Y/Y Q3 | 6.80% | 6.80% | 6.90% | |

| 02:00 | CNY | Retail Sales Y/Y Sep | 10.30% | 10.20% | 10.10% | |

| 02:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Sep | 7.50% | 7.70% | 7.80% | |

| 02:00 | CNY | Industrial Production Y/Y Sep | 6.60% | 6.40% | 6.00% | |

| 04:30 | JPY | All Industry Activity Index M/M Aug | 0.10% | 0.20% | -0.10% | |

| 06:00 | CHF | Trade Balance (CHF) Sep | 2.92B | 2.47B | 2.17B | 2.20B |

| 08:30 | GBP | Retail Sales M/M Sep | -0.80% | -0.10% | 1.00% | 0.90% |

| 12:30 | USD | Initial Jobless Claims (OCT 14) | 222K | 240K | 243K | 244K |

| 12:30 | USD | Philadelphia Fed Business Outlook Oct | 27.9 | 22 | 23.8 | |

| 14:00 | USD | Leading Indicators Sep | 0.10% | 0.40% | ||

| 14:30 | USD | Natural Gas Storage | 87B |