Dollar is steady against European majors as FOMC rate decision looms. Job data from US is basically in line with expectation and triggers little reactions. Instead, news regarding ultra-long bonds sends the Japanese Yen lower again. Released from US, ADP report showed 177k growth in private sector jobs in April, comparing to expectation of 178k. The US Treasury Department said today that it’s conducting an "internal review" regarding ultra-long bonds. The department was meeting with "a broad variety of market participants" regarding the pros and cons of 50-year and 100-year securities. Earlier this week, Treasury Secretary Steven Mnuchin said that ultra-long bonds absolutely makes sense to the Treasury. 30 year yield jumped on Monday after Mnuchin’s comments.

FOMC rate decision will be a major focus today and it’s widely expected to keep monetary policies unchanged. At this point, the base case for Fed remains unchanged. That is, Fed will continue with it’s plan of a total of three rate hikes this year. That would be followed by a "brief pause" as Fed starts shrinking its balance sheet later in the year. Markets are pricing in over 60% chance of a rate hike by Fed in June. It’s generally believed Fed will look past the weaker than expected Q1 GDP data. There is no post meeting press conference scheduled.

Eurozone GDP grew 0.5% qoq, focus on French debate

Eurozone GDP grew 0.5% qoq in Q1, up from prior quarter’s 0.4% and met expectation. However, PPI dropped -0.3% mom, rose 3.9% yoy in March, below expectation of 0.1% mom, 4.3% yoy. German unemployment dropped -15k in April, larger than expected drop of -10k. Unemployment rate was unchanged at 5.8%. The set of data does little to change ECB’s monetary policy stance. The central bank should continue with it’s asset purchase of EUR 60b a month till the end of the year. And it will keep interests rate unchanged before ending the purchases. Nonetheless, markets would be eager to hear if ECB policymakers would start reassessing the monetary policy stance in June meeting.

For now, focus will stay in French election. Pro-EU centrist Emmanuel Macron and EU-sceptic far right Marine Le Pen will have a head-to-head TV debate tonight. At this point, polls are still suggesting Macron as a clear winner out of the run-off of the French Presidential election this Sunday. With just four days to go, Macron is having a strong lead of 20 points over Le Pen. Macron said that he will use "hand-to-hand fighting to demonstrate that her ideas represent false solutions" in the debate. On the other hand, Le Pen said that "his program seems to be very vague, but in reality it is a simple continuation of (Socialist President) Francois Hollande’s government."

EU and UK at odds over EUR 100b Brexit bill

Regarding Brexit, it’s reported that EU has raised the up-front settlement bill to EUR 100 on request of France and Germany. EU’s chief Brexit negotiator Michel Barrier said that "some have created the illusion that Brexit would have no material impact on our lives or that negotiations can be concluded quickly and painlessly." And, "this is not the case". Meanwhile he emphasized that "mutual commitments" must be honored and "the final settlement is all about settling the accounts".

On the other hand, UK’s Brexit Secretary David Davis said that "this is a negotiation. They lay down what they want and we lay down what we want." And when asked when at figure of EUR 100b was acceptable, Davis said that "we will not be paying €100bn." He emphasized that "we will meet our international obligations, but there will be our international obligations including assets and liabilities and there will be the ones that are correct in law, not just the ones the Commission want."

Released from UK, construction PMI rose to 53.1 in April. BRC shop price index dropped -0.5% yoy in April.

Surge in NZD/USD was brief

New Zealand Dollar surged sharply against Australian Dollar today after solid employment data. NZD/USD also spiked higher to 0.6967 but quickly lost steam. New Zealand unemployment rate dropped to 4.9% in Q1, down from 5.2% and below expectation of 5.1%. Employment grew 1.2% qoq, up from prior quarter’s 0.7% qoq and beat expectation of 0.8% qoq. However wage growth was muted as the ordinary time private sector labor cost index just rose 0.4% qoq, 1.5% yoy. That was at the lowest level since 2010. The lack of wage pressure should keep RBNZ on hold.

