Dollar extends post FOMC rebound in early US session after positive economic data. Initial jobless claims dropped 8k to 237k in the week ended June 10, below expectation of 241k. Four-week moving average rose 1k to 243k. That’s the 119 straight weeks initial claims stayed below 300k handle, last seen in early 1970s. Continuing claims rose 6k to 1.935m in the week ended June 3 staying below 2m handle for the 9 straight week, last seen back in 1973. Empire State manufacturing index rebound to 19.8, up from -1. Philly Fed survey though, retreated to 27.6 but beat expectation of 25.0. Industrial production, rose 0.0% in May while capacity utilization dropped to 76.6%.

EUR/USD’s fall accelerates today and breaks through 1.1165 minor support. Main focus is now back to 1.1109. As long as this support holds, further rally is still in favor and firm break of 1.1298 key resistance will carry larger bullish implication. However, break of 1.1109 will confirm rejection from 1.1298 and bring deeper pull back. USD/JPY, at this point, is also staying below 110.80 near term resistance and outlook stays bearish until a break of this level. USD/CAD, despite today’s rebound, is held well below 1.3387 resistance and maintains bearish outlook.

Dollar’s rebound started after yesterday’s FOMC rate decision. The overall announcement, including new economic projections, was not as bad as some anticipated. Fed maintained the projection of a total of three rate hike this year. Downward revision in 2017 inflation forecast was somewhat offset by the upward revision in GDP forecast and downward revision in unemployment rate forecast. On other hand, both growth and inflation forecasts for 2018 and 2019 were held unchanged.

Three voted for rate hike in BoE decision

BoE kept bank rate unchanged at 0.25% and asset purchase target at GBP 435b as widely expected. To the markets’ surprise two officials joined Kristin Forbes to vote for rate hike this year. That include Michael Saunders and Ian McCafferty. Overall, the statement suggests that MPC policy makers are getting more impatient with surging inflation. The statement noted that "the continued growth of employment could suggest that spare capacity is being eroded, lessening the trade-off that the MPC is required to balance and, all else equal, reducing the MPC’s tolerance of above-target inflation." Nonetheless, the central bank also emphasized that any rate hike will be at a "gradual pace and to limited extent".

Also from UK, retail sales dropped more than expected by -1.2% mom in May.

Technically, GBP/USD is staying in tight range above 1.2633 temporary low and lacks clear momentum to extend the recovery from there. EUR/GBP dips sharply to as low as 0.8722 but stays well above 0.8639 near term support. GBP/JPY also recovers today but stays well below 142.75 resistance. There is no change in the near term bearish trend in the Pound yet.

SNB stands pat, Jordan open to further stimulus

SNB held sight deposit rate unchanged at -0.75% as widely expected. Three month LIBOR rate was held at -1.25% to -0.25%. The central bank kept 2017 inflation forecast unchanged at 0.3%. However, for 2018 and 2019, inflation projected was downgraded to 0.3% (from 0.4%) and 1.0% (from 1.1%) respectively. Growth is projected to be at 1.5% this year. SNB President Thomas Jordan said that "available economic indicators suggest that the Swiss economy is on the road to recovery." But he also warned that "certain indicators suggest that the recovery has not yet taken hold in all areas of the economy." Also, "the strong Swiss franc continues to weigh on some industries" and it’s still "significantly overvalued".

Jordan seems not concerned with its balance street and said that "our monetary policy remains expansionary for the reasons we’ve given, namely low inflation, underutilisation of production capacities and a significantly overvalued franc." He also left the door open for further rate cut and said that "all options are still open, we could also cut rates further if needed.

Also from Swiss, PPI dropped -0.3% mom, rose 0.1% yoy in May. Also from Europe, Eurozone trade surplus narrowed to EUR 19.6b in April.

Australia unemployment rate dropped to lowest since 2013

Australia unemployment rate unexpectedly dropped to 5.5% in May, down from 5.7% and below expectation of 5.7%. That’s also the lowest number since February 2013. Headline job number showed 42k growth, well above expectation of 10k. Full-time jobs grew 52.1k while part-time jobs fell -10.1k. Participation rate also rose 0.1% to 64.9%. Speculations of a rate cut by RBA receded after the release. On the other hand, New Zealand GDP grew only 0.5% qoq in Q1, below expectation of 0.7% qoq.

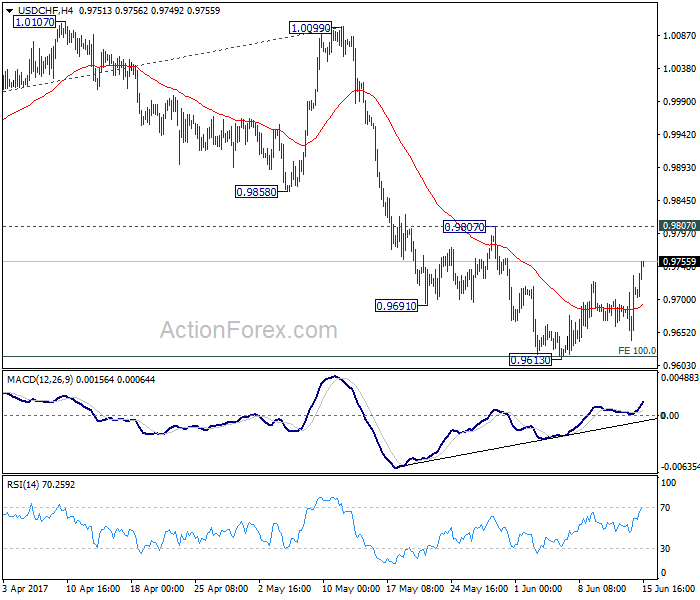

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9654; (P) 0.9694; (R1) 0.9749; More…..

