The forex markets remain generally range-bound except that Swiss is attempting for a recovery. Meanwhile Aussie is extending last week’s rally ahead of RBA minutes. Gold rides on Dollar’s weakness and is extending last week rebound to 1234.7 so far. On ther other hand WTI crude oil is losing momentum again as it’s struggling around 55 day EMA. Economic data released today triggered little reactions. Empire State manufacturing in US dropped to 9.8 in July, down from 19.8, below expectation of 9.8. Canada international securities transactions came in at CAD 29.5, above expectation of CAD 9.78b. Eurozone CPI was confirmed at 1.3% yoy in June while core CPI was unrevised at 1.1% yoy. Trading could remain subdued in US session. But events in upcoming Asian session from Australia and New Zealand might trigger some volatility.

RBA minutes, New Zealand CPI to be released

Minutes of RBA July meeting will be a main focus in the upcoming Asian session. The central bank disaapointed the markets at the meeting by not turning hawkish like other major central banks. Aussie tumbled sharply but the weakness was very brief. Instead Aussie jumped last week on strong iron ore prices as well as dovish Fed messages. The upbeat Chinese dataflow should also give Aussie a boost as China is the world’s biggest consumer of iron ore and the largest importer of Australia’s iron ores. The strength in the exchange rate could now give RBA some headache. The central bank repeatedly noted that "appreciating exchange rate would complicate" the economic transition from the mining investment boom

New Zealand CPI will be another main focus. CPI is expected to rise a mere 0.2% qoq in Q2, dragging down annual rate from 2.2% yoy to 1.9% yoy. Just when inflation hit the higest level in five years in Q1, there were expectation that RBNZ could turn hawkish. But the central bank disappointed by maintaining that policy would stay accommodative for a "considerable period" of time. The slowdown in inflation would affirm RBNZ’s neutral stance.

AUD/NZD’s strong rebound last week indcaites that fall from 1.1017 has compelted with a head and shoudler bottom pattern. Further rise could now be seen back to 1.1017 resistance. But after all, larger outlook is neutral as the cross is staying in side range of 1.0234/1.1017. Below 1.0493 minor support will extend the fall from 1.1017 to 1.0234 key supprot.

China GDP grew 6.9% in Q2.

Released from China, GDP expanded 6.9% yoy in Q2, same pace as the prior quarter but above consensus of 6.8%. Economic activities in June continued to improve. Industrial production growth accelerated to 7.6% yoy in June, beating consensus of and May’s 6.5%. Retail sales expanded 11% yoy in June, up from 10.7% a month ago. The market had anticipated mild deceleration to 10.6%. Fixed asset investment in urban areas grew 8.6% yoy in the first half of the year, same pace as in the first five months of the year. The government acknowledged that the country’s economy continued to improve. It appears that the country’s growth is on track to meet the government target of "around 6.5%".

In his first address at the National Financial Work Conference, which is held once every five years, over the weekend, Chinese President Xi Jinping affirmed that the PBOC would play a stronger role in defending against risks, calling for more work on safeguarding the financial system and modernizing its regulatory framework. Interestingly, the word "risk" appeared 31 times in the meeting note, followed by "regulation", which appeared 28 times, signaling that implementation of "regulations" to prevent financial system "risks" is the key direction of the government’s policy.

More in China Watch – 2017 Growth Target On Track, Xi Commands To Prevent Risks And Tighten Regulations

Brexit negotiation round 2

The second round of Brexit negotiation starts today in Brussels. UK Brexit Secretary David Davis said ahead of the week long meeting that "we made a good start last month, and this week we’ll be getting into the real substance." He noted that "protecting the rights of all our citizens is the priority for me going into this round and I’m clear that it’s something we must make real progress on." EU’s chief negotiator Michel Barnier said that "we will now delve into the heart of the matter. We need to examine and compare our respective positions in order to make good progress."

There will be working groups focusing on three areas, including citizen’s rights, the divorce bill and other loose ends. Another group will focus on the border of Ireland. Three more weeks of talks will be held till early October. By that time, Barnier would hope to show "significant" progress to EU leaders to approve moving the negotiations to trade agreements.

