The direction in the forex markets isn’t too clear for the moment. Dollar firmed up mildly overnight and is maintaining broad based gains over the week. But there is clearly no follow through momentum while USD/JPY has indeed dipped notably in Asian session. Sterling continues to stay soft on Brexit dead lock but than the sellers are refusing to jump in yet. There are still hopes of a breakthrough in Brexit negotiation by the end of the week. Meanwhile, Aussie tumbles broadly today after GDP missed expectation and showed very weak consumption. BoC rate decision is the biggest feature today but could be a non-event. Instead, ADP job data from US could sparkle some moves in the greenback.

Australia GDP showed weak spending growth

Australian Dollar tumbles broadly today as weighed down by disappointing GDP data. Q3 GDP rose 0.6% qoq 2.8%, below expectation of 0.7% qoq, 3.0% yoy. Despite the miss, the headline numbers are not bad at all. Treasurer Scott Morrison described the figures as indicating "solid" economic growth. And he said that "this is above the OECD average and puts Australia back up towards the top of the pack for major advanced economies around the world." However, weak household consumption is seen as the most worrying part of the details. Consumer spending grew just 0.1% qoq and was at the lowest rate in more than a decade since 2005. Sluggish wage growth, as pointed out by RBA rate statement released yesterday, was a key factor and would likely continue to be.

House named tax bill conference committee member, Senate to follow

US House Speaker Paul Ryan has always named nine Republicans to join the conference committee on reconciling the tax bills with Senate. Senate Majority Whip John Cornyn indicated that a couple of days are needed to appoint the conference committee members. The so called corporate Alternative Minimum Tax is a sticky point which House and some Senators would try to repeal. It’s an insurance policy to prevent companies from using various breaks to pay too little tax under the current law. And Senate made a last minute change to preserve this AMT in their bill. House Ways and Means Chairman Kevin Brady criticized that preserving AMT would "undermine the pro-growth provisions in that code." And it’s seen by tax experts to result in higher than intended taxes in particular for the technology sector. That’s a major reason for NASDAQ underperforming DOW recently.

Chicago Fed Evans wants to push next rate move to mid 2018

Chicago Fed President Charles Evans, a known dove, said in an interview by NY Times that the case for a December rate hike is not "obvious". And he urged a cautious approach to delay the next move till next summer. He noted that "maybe it’s time to stop and see whether inflation expectations are going to move in line with our 2% objective. And if the judgment was that we’re still likely to be underrunning our 2% objective, maybe we would stop briefly and assess for more information, maybe wait until mid-2018."

Brexit Secretary Davis: Everything applies to whole UK

In UK, Brexit Secretary David Davis told the parliament that regarding the issue of Irish border, the government is just seeking "regulatory alignment" with EU. He added that "alignment isn’t harmonization. It isn’t having exactly the same rules. It is sometimes having mutually recognized rules, mutually recognized inspection – that is what we are aiming at." And, he emphasized that "the presumption of the discussion was that everything we talked about applied to the whole United Kingdom." This is in response to Northern Irish DUP, which interrupted the meeting between Prime Minister Theresa May and European Commission President Jean Claude Juncker. DUP leader Arlene Foster was deeply concerned that the deal of Irish border will make Northern Ireland leaving EU on different terms then other part of the UK.

The collapse of the Brexit talk and failure to reach any agreement left many EU officials in frustration. It’s reported that the May will need to confirm the final proposal by this Friday, or Sunday as the last resort, for review in the EU summit on December 14/15. It’s pointed out that the collapse was just the symptom of a wider problem. Weakness of the UK government is the main obstacle to the negotiation. And, May seems unable to make her decisions as there is not even unified stance within her own party, not to mention with her coalition partners. The upcoming developments will be watched as May is expected to go back to Brussels by the end of the week.

Looking ahead

Bank of Canada rate decision will be the main focus of the day. BoC is widely expected to keep interest rate unchanged at 1.00%. Attention will be on whether BoC would sound more upbeat in the statement after recent solid data. And, traders will reassess the chance of more rate hike by BoC next year.

Germany factory order, Swiss CPI and Eurozone retail PMI will be released in European session. US ADP employment, non-farm productivity and Canada labor productivity will be featured in US session.

AUD/USD Daily Outlook

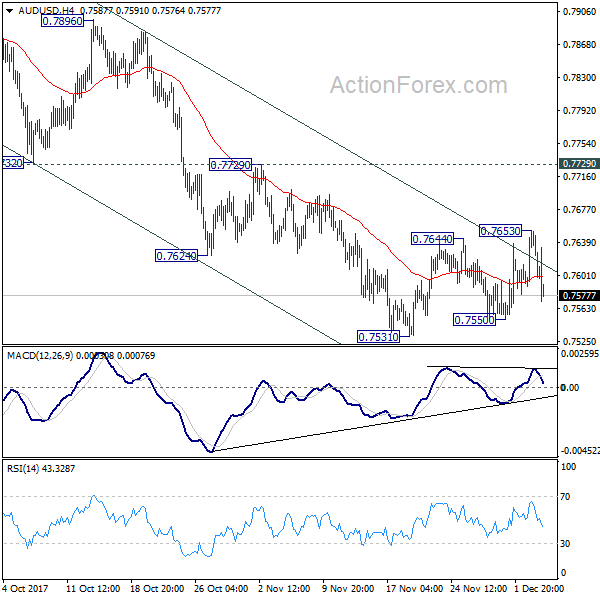

Daily Pivots: (S1) 0.7584; (P) 0.7618; (R1) 0.7642; More…

AUD/USD’s recovery was limited at 0.7653 and weakened again. Outlook remains unchanged that price actions from 0.7531 are forming a consolidation pattern. Intraday bias stays neutral for the moment. In case of another rise, upside should be limited by 0.7729 resistance to bring fall resumption. Break of 0.7550 will resume whole decline from 0.8124 and target next key cluster level at 0.7322/8. Nonetheless, break of 0.7729 will indicate near term reversal, with bearish divergence condition in 4 hour MACD. And stronger rebound would be seen back to 0.7896 resistance and above.

In the bigger picture, corrective rise from 0.6826 medium term bottom is likely completed at 0.8124, after hitting 55 month EMA (now at 0.8033). Decisive break of 0.7328 key cluster support (61.8% retracement 0.6826 to 0.8124 at 0.7322) will confirm. And in that case, long term down trend from 1.1079 (2011 high) will likely be resuming. Break of 0.6826 will target 61.8% projection of 1.1079 to 0.6826 from 0.8124 at 0.5496. This will now be the favored case as long as 0.7729 near term resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | GDP Q/Q Q3 | 0.60% | 0.70% | 0.80% | 0.90% |

| 7:00 | EUR | German Factory Orders M/M Oct | -0.20% | 1.00% | ||

| 8:15 | CHF | CPI M/M Nov | 0.00% | 0.10% | ||

| 8:15 | CHF | CPI Y/Y Nov | 0.80% | 0.70% | ||

| 9:10 | EUR | Eurozone Retail PMI Nov | 51.1 | |||

| 13:15 | USD | ADP Employment Change Nov | 191K | 235K | ||

| 13:30 | CAD | Labor Productivity Q/Q Q3 | -0.10% | |||

| 13:30 | USD | Nonfarm Productivity Q3 F | 3.30% | 3.00% | ||

| 13:30 | USD | Unit Labor Costs Q3 F | 0.30% | 0.50% | ||

| 15:00 | CAD | BoC Rate Decision | 1.00% | 1.00% | ||

| 15:30 | USD | Crude Oil Inventories | -3.4M |