Risk aversion comes back to drive the market as US President Donald Trump, while he was meeting with China President Xi Jinping, ordered air strike on Syria. That was in response to Syrian government’s use of chemical weapons on civilians. Nikkei reversed earlier gains and is trading in red at the time of writing while Hong Kong HSI is trading down -1%. Most Asian indices are generally in red. Gold soars through 1270 to as high as 1271.5 and takes out resistance at 1264.9 firmly. WTI crude oil surges to as high as 52.94, comparing to yesterday’s close at 51.70. In the currency market, renewed buying is seen in the Japanese yen and Swiss Franc. Canadian Dollar decouples with Aussie and Kiwi thanks to oil prices.

Trump told reporters that he "ordered a targeted military strike on the airfield in Syria from where the chemical attack was launched." And he emphasized that the strike was in the "vital national security interest of the United States" as more than 70 civilians were killed by chemical weapons. Trump’s act is seen by some analysts as a reversal of his stance during his election campaign last year. At the time Trump repeatedly criticized former President Barrack Obama for acting in Syria without approval of the Congress.

Meanwhile, the focus will stay on Trump as he meets Chinese President Xi Jinping with topics like North Korea and trade at the top of the agenda.

Non-farm payroll expected to be a solid one

US job report will be another major focus of the day. Markets expect non-farm payroll to show 177k growth in March. Unemployment rate is expected to be unchanged at 4.7%. Average hour earnings are expected to rise 0.3% mom. Taking a look at other employment data, the ADP report showed solid growth of 263k in private sector jobs. Four week moving average of initial jobless claims rose 6k to 250k but stayed low.

Employment component of ISM manufacturing index jumped to 58.9, up from 54.2 and hit the highest level since June 2011. However, employment component of ISM non-manufacturing tumbled to 51.5, down from 55.2, and hit the lowest level since last August. Conference Board consumer confidence, on the other hand, jumped to 125.6, up from 116.1, and hit the highest level since December 2000.

So overall, other employment data suggest that today’s NFP will be a solid one. The greenback could have a positive reaction, in particular if wage growth maintained pace. But the impact could be temporary as Fed policy makers will still need something more to convince them to adapt a faster tightening path.

Elsewhere…

Japan labor cash earnings rose 0.4% yoy in February. Swiss will release unemployment rate and foreign currency reserves in European session. UK will release productions and trade balance. Germany will also release production and trade balance. In US session, in addition to NFP, Canada will also release employment data and Ivey PMI.

USD/JPY Daily Outlook

Daily Pivots: (S1) 110.34; (P) 110.74; (R1) 111.19; More….

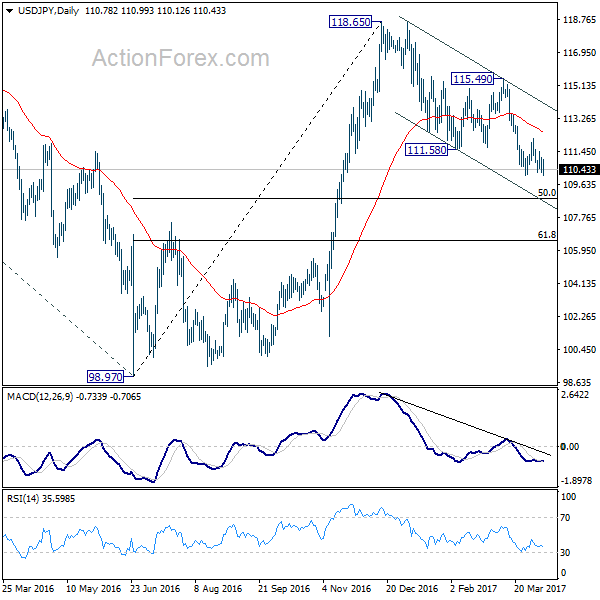

USD/JPY dips notably in Asian session but stays above 110.10 support so far. Intraday bias remains neutral and more consolidations cannot be ruled out. But still, break of 112.19 resistance is needed to indicate short term reversal. Otherwise, outlook will stay bearish for another fall. Break of 110.10 will extend the whole decline from m 118.65 and target 50% retracement of 98.97 to 118.65 at 108.81. On the upside, however, break of 112.19 resistance will indicate short term reversal and turn bias back to the upside for 115.49 resistance.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the correction is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance. Nonetheless, sustained trading below 55 week EMA (now at 111.16) will extend the consolidation from 125.85 with another fall through 98.97 before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:00 | JPY | Labor Cash Earnings Y/Y Feb | 0.40% | 0.50% | 0.50% | 0.30% |

| 5:00 | JPY | Leading Index Feb P | 104.6 | 104.9 | ||

| 5:45 | CHF | Unemployment Rate Mar | 3.30% | 3.30% | ||

| 6:00 | EUR | German Industrial Production M/M Feb | -0.20% | 2.80% | ||

| 6:00 | EUR | German Trade Balance (EUR) Feb | 19.4B | 18.5B | ||

| 7:00 | CHF | Foreign Currency Reserves Mar | 674.0B | 668.2B | ||

| 8:30 | GBP | Industrial Production M/M Feb | 0.20% | -0.40% | ||

| 8:30 | GBP | Industrial Production Y/Y Feb | 3.70% | 3.20% | ||

| 8:30 | GBP | Manufacturing Production M/M Feb | 0.30% | -0.90% | ||

| 8:30 | GBP | Manufacturing Production Y/Y Feb | 3.90% | 2.70% | ||

| 8:30 | GBP | Construction Output M/M Feb | 0.00% | -0.40% | ||

| 8:30 | GBP | Visible Trade Balance (GBP) Feb | -10.9B | -10.8B | ||

| 12:00 | GBP | NIESR GDP Estimate Mar | 0.60% | 0.60% | ||

| 12:30 | CAD | Net Change in Employment Mar | 5.7k | 15.3k | ||

| 12:30 | CAD | Unemployment Rate Mar | 6.70% | 6.60% | ||

| 12:30 | USD | Change in Non-farm Payrolls Mar | 177k | 235k | ||

| 12:30 | USD | Unemployment Rate Mar | 4.70% | 4.70% | ||

| 12:30 | USD | Average Hourly Earnings M/M Mar | 0.30% | 0.20% | ||

| 14:00 | CAD | Ivey PMI Mar | 56.3 | 55 |