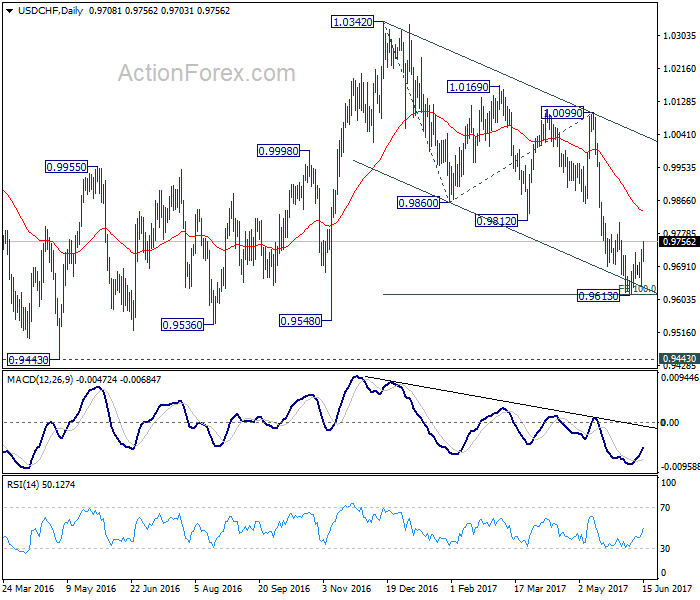

USD/CHF’s rebound from 0.9613 extends to as high as 0.9755 so far. However, it’s kept well below 0.9807 resistance. Thus, there is no clear indication of reversal yet. As long as 0.9807 stays intact, deeper fall is still in favor. Break of 0.9613 will extend the whole decline from 1.0342 to 0.9548 support and below. We’d start to look for bottoming signal again as it approaches 0.9443 key support level. However, considering bullish convergence condition in 4 hour MACD, break of 0.9807 will indicate near term reversal and turn outlook bullish for 1.0099 resistance next.

In the bigger picture, USD/CHF is still bounded in medium term range of 0.9443/1.0342 for the moment. Consolidative trading would likely continue and medium term outlook remains neutral. Break of 1.0342 key resistance is needed to confirm underlying bullish momentum in the pair. Meanwhile, downside attempts should be contained by 0.9443 key support level. However, sustained break of 0.9443 will carry larger bearish implication and target 0.9 handle.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | GDP Q/Q Q1 | 0.50% | 0.70% | 0.40% | |

| 01:00 | AUD | Consumer Inflation Expectation Jun | 3.60% | 4.00% | ||

| 01:30 | AUD | Employment Change May | 42.0K | 10.0K | 37.4K | |

| 01:30 | AUD | Unemployment Rate May | 5.50% | 5.70% | 5.70% | |

| 07:15 | CHF | Producer & Import Prices M/M May | -0.30% | 0.00% | -0.20% | |

| 07:15 | CHF | Producer & Import Prices Y/Y May | 0.10% | 0.20% | 0.80% | |

| 07:30 | CHF | SNB Sight Deposit Interest Rate | -0.75% | -0.75% | -0.75% | |

| 07:30 | CHF | SNB 3-Month Libor Lower Target Range | -1.25% | -1.25% | -1.25% | |

| 07:30 | CHF | SNB 3-Month Libor Upper Target Range | -0.25% | -0.25% | -0.25% | |

| 08:30 | GBP | Retail Sales M/M May | -1.20% | -0.90% | 2.30% | 2.50% |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Apr | 19.6B | 22.4B | 23.1B | 22.2B |

| 11:00 | GBP | BoE Rate Decision | 0.25% | 0.25% | 0.25% | |

| 11:00 | GBP | BoE Asset Purchase Target Jun | 435B | 435B | 435B | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 3–0–5 | 1–0–6 | 1–0–7 | |

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–8 | 0–0–7 | 0–0–8 | |

| 12:30 | CAD | Manufacturing Shipments M/M Apr | 0.90% | 1.00% | ||

| 12:30 | USD | Import Price Index M/M May | -0.30% | -0.10% | 0.50% | 0.20% |

| 12:30 | USD | Empire State Manufacturing Index Jun | 19.8 | 6 | -1 | |

| 12:30 | USD | Initial Jobless Claims (JUN 10) | 237K | 241K | 245K | |

| 12:30 | USD | Philly Fed Manufacturing Index Jun | 27.6 | 25 | 38.8 | |

| 13:15 | USD | Industrial Production May | 0.00% | 0.20% | 1.00% | 1.10% |

| 13:15 | USD | Capacity Utilization May | 76.60% | 76.70% | ||

| 14:00 | USD | NAHB Housing Market Index Jun | 70 | 70 | ||

| 14:30 | USD | Natural Gas Storage | 106B | |||

| 20:00 | USD | Net Long-term TIC Flows Apr | 37.3B | 59.8B |