Yen opens the weak generally lower. USD/JPY’s break of 114.49 key resistance could now open up further rally to 118.65 key resistance. But more is needed to confirm underlying bullish momentum. BoJ Governor Haruhiko Kuroda sounds quite upbeat in his latest assessment in the Japanese economy. US President Donald Trump started his Asian tour by crying that the US has suffered at hands of Japan for many many years, but markets paid little attention. The forex markets are mixed elsewhere with mild strength in Euro. But the initial focus of the week will on whether Dollar can ride on Friday’s strength to resume recent uptrend.

BoJ Kuroda: Economic expansion highly sustainable

BoJ Governor Haruhiko Kuroda said today that the current economic expansion in Japan is "highly sustainable" because it "doesn’t rely on specific factors and is supported by various elements." Also, "the BoJ is mindful of the risk that its low-interest rate policy, if prolonged, could weigh on financial institutions’ profits." These comments are seen as sign that BoJ is not in a position to expand stimulus further, even though it’s still far from an exit.

Trump: US has suffered at the hands of Japan for many, many years

US President Donald Trump started his five nation Asian tour in Japan over the weekend. Trump criticized one of the closest allies of US in their their home land and said that "the United States has suffered massive trade deficits at the hands of Japan for many, many years." He went further and said that "right now our trade with Japan is not free and it’s not reciprocal" and pledged that "it will be done in a quick and very friendly manner."

General HR McMaster said Trump’s focuses will be on three goals, including promoting an open and free Indo-Pacific region, boosting fair trade, and strengthening international resolve to denuclearize North Korea. Trump will also visit South Korea, China, Vietnam and the Philippines during the 11 day trip.

New York Fed Dudley to announce early retirement

It’s reported that outspoken New York Fed President William Dudley is going to announce retirement as soon as this week. And, the data is pulled head from January 2019 to spring 2018. That would come after Fed Governor Jerome Powell take over the Fed chair job from Janet Yellen in February. Dudley is widely regarded as a close ally of Yellen and her predecessor Ben Bernanke. Dudley’s departure is seen as another sign that Fed would further depart from the path laid down by Bernanke and Yellen after the global financial crisis.

BoE Carney: Brexit could limit rate cuts to boost slow growth

BoE Governor Mark Carney said on Sunday that growth will slow if UK fails to secure a trading agreement with EU after Brexit. He noted that "in the short term, without question, if we have materially less access (to the EU’s single market) than we have now, this economy is going to need to reorient and during that period of time it will weigh on growth." And there is an "extreme possibility" that if inflation gets out of control in a no-deal scenario, BoE would have no room to cut interest rate to lift growth back on track. .

UK Prime Minister Theresa May will emphasize in a speech to the Confederation of British Industry that the transition period for Brexit is crucial. In an extract of her speech released by office, she said "I know how important it is for business and industry not to face a cliff-edge and to have the time it needs to plan and prepare for the new arrangements." And therefore, "a strictly time-limited implementation period will be crucial to our future success."

RBA and RBNZ to headline a light week

On the data front, Australia TD securities inflation rose 0.3% mom in October. RBNZ 2 year inflation expectations slowed to 2.0% in Q4. Looking ahead, German will release factory orders in European session. Eurozone will release Sentix Investor Confidence, PPI and PMI revision. Swiss will release CPI. Later in the day, Canada will release Ivey PMI.

For the week ahead, RBA and RBNZ rate decisions are the main focus in a rather light week. Both are widely expected to keep interest rates unchanged. Here are some highlights:

- Tuesday: Japan labor cash earnings; UK BRC retail sales monitor; RBA rate decision; German industrial production, Eurozone retail sales and retail PMI; Swiss foreign currency reserves

- Wednesday: China trade balance; Japan leading indicator; Canada housing starts and building permits

- Thursday: RBNZ rate decision; Japan machine orders, current account; Australia home loans, China CPI and PPI; Swiss unemployment; German trade balance; Canada new housing price index; US jobless claims, whole sale inventories

- Friday: RBA monetary policy statement; Japan tertiary index; UK productions, trade balance

USD/JPY Daily Outlook

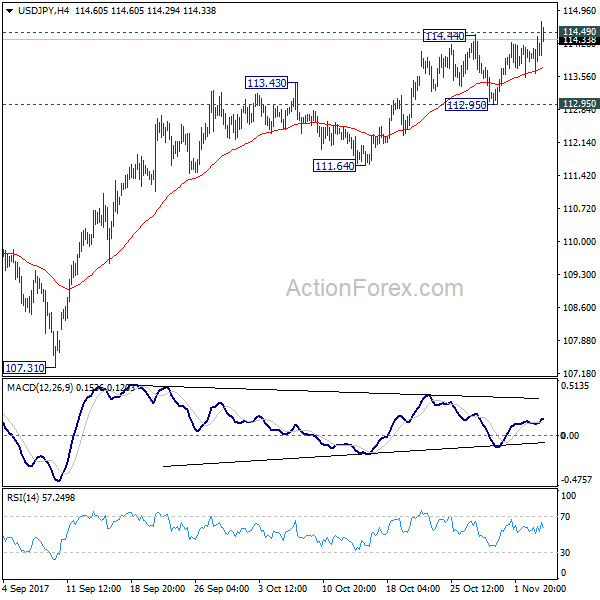

Daily Pivots: (S1) 113.60; (P) 114.01; (R1) 114.44; More…

USDJPY surges in initial trading and breaches 11449 key resistance. The development argues that rally from 107.31 is possibly resuming. Intraday bias is now cautious on the upside. Sustained trading above 114.49 will pave the way to retest 118.65 high. However, break of 112.95 support will now indicate rejection from 114.49 and turn bias to the downside for 111.64 support and below.

In the bigger picture, medium term rise from 98.97 (2016 low) is not completed yet. It should resume after corrective fall from 118.65 completes. Break of 114.49 resistance will likely resume the rise to 61.8% projection of 98.97 to 118.65 from 107.31 at 119.47 first. Firm break there will pave the way to 100% projection at 126.99. This will be the key level to decide whether long term up trend is resuming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Minutes Sep Meeting | ||||

| 0:00 | AUD | TD Securities Inflation M/M Oct | 0.30% | 0.30% | ||

| 2:00 | NZD | RBNZ 2-Year Inflation Expectation Q4 | 2.00% | 2.10% | ||

| 7:00 | EUR | German Factory Orders M/M Sep | -1.10% | 3.60% | ||

| 8:15 | CHF | CPI M/M Oct | 0.10% | 0.20% | ||

| 8:15 | CHF | CPI Y/Y Oct | 0.70% | 0.70% | ||

| 8:45 | EUR | Italy Services PMI Oct | 53 | 53.2 | ||

| 8:50 | EUR | France Services PMI Oct F | 57.4 | 57.4 | ||

| 8:55 | EUR | Germany Services PMI Oct F | 55.2 | 55.2 | ||

| 9:00 | EUR | Eurozone Services PMI Oct F | 54.9 | 54.9 | ||

| 9:30 | EUR | Eurozone Sentix Investor Confidence Nov | 31 | 29.7 | ||

| 10:00 | EUR | Eurozone PPI M/M Sep | 0.40% | 0.30% | ||

| 15:00 | CAD | Ivey PMI Oct | 59.6 |