Much volatility was seen in Sterling in the past 24 hours on news regarding Brexit. British Pound suffered steep selling yesterday on news that the fifth round of Brexit negotiations ended with "deadlocks" on the issue of the divorce bill. Nonetheless, Sterling was quickly popped up by reports that UK could get a 2-year Brexit extension. A German newspaper Handelsblatt quoted unnamed source that EU could give that extension to UK under the conditions that the latter will fullfil all obligations as a member country. However, UK will be required to give up its voting rights. If it’s true, more time will be allowed for business and citizens of both UK and EU to adjust to the changes.

Meanwhile, BBC reported that a draft paper was submitted to the 27 EU states by European Council President Donald Tusk. The paper indicates that free trade talks could start as soon as December. It’s near impossible that EU officials will give a "go" signal for trade discussion at the October 19/20 summit due to lack of "sufficient progress" in the negotiations. But opening up the case for start trade agreements in December could give UK the "carrots" for being more decisive on closing issues like the divorce bill.

ECB to cut monthly asset purchase size by half

It’s reported the ECB policy makers are considering to cut the monthly asset purchase target by at least half starting next year. That is, the current EUR 60b per month pace could be lowered to EUR 30b per month. Some officials see that as a feasible option. But there are differences on the duration of the extension of the program. ECB spokesman declined to comment on the report.

ECB President Mario Draghi reiterated that interest rate will remain at the current record low "well past" the end of the asset purchase program. He emphasized that the "’well past’ is very, very important in anchoring rate expectations." ECB is widely expected to "recalibrate" its asset purchase program this month on October 26.

Trump have more Fed chair interviews to come

In US, White House Chief of Staff John Kelly said that President Donald Trump will have more interviews with the candidates for the job of Fed chair. Kelly said that "all of the people who’ve been in to interview have been first-round draft choices". And, "we still have more to come." The current short list include Fed Chair Janet Yellen, former Fed Governor Kevin Warsh, current Fed Governor Jerome Powell, Trump’s economic advisor Gary Cohn and Stanford University economist John Taylor. Separately, Treasury Secretary Steven Mnuchin said that Trump has no specific deadline to make the decision but it should happen within the month.

Fed Bullard urged not to lose credibility

St. Louis Fed President James Bullard warned that Fed could lose its credibility if it insists on normalizing interest rate without clear evidence of rising inflation. He noted that "if you are going to have an inflation target you should defend it. If you say you are going to hit the inflation target then you should try to hit it and maintain credibility." He pointed to the sluggishness in this year’s inflation and said "we more or less lost all the progress that we made the last two years". And, that can send a signal to markets that the inflation target is not that important."

Fed Governor Jerome Powell said that "Fed policy normalization is occurring not in isolation, but in the context of a solid U.S. economic recovery, which should benefit all economies around the world." And, "the most likely outcome is that the challenges posed to (emerging markets) by the normalization of global financial conditions will be manageable."

China trade surplus narrowed

Released from China, trade surplus surprisingly narrowed to a 6-month low of US$28.5B in September, from US$42B a month ago. The market had anticipated a milder drop to US$39.5B. Growth in exports improved to 8.1% y/y from 5.5% in August, while growth imports accelerated significantly to +18.7% from July’s +13.3%.

Notwithstanding a disappointing headline, the report continued to paint a healthy picture on China’s economic outlook. A stronger-than-expected imports growth underpinned domestic economic strength. Exports growth, despite missing consensus, still picked up from the same period last year.

More importantly, a narrowing trade surplus could tame the US’ complaint of China’s currency manipulation. This should help the government maintain a stable and modestly strong renminbi as CCP’s 19th national congress approaches. More in Strong Domestic Demand Despite Weak Surplus Headline.

Elsewhere

New Zealand Business NZ manufacturing index dropped to 57.5 in September. Japan M2 rose 4.1% yoy in September. German CPI was finalized at 0.1% mom, 1.8% yoy in September. US CPI and retail sales will be the main feature later in the day.

EUR/GBP Daily Outlook

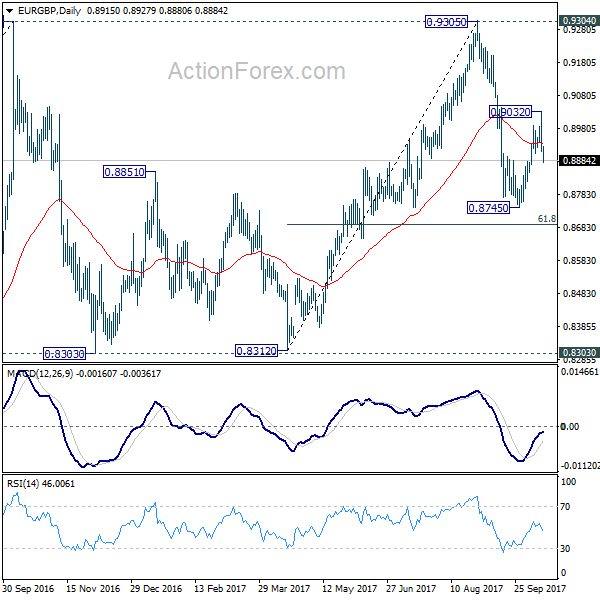

Daily Pivots: (S1) 0.8877; (P) 0.8954; (R1) 0.8995; More…

The sharp decline from 0.9032 argues that rebound from 0.8745 could have completed. Intraday bias in EUR/GBP is turned back to the downside for 0.8745. Break there will resuming the whole fall from 0.9305 towards 0.8303/12 key support level. On the upside, above 0.9032 will resume the rebound from 0.8745 through 61.8% retracement of 0.9305 to 0.8745 at 0.9091 for retesting 0.9305.

In the bigger picture, there are various ways to interpret price actions from 0.9304 high. But after all, firm break of 0.9304/5 is needed to confirm up trend resumption. Otherwise, range trading will continue with risk of another fall. And in that case, EUR/GBP could have a retest on 0.9303 low. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business Performance of Manufacturing Index Sep | 57.5 | 57.9 | ||

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Sep | 4.10% | 4.00% | 4.00% | |

| 0:30 | AUD | RBA Financial Stability Review | ||||

| 3:30 | CNY | Trade Balance (USD) Sep | 28.5B | 38.1B | 42.0B | |

| 3:30 | CNY | Trade Balance (CNY) Sep | 193B | 266B | 287B | |

| 6:00 | EUR | German CPI M/M Sep F | 0.10% | 0.10% | 0.10% | |

| 6:00 | EUR | German CPI Y/Y Sep F | 1.80% | 1.80% | 1.80% | |

| 7:15 | CHF | Producer & Import Prices M/M Sep | 0.50% | 0.30% | 0.30% | |

| 7:15 | CHF | Producer & Import Prices Y/Y Sep | 0.80% | 0.60% | 0.60% | |

| 12:30 | USD | CPI M/M Sep | 0.60% | 0.40% | ||

| 12:30 | USD | CPI Y/Y Sep | 2.30% | 1.90% | ||

| 12:30 | USD | CPI Core M/M Sep | 0.20% | 0.20% | ||

| 12:30 | USD | CPI Core Y/Y Sep | 1.80% | 1.70% | ||

| 12:30 | USD | Advance Retail Sales Sep | 1.50% | -0.20% | ||

| 12:30 | USD | Retail Sales Less Autos Sep | 0.90% | 0.20% | ||

| 14:00 | USD | U. of Michigan Confidence Oct P | 95.1 | 95.1 | ||

| 14:00 | USD | Business Inventories Aug | 0.50% | 0.20% |