Dollar recovers broadly today, except versus Japanese yen. But momentum in the greenback doesn’t warrant a sustainable rebound yet. For the moment, Euro is still in the driving seat in the forex markets. Political news out of Germany over the weekend looked positive as Chancellor Angela Merkel secured support form her allies on grand coalition. This will remain a major topic of attention for the week ahead. Besides, US Senate is set to floor their version of tax bill and could trigger some volatilities on the markets. The economic calendar is light today but will build up intensity towards the end of the week. In particular, inflation data from Eurozone, US and Japan are the highlights.

Merkel got support for grand coalition ahead of meeting with SPD

In Germany, Chancellor Angela Merkel met several leaders in her Christian Democratic party in Berlin over the week end. Merkel got some support for reforming the grand coalition with SPD After the meeting Daniel Günther, A CDU member and Minister President of Schleswig-Holstein said that effectiveness won’t come from a minority government but "instead an alliance with a parliamentary majority. That is a grand coalition." Leader of the Christian Social Union Horst Lorenz Seehofer also said that "an alliance of the conservatives and the SPD is the best option for Germany – better anyway than a coalition with the Free Democrats and the Greens, new elections or a minority government."

Foreign Minister Sigmar Gabriel, the former leader of the SPD, sounded no committal as he said that no one should take the grand coalition for granted. But he added that Germany needs "a sufficiently courageous, majority-equipped government that is capable of action" as the leader in EU. Merkel will meet with SPD leader Martin Schulz, CSU leader Seehofer and President Frank-Walter Steinmeier on Thursday.

Irish border surfaced as another sticky point for Brexit negotiation

In the Brexit negotiation between UK and EU, the topic of Irish border surfaced as a tough one over the weekend. UK’s international trade secretary Liam Fox warned that "we can’t come to a final answer to the Irish question until we get an idea of the end state." That is, according to Fox, the decision on Irish border won’t be made before reaching a trade agreement with EU. And Fox blamed that "the quicker we can do that the better, and we are still in a position where the EU doesn’t want to do that." UK Prime Minister Theresa May would have to provide further proposals to EU on the three main ares, divorce bill, Irish border and citizens right, before December 4.

Senate to make last minute changes to tax bill before flooring

In the US, it’s reported that Senate Republicans are considering some last-minute changes to the tax bill to secure the votes before flooring this week. Republicans have only a slim 52 majority in the Senate and could afford losing two votes. Ron Johnson and Steve Daines have already expressed concerns that the current bill favors large corporations over other businesses. President Donald Trump also hinted changes as he tweeted "the Tax Cut Bill is getting better and better". Generally, it’s seen that this week is a "make or break" for the tax plan.

For the week ahead

The economic calendar will be very busy towards the end of the week. Inflation data will be the major focuses as Eurozone will release CPI flash, US will release PCE, Japan will also release CPI. ECB will be happy if Eurozone CPI climb to 1.6% yoy as expected. Fed officials will also need to seem some strengthening in core PCE to ease their concerns on slow inflation. Other than those, Fed will release Beige Book economic report. Fed chair Janet Yellen’s testimony will also be watched no matter what. PMI data from UK, ISM from US and Canada employment could also shape the trend in December.

Here are some highlights for the week ahead:

- Monday: US New home sales

- Tuesday: German import prices Gfk consumer sentiment; Eurozone M3; Canada IPPI and RMPI; US trade balance, wholesale inventories, house price indices, consumer confidence

- Wednesday: Japan retail sales; UK BRC shop price, M4, mortgage approvals; Swiss UBS consumption indicator; German CPI, French GDP; US GDP revisions, pending home sales, Fed’s Beige book

- Thursday: New Zealand building permits, ANZ business confidence; Australia private capital expenditure, building approvals; China PMIs; Japan industrial production, housing starts; UK Gfk consumer confidence; Swiss GDP, KOF, retail sales; German retail sales, unemployment; Eurozone CPI, unemployment rate; Canada current account; US unemployment claims, personal income and spending, Chicago PMI

- Friday: New Zealand terms of trade; Japan CPI, household spending, unemployment rate, capital spending; China Caixin PMI manufacturing; Eurozone PMI revision. UK PMI manufacturing; Canada employment; US ISM manufacturing

AUD/USD Daily Outlook

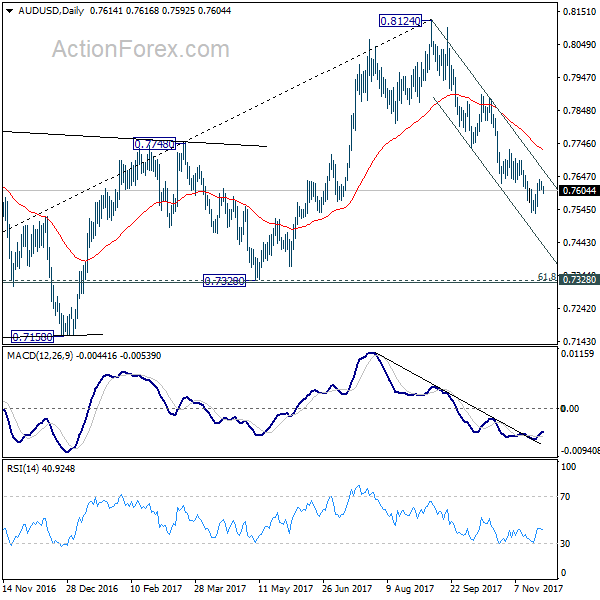

Daily Pivots: (S1) 0.7601; (P) 0.7617; (R1) 0.7627; More…

AUD/USD weakens mildly today as recovery from 0.7531 lost momentum after hitting 0.7638. Intraday bias remains neutral at this point. Near term outlook remains bearish with 0.7729 resistance intact and deeper decline is expected. Break of 0.7531 will resume whole decline from 0.8124 and target next key cluster level at 0.7322/8. However, considering bullish divergence condition in 4 hour MACD, break of 0.7729 will indicate near term reversal and bring stronger rebound back to 0.7896 resistance and above.

In the bigger picture, corrective rise from 0.6826 medium term bottom is likely completed at 0.8124, after hitting 55 month EMA (now at 0.8049). Decisive break of 0.7328 key cluster support (61.8% retracement 0.6826 to 0.8124 at 0.7322) will confirm. And in that case, long term down trend from 1.1079 (2011 high) will likely be resuming. Break of 0.6826 will target 61.8% projection of 1.1079 to 0.6826 from 0.8124 at 0.5496. This will now be the favored case as long as 0.7729 near term resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Y/Y Oct | 0.80% | 0.90% | 0.90% | |

| 15:00 | USD | New Home Sales Oct | 627K | 667K |