This is a quick update.

Euro tumbles sharply while Yen jumps on as political risks come back to markets. Passing the deadline imposed to Catalan leader Carles Puigdemont, Spanish government said they will "continue with the procedures set out in Article 155 of the Constitution to restore the legality of self-rule in Catalonia." That is, the Spanish Government is going to suspend autonomy of Catalonia.

On the other hand, Puigdemont refused to withdraw the declaration of independence. And Puigdemont said that he will still go on with the declaration unless Madrid agrees to talk. Puigdemont said that "if the central government persists in blocking dialogue and continues its repression, the Catalan Parliament may proceed, if it considers it appropriate, to approve a formal declaration of independence."

Euro reverses much gains against Yen and Dollar. But still, EUR/JPY is staying in range and keeping intraday bias neutral.

New Zealand Dollar plunges today on news that New Zealand First would be forming a coalition with the Labour Party. And Jacinda Ardern will become the next Prime Minister. An important to note is that both Labour and NZ First propose reduction in net immigrations and reform on the RBNZ. Cutting immigration is seen as a factor that will drag on economic growth. Also, Labour-led government would likely boost social spending and push to add full employment to RBNZ’s mandate. And the overall effect is prolonging RBNZ’s accommodative policy.

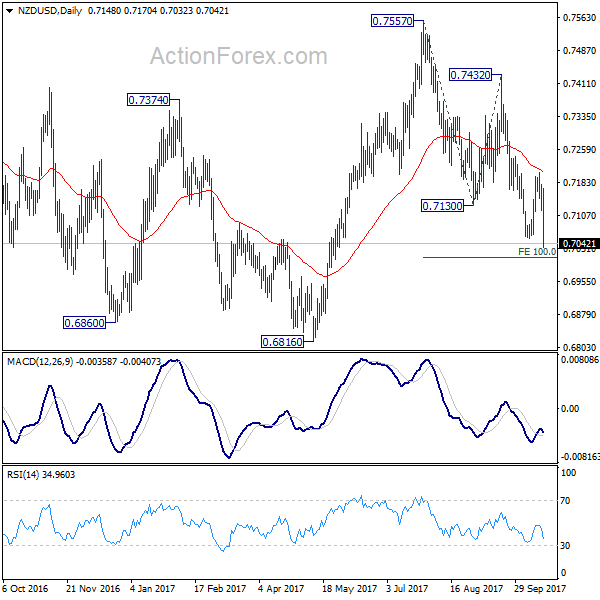

NZD/USD dives to as low as 0.7032 so far today. The break of 0.7055 support confirms resumption of whole decline from 0.7557. NZD/USD should now target 100% projection of 0.7557 to 0.7130 from 0.7432 at 0.7005 first. And, sustained break there will pave the way to retest 2017 low at 0.6816.