Asian markets trade lower as the week starts on concerns of unrests and geopolitical tensions caused by US president Donald Trump’s executive order regarding immigration ban. Trump signed an executive order last Friday, suspending entry of people from seven Muslim-majority countries for 90 days and suspending the refugee program for 120 days. The situation has then developed into a chaotic one as a federal judge in Brooklyn temporarily blocked part of the executive order. And there were waves of protests with ten of thousands of people rallied in US cities to voice the opposition of the order. The uncertainties over the situation weighed down on market sentiments As Nikkei lost -0.51%. In the currency markets, Dollar trades broadly lower except versus Kiwi. Yen surges on risk aversion. The uncertainties might take some time to clear.

On the data front, New Zealand trade deficit narrowed to NZD -41m in December. Japan retail sales rose 0.6% yoy in December, below expectation of 1.6% yoy. Swiss KOF leading indicator will be featured in European session. Eurozone will also release confidence indicators and German CPI. US personal income and spending will be the main focus of the day. In particular, core PCE is expected to accelerate to 1.7% yoy in December. And upside surprise there will solidify the case for Fed to hike rates three times this year. US will also release pending home sales.

Looking ahead, one focus of the week is the 2-day FOMC meeting on January 31 and February 1. We do not expect any change in the policy rate as a rate hike was announced in December. Yet, we would focus on the central bank’s tone on the economic outlook after Donald Trump’s inauguration and his signing of a number of executive orders. In addition, US will release ISM indices and non-farm payroll report.

The BoE meeting scheduled on Thursday is also closely watched. We expect policymakers to stay cautious as PM Theresa May indicated a hard Brexit earlier this month. In addition, BoE will release the latest inflation report. Upgrade in growth and inflation forecast could give Sterling a lift. BOJ meeting would be held on Tuesday. Yet, we expect it would be a non-event as the central bank has announced to increase purchases of 5-10 years bonds to JPY 450b, from JPY 410b previously, last week.

Here are some highlights for the week ahead:

- Tuesday: BoJ, Japan household spending, unemployment rate, industrial production; Australia NAB business confidence; France GDP, German retail sales, unemployment, Eurozone CPI, GDP, unemployment rate; UK mortgage approvals; Canada GDP, IPPI and RMPI; US employment cost index, S&P Case Shiller house price, Chicago PMI, consumer confidence

- Wednesday: New Zealand employment; China PMI manufacturing; UK PMI manufacturing; Eurozone PMI manufacturing final; US ADP employment, ISM manufacturing, FOMC rate decision

- Thursday: Australia building approvals, trade balance; Japan consumer confidence; Swiss retail sales; UK construction PMI, BoE rate decision and inflation report; Eurozone PPI; US jobless claims, non-farm productivity

- Friday: China Caixin PMI manufacturing; Eurozone PMI services final, retail sales; UK PMI services; US non-farm payroll, ISM non-manufacturing, factory orders

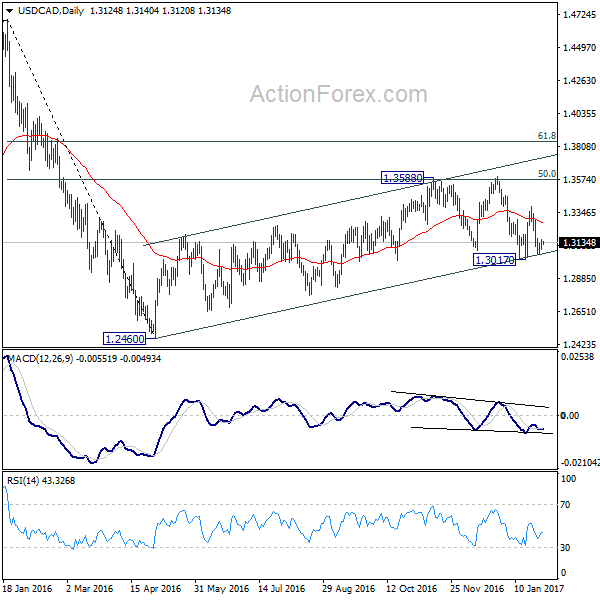

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3103; (P) 1.3127; (R1) 1.3175; More…

Intraday bias in USD/CAD remains neutral for the moment. We’re holding on to the view that consolidation from 1.3588 has completed at 1.3017. Break of 1.3598 will extend the whole choppy rise from 1.2460 to next fibonacci level at 1.3838 and possibly above. Meanwhile, sustained break of 1.3017 will invalidate our view and indicate that rise from 1.2460 has completed and turn outlook bearish for 1.2460.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg is still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. As rise from 1.2460 is seen as a corrective move, we’d look for reversal signal above 1.3838. Meanwhile, break of 1.3017 will likely start the third leg to 1.2460 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Dec | -41M | -95M | -705M | -746M |

| 23:50 | JPY | Retail Trade Y/Y Dec | 0.60% | 1.60% | 1.70% | |

| 8:00 | CHF | KOF Leading Indicator Jan | 102.9 | 102.2 | ||

| 10:00 | EUR | Eurozone Business Climate Indicator Jan | 0.8 | 0.79 | ||

| 10:00 | EUR | Eurozone Economic Confidence Jan | 107.8 | 107.8 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Jan | 0.2 | 0.1 | ||

| 10:00 | EUR | Eurozone Services Confidence Jan | 12.7 | 12.9 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Jan F | -4.9 | -4.9 | ||

| 13:00 | EUR | German CPI M/M Jan P | -0.50% | 0.70% | ||

| 13:00 | EUR | German CPI Y/Y Jan P | 2.00% | 1.70% | ||

| 13:30 | USD | Personal Income Dec | 0.40% | 0.00% | ||

| 13:30 | USD | Personal Spending Dec | 0.50% | 0.20% | ||

| 13:30 | USD | PCE Deflator M/M Dec | 0.20% | 0.00% | ||

| 13:30 | USD | PCE Deflator Y/Y Dec | 1.70% | 1.40% | ||

| 13:30 | USD | PCE Core M/M Dec | 0.10% | 0.00% | ||

| 13:30 | USD | PCE Core Y/Y Dec | 1.70% | 1.60% | ||

| 15:00 | USD | Pending Home Sales M/M Dec | 1.10% | -2.50% |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box