Dollar weakens mildly again as markets are awaiting FOMC rate decision, economic projections and press conference. Headline CPI rose 0.1% mom, 2.7% yoy in February, up from 2.5% yoy and beat expectation of 2.6% yoy. Core CPI rose 0.2% mom mom, 2.2% yoy, down from 2.3% yoy but met expectation of 2.2% yoy. Retail sales rose 0.1% in February, above expectation of -0.1%. Ex-auto sales rose 0.2% , above expectation of -0.1%. Empire state manufacturing index dropped to 16.4 in March, down from 18.7 but beat expectation of 15.0. The data are mixed to positive but markets paid little attention to them.

Fed to upgrade economic projections

Fed is widely expected to hike federal funds rate by 25bps to 0.75-1.00%. The rate hike itself is well priced in. Thus the focus will be largely on three things, the FOMC statement, new economic projection, and Fed chair Janet Yellen’s press conference. Markets are looking through today’s hike and are eager to get the hints on what Fed would do next. The table below showed FOMC’s median projections back in December.

Federal funds rate are projected to be at 1.4% by the end of 2017, 2.1% by the end of 2018. They equivalent to 3 rate hikes in total for this year and 2-3 hikes next year. Any upward revision to the numbers will imply a faster path. In particular, some analysts are anticipating a meaningful revision to 2018’s projections to reflect a firmer chance of 3 hikes. Meanwhile, the markets will also look closely to the revisions to economic projections, with focuses on the core PCE number for this year and next.

More on FOMC:

- Upcoming Rate Hikes And 2018 Median Dot Plot In Focus

- FOMC Preview – It’s All in the Dots

- Fed Expected to Raise US Interest Rates

- FOMC Preview: Fed to Maintain Signal of Three Hikes this Year

Sterling rebounds as unemployment rate hit 4 decade low

Sterling recovers notably today after stronger than expected job data. ILO unemployment rate dropped to 4.7% in January, better than expectation of being unchanged at 4.8%. Also, that’s the lowest level in more than four decades since mid-1975. Employment rose 92k, and hit the highest level on record. However, was growth was disappointing as average weekly earnings rose 2.2% 3moy slowed from 2.6% 3moy and missed expectation of 2.4% 3moy. Meanwhile, claimant counts dropped -11.3k in February versus expectation of 3.2k rise. Claimant count rate was unchanged at 2.1%.

Strength in the Pound is relatively limited though as markets await FOMC rate decision today and then BoE rate decision tomorrow. At the mean time, traders are still awaiting UK prime minister Theresa May to finally trigger the Article 50 to kick start Brexit negotiation with EU.

Dutch voters heading to election

The Dutch election held today is generally seen as a first gauge of spread of populism into Europe, ahead of elections in France and Germany. There have been voices from right-wing parties in the core of EU calling for anti-EU referendum. Meanwhile, the exact result of the election in the Netherland could be less important than the implications. The fractured political environment will certainly produce no majority in the parliament. And as many as five parties are possibly needed to form a coalition. Also from Europe, Swiss PPI dropped -0.2% mom rose 1.3% yoy in February. Eurozone employment rose 0.3% qoq in Q4.

BoJ watched in Asian session

BoJ monetary policy decisions will be the focus in the coming Asian session. The central bank is widely expected to keep interest rate unchanged at -0.1%. Also, it will maintain the Yield Curve Control framework to guide 10 year yield to around zero. With the YCC, BoJ will likely keep the pace of asset purchase at JPY 80T per annum. The announcement could end as a non-event.

GBP/USD Mid-Day Outlook

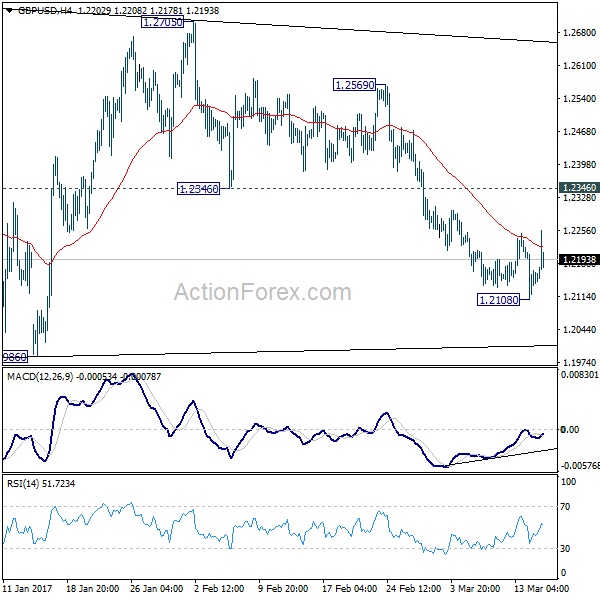

Daily Pivots: (S1) 1.2100; (P) 1.2161; (R1) 1.2213; More…

GBP/USD formed a temporary low again at 1.2108 and recovered. Intraday bias is turned neutral for another round of consolidation. But still, outlook stays bearish as long as 1.2346 support turned resistance holds. As noted before, consolidation pattern from 1.1946 is completed at 1.2705 is resuming larger down trend. Below 1.2108 will target a test on 1.1946/86 support zone. Break of 1.1946 will confirm our bearish view.

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term bottoming yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account Balance (NZD) Q4 | -2.3B | -2.43B | -4.89B | -5.03B |

| 23:30 | AUD | Westpac Consumer Confidence Mar | 0.10% | 2.30% | ||

| 04:30 | JPY | Industrial Production M/M Jan F | -0.40% | -0.80% | -0.80% | |

| 08:15 | CHF | Producer & Import Prices M/M Feb | -0.20% | 0.40% | 0.40% | |

| 08:15 | CHF | Producer & Import Prices Y/Y Feb | 1.30% | 0.80% | ||

| 09:30 | GBP | Jobless Claims Change Feb | -11.3K | 3.2K | -42.4K | -41.4K |

| 09:30 | GBP | Claimant Count Rate Feb | 2.10% | 2.10% | ||

| 09:30 | GBP | ILO Unemployment Rate (3M) Jan | 4.70% | 4.80% | 4.80% | |

| 09:30 | GBP | Average Weekly Earnings 3M/Y Jan | 2.20% | 2.40% | 2.60% | |

| 10:00 | EUR | Eurozone Employment Q/Q Q4 | 0.30% | 0.20% | 0.20% | |

| 12:30 | USD | Empire State Manufacturing Index Mar | 16.4 | 15 | 18.7 | |

| 12:30 | USD | CPI M/M Feb | 0.10% | 0.00% | 0.60% | |

| 12:30 | USD | CPI Y/Y Feb | 2.70% | 2.60% | 2.50% | |

| 12:30 | USD | CPI Core M/M Feb | 0.20% | 0.20% | 0.30% | |

| 12:30 | USD | CPI Core Y/Y Feb | 2.20% | 2.20% | 2.30% | |

| 12:30 | USD | Advance Retail Sales Feb | 0.10% | -0.10% | 0.40% | 0.60% |

| 12:30 | USD | Retail Sales Less Autos Feb | 0.20% | -0.10% | 0.80% | 1.20% |

| 14:00 | USD | NAHB Housing Market Index Mar | 65 | 65 | ||

| 14:00 | USD | Business Inventories Jan | 0.30% | 0.40% | ||

| 14:30 | USD | Crude Oil Inventories | 3.3M | 8.2M | ||

| 18:00 | USD | FOMC Rate Decision | 1.00% | 0.75% |