Euro extends recent rally against dollar today with EUR/USD hitting as high as 1.1188 so far. The common currency continues to draw support from expectation of a hawkish twist in ECB’s June meeting. Also, based on recent solid economic data, there is realistic chance of upward revisions in the central bank’s staff projections to be released at that meeting. Indeed, Euro’s strength is even clearer considering that fact that it now overtakes Yen as the second strongest major currency for the week, following Swiss Franc. On the other hand, Dollar’s recovery was weak and short lived as it’s also back under some selling pressure against Sterling.

ECB Vasiliauskas: To discuss changing forward guidance in June

ECB Governing Council member Vitas Vasiliauskas said the ECB could consider tweaking its forward guidance to reflect that it’s now closer to stimulus exit. He noted that "everybody is prepared to discuss forward guidance in June". He prefers to "take a look into the hard data" and then discuss the "speed of changing of communications". Nonetheless, he also emphasized to keep the sequence of the exit. That is, ECB shouldn’t raise interest rate from the current negative level before ending the asset purchase program by the end of the year. Also, Vasiliauskas said that he would "wait for maybe autumn" regarding to "possible decision". But he prefer not to wait till December as that "would probably be too late". He pointed out "then you have not enough space or room before the program ends."

Divorce bill a most difficult topic in Brexit negotiation

EU’s chief Brexit negotiator Michael Barnier pointed out in a European Commission meeting that UK’s "divorce bill" is doubtlessly one of the "most difficult in the negotiation". It’s believed that Germany and France would refuse to pay more to EU budget to cover UK’s departure. Meanwhile, member states would also object to getting less funding in projects financed under the EU framework. And, it’s believed that European Commission President Juncker expressed his doubt on Barnier’s target of concluding the deal by the end of the year and noted that was "over-optimistic".

The size of the "divorce bill" was first estimated to be at EUR 60b and was raised to EUR 100b then. Nonetheless, according to a report from the Institute of Chartered Accountants, the amount owed by UK to EUR could be at little as GBP 5b and won’t be higher than GBP 30b. While this not the official positions of either UK or EU, the news was a clear reflection of the discrepancies in the way both sides see the matter. And as the negotiation starts after UK election on June 8, noise level will increase which could further complicate the negotiations.

On the data front…

Released from Canada, retails sales rose more than expected by 0.7% mom in March, versus consensus of 0.3% mom. Ex-auto sales dropped -0.2% mom versus expectation of 0.2% mom. Headline CPI was unchanged at 1.6% yoy, below expectation of 1.7% yoy. CPI core common was unchanged at 1.3% yoy, trim slowed to 1.3% yoy, median slowed to 1.6% yoy. Released early today, UK CBI trends total orders rose to 9 in May. Eurozone current account surplus narrowed to EUR 34.1b in March. German PPI rose 0.4% mom, 3.4% yoy in April.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1061; (P) 1.1116 (R1) 1.1157; More….

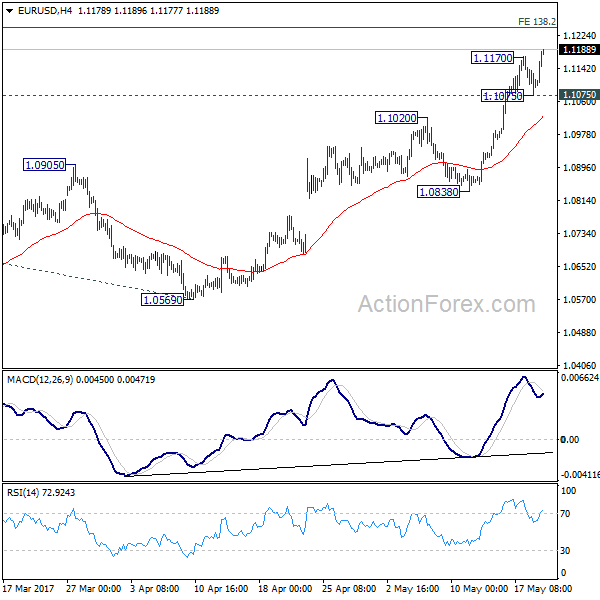

EUR/USD’s rally resumed after brief consolidation and hits as high as 1.1188 so far. Intraday bias is back on the upside. Current rise from 1.0569 is seen as part of the rebound from 1.0339 and would target 138.2% projection of 1.0339 to 1.0828 from 1.0569 at 1.1245, which is close to 1.1298 key resistance. For now, we’d be cautious on strong resistance between 1.1245/1298 to limit upside and bring reversal. On the downside, below 1.1075 minor support will turn intraday bias neutral first. But break of 1.0838 support is needed to indicate reversal. Otherwise, further rally will remain in favor.

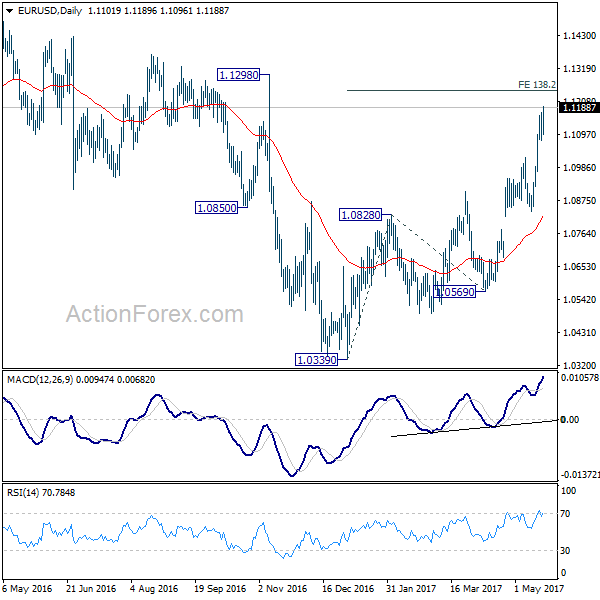

In the bigger picture, as long as 1.1298 key resistance holds, whole down trend from 1.6039 (2008 high) is still expected to continue. Break of 1.0339 low will send EUR/USD through parity. However, considering bullish convergence condition in weekly MACD, break of 1.1298 will indicate long term reversal. In such case, further rally would be seen back to 1.2042 support turned resistance next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | German PPI M/M Apr | 0.40% | 0.20% | 0.00% | |

| 06:00 | EUR | German PPI Y/Y Apr | 3.40% | 3.20% | 3.10% | |

| 08:00 | EUR | Eurozone Current Account (EUR) Mar | 34.1B | 32.3B | 37.9B | 37.8B |

| 10:00 | GBP | CBI Trends Total Orders May | 9 | 4 | 4 | |

| 12:30 | CAD | Retail Sales M/M Mar | 0.70% | 0.30% | -0.60% | -0.40% |

| 12:30 | CAD | Retail Sales Less Autos M/M Mar | -0.20% | 0.20% | -0.10% | |

| 12:30 | CAD | CPI M/M Apr | 0.40% | 0.50% | 0.20% | |

| 12:30 | CAD | CPI Y/Y Apr | 1.60% | 1.70% | 1.60% | |

| 12:30 | CAD | CPI Core – Common Y/Y Apr | 1.30% | 1.40% | 1.30% | |

| 12:30 | CAD | CPI Core – Trim Y/Y Apr | 1.30% | 1.40% | ||

| 12:30 | CAD | CPI Core – Median Y/Y Apr | 1.60% | 1.70% | ||

| 14:00 | EUR | Eurozone Consumer Confidence May A | -3 | -4 |