The forex markets open the week rather steadily. Dollar recovers as it’s digesting last week’s steep selloff. The greenback will look into the key events including ISM indices, NFP and FOMC minutes for reasons to rebound. On the other hand, there are important economic data from UK and Canada, as well as ECB accounts that could trigger further rises in respective currency. Meanwhile, additional focus will also be on whether the selloff in global equities last week would extend. It isn’t too bad at the timing of writing as Nikkei is trading up 0.28%, above 20000 handle. An eye will also be on oil price while WTI is consolidating above 46 handle, looking for strength to extend the rebound in the last two weeks.

Japan large manufacturers sentiment hits 3 year high

Japan Tankan large manufacturers index jumped to 17 in Q2, up fro 12, and beat expectation of 15. That’s the highest reading in three years. Large manufacturers outlook improved to 15, up from 11, above expectation of 14. Non-manufacturing index rose to 23, up from 20, and met consensus. Non-manufacturing outlook rose to 18, up from 16, but missed expectation of 21. The survey was generally consistent with recent upgrade of economic assessment by BoJ. But still, the positive developments in the economy is not being translated into price pressure yet. And BoJ is far from stimulus exit.

Rebound in China manufacturing may be temporary

The Caixin China PMI manufacturing rose to 50.4 in June, up from 49.6 and beat expectation of 49.8. That’s back in expansion territory and was the highest level in three months. However, a CEBM Group economist noted in the accompany statement for the release that "based on the inventory trends and confidence around future output, the June reading was more like a temporary rebound, with an economic downtrend likely to be confirmed later."

Elsewhere, Australia TD Securities inflation rose 0.1% mom in June. Building approvals dropped -5.6% mom in May.

PMI data as the focus on the day

As for today, PMI data will be the main focus. UK will release PMI manufacturing in European session. Eurozone will release unemployment rate and PMI manufacturing final. Swiss will release retail sales and SVME PMI. Later in US session, US will release ISM manufacturing and construction spending.

Fed minutes and non-farm payroll keys for the week

For the week ahead, US events will be the major focuses. Dollar was the second weakest major currency last month as many of global central banks turned hawkish. There are a lot of doubts on whether Fed will deliver another rate hike in September. So far, comments from FOMC officials are divided. And the markets will be eager to look deeper into the discussion regarding the rate hike in June, from the FOMC minutes. In addition, ISM manufacturing and non-manufacturing indices, and more importantly, the non-farm payroll report will be important in shaping up the chance for the September decision.

Elsewhere, ECB monetary policy meeting accounts will also be watched for indication on how ready are policymakers on stimulus exit. UK data including PMIs and productions will be watched as BoE will start debating rate hikes in the coming months. Canadian employment data will also be important in shaping the chance for a July hike by BoC. RBA rate decision on Tuesday will likely be a non-event.

Here are some highlights for the week ahead:

- Tuesday: Australia retail sales, RBA; UK construction PMI, BRC shop price; Eurozone PPI

- Wednesday: Eurozone PMI services final, retail sales; UK PMI services; US factory orders, FOMC minutes

- Thursday: Australia trade balance; German factory orders, ECB meeting accounts; Swiss CPI; US ADP employment, trade balance, ISM services, jobless claims; Canada building permits, trade balance

- Friday: Japan labor cash earnings; Swiss unemployment, foreign currency reserves; German industrial production; UK productions, trade balance; Canada employment, Ivey PMI; US non-farm payrolls

USD/JPY Daily Outlook

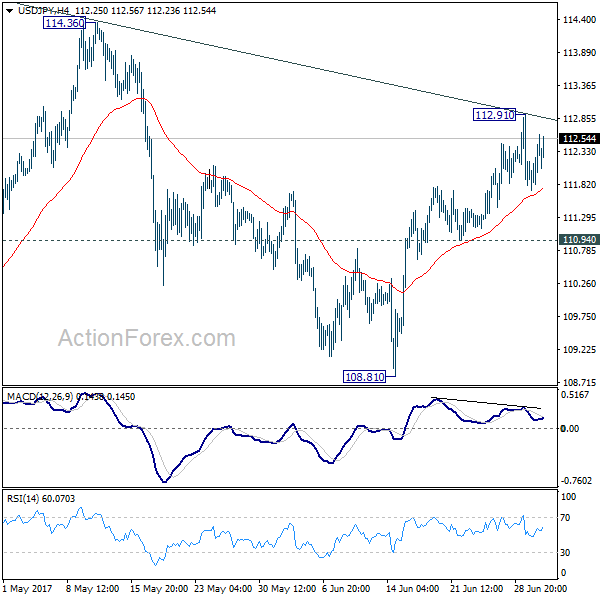

Daily Pivots: (S1) 111.85; (P) 112.23; (R1) 112.73; More…

Intraday bias in USD/JPY remains neutral as it’s consolidating below 112.91 temporary top. On the upside, Sustained break of the medium term channel resistance will argue that whole pull back from 118.65 has completed at 108.12 already. In such case, further rise should be seen to 114.36 resistance for confirmation. However, break of 110.94 will argue that rebound from 108.81 has completed and will turn bias back to the downside for this support instead.

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturers Index Q2 | 17 | 15 | 12 | |

| 23:50 | JPY | Tankan Large Manufacturers Outlook Q2 | 15 | 14 | 11 | |

| 23:50 | JPY | Tankan Non-Manufacturing Index Q2 | 23 | 23 | 20 | |

| 23:50 | JPY | Tankan Non-Manufacturing Outlook Q2 | 18 | 21 | 16 | |

| 23:50 | JPY | Tankan Small Mfg Index Q2 | 7 | 7 | 5 | |

| 23:50 | JPY | Tankan Small Mfg Outlook Q2 | 6 | 4 | 0 | |

| 23:50 | JPY | Tankan Small Non-Mfg Index Q2 | 7 | 6 | 4 | |

| 23:50 | JPY | Tankan Small Non-Mfg Outlook Q2 | 2 | 3 | -1 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q2 | 7.20% | 0.60% | ||

| 0:30 | JPY | Manufacturing PMI Jun F | 52.4 | 52 | 52 | |

| 1:00 | AUD | TD Securities Inflation M/M Jun | 0.10% | 0.00% | ||

| 1:30 | AUD | Building Approvals M/M May | -5.60% | -1.30% | 4.40% | |

| 1:45 | CNY | Caixin PMI Manufacturing Jun | 50.4 | 49.8 | 49.6 | |

| 5:00 | JPY | Consumer Confidence Jun | 43.9 | 43.6 | ||

| 7:15 | CHF | Retail Sales (Real) Y/Y May | -0.80% | -1.20% | ||

| 7:30 | CHF | SVME PMI Jun | 56.3 | 55.6 | ||

| 7:45 | EUR | Italy Manufacturing PMI Jun | 55.3 | 55.1 | ||

| 7:50 | EUR | France Manufacturing PMI Jun F | 55 | 55 | ||

| 7:55 | EUR | Germany Manufacturing PMI Jun F | 59.3 | 59.3 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Jun F | 57.3 | 57.3 | ||

| 8:30 | GBP | PMI Manufacturing Jun | 56.3 | 56.7 | ||

| 9:00 | EUR | Eurozone Unemployment Rate May | 9.30% | 9.30% | ||

| 14:00 | USD | ISM Manufacturing Jun | 55 | 54.9 | ||

| 14:00 | USD | ISM Prices Paid Jun | 58.5 | 60.5 | ||

| 14:00 | USD | Construction Spending M/M May | 0.20% | -1.40% |