AUD/USD Mid-Day Outlook

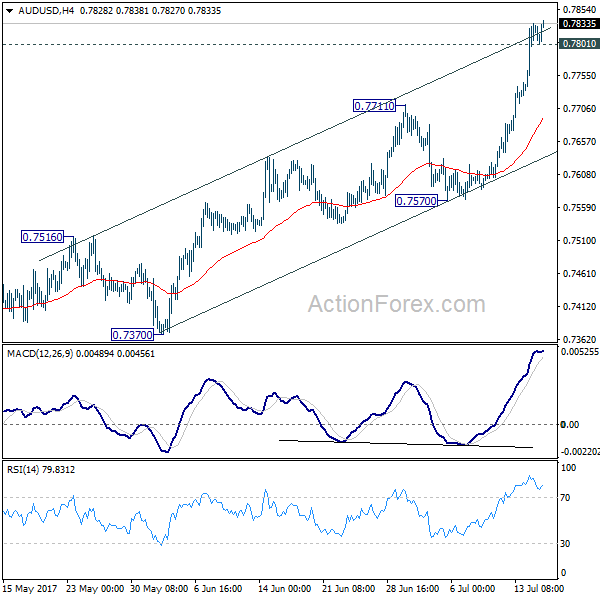

Daily Pivots: (S1) 0.7755; (P) 0.7794; (R1) 0.7864; More…

AUD/USD’s rally is still in progress and edges higher to 0.7838. Intraday bias remains on the upside at this point. Firm break of 0.7833 resistance will confirm resumption of whole rebound from 0.6826 bottom. In such case, AUD/USD would target 61.8% projection of 0.6826 to 0.7833 from 0.7328 at 0.7950 next. On the downside, below 0.7801 minor support will turn intraday bias neutral first. But near term outlook will stay cautiously bullish as long as 0.7570 support holds.

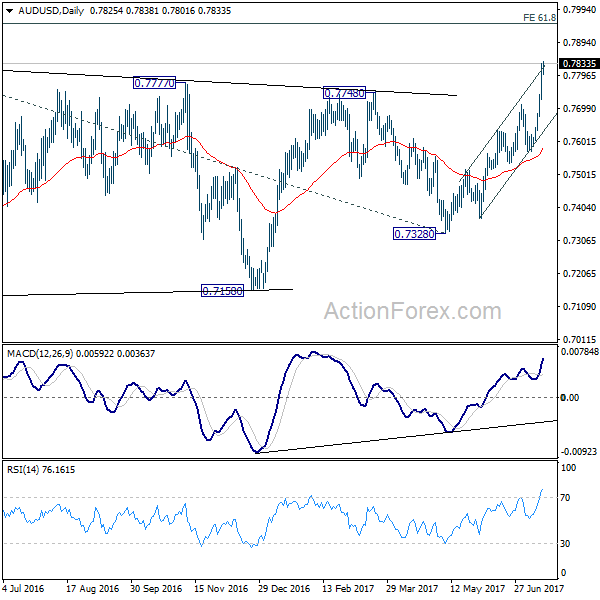

In the bigger picture, current development suggests that rebound from 0.6826 is developing into a medium term rise. There is no confirmation of trend reversal yet and we’ll continue to treat such rebound as a corrective pattern. But in any case, further rise is now expected to 55 month EMA (now at 0.8100) or even further to 38.2% retracement of 1.1079 to 0.6826 at 0.8451. Break of 0.7328 support is needed to confirm completion of the rebound. Otherwise, further rise is now in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Jul | 0.10% | -0.40% | ||

| 02:00 | CNY | Retail Sales Y/Y Jun | 11.00% | 10.60% | 10.70% | |

| 02:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Jun | 8.60% | 8.50% | 8.60% | |

| 02:00 | CNY | Industrial Production Y/Y Jun | 7.60% | 6.50% | 6.50% | |

| 02:00 | CNY | GDP Y/Y Q2 | 6.90% | 6.80% | 6.90% | |

| 09:00 | EUR | Eurozone CPI M/M Jun | 0.00% | 0.00% | -0.10% | |

| 09:00 | EUR | Eurozone CPI Y/Y Jun F | 1.30% | 1.30% | 1.40% | |

| 09:00 | EUR | Eurozone CPI – Core Y/Y Jun F | 1.10% | 1.10% | 1.10% | |

| 12:30 | CAD | International Securities Transactions (CAD) May | 29.5B | 9.78B | 10.60B | |

| 12:30 | USD | Empire State Manufacturing Jul | 9.8 | 15 | 19.8 |