EUR/USD Mid-Day Outlook

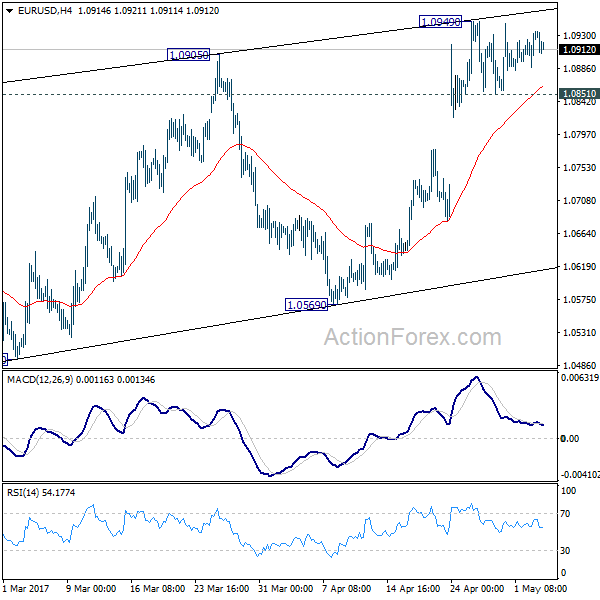

Daily Pivots: (S1) 1.0902; (P) 1.0917 (R1) 1.0946; More….

Intraday bias in EUR/USD stays neutral as the consolidation form 1.0949 temporary top continues. At this point, further rise is still expected as long as 1.0851 minor support holds. However, choppy rebound from 1.0339 is seen as a correction. Hence we’d look for topping again on next rise. Meanwhile, on the downside, break of 1.0777 will turn turn bias to the downside for 1.0851 support first.

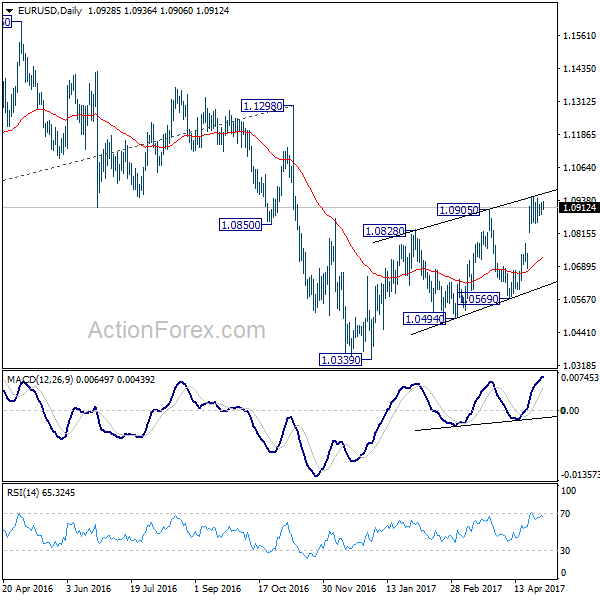

In the bigger picture, as long as 1.1298 key resistance holds, whole down trend from 1.6039 (2008 high) is still expected to continue. Break of 1.0339 low will send EUR/USD through parity to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. However, considering bullish convergence condition in weekly MACD, break of 1.1298 will indicate term reversal. This would also be supported by sustained trading above 55 week EMA.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Unemployment Rate Q1 | 4.90% | 5.10% | 5.20% | |

| 22:45 | NZD | Employment Change Q/Q Q1 | 1.20% | 0.80% | 0.80% | 0.70% |

| 23:01 | GBP | BRC Shop Price Index Y/Y Apr | -0.50% | -0.80% | ||

| 07:55 | EUR | German Unemployment Change Apr | -15K | -10K | -30K | -29K |

| 07:55 | EUR | German Unemployment Rate Apr | 5.80% | 5.80% | 5.80% | |

| 08:30 | GBP | Construction PMI Apr | 53.1 | 52.1 | 52.2 | |

| 09:00 | EUR | Eurozone PPI M/M Mar | -0.30% | 0.10% | 0.00% | |

| 09:00 | EUR | Eurozone PPI Y/Y Mar | 3.90% | 4.30% | 4.50% | |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 A | 0.50% | 0.50% | 0.40% | |

| 12:15 | USD | ADP Employment Change Apr | 177K | 178K | 263K | 255K |

| 14:00 | USD | ISM Services/Non-Manufacturing Composite Apr | 55.9 | 55.2 | ||

| 14:30 | USD | Crude Oil Inventories | -3.3M | -3.6M | ||

| 18:00 | USD | FOMC Rate Decision | 1.00% | 1.00% |