Sterling is steadily in range as the latest poll on the eve of today’s election showed that the Conservative could get an increased majority. According to ICM, Conservatives got a 12 point lead over Labour, 46 to 34. ComRes suggested a 10 point lead with Conservatives at 44, Labour at 34. YouGov said Conservatives got 42 and Labour got 35, 7 point lead. Meanwhile, Survation results showed Conservative at 41.3, Labour at 40.4, a mere 0.9 point lead. YouGov Director Anthony Wells said that "the seven-point Conservative lead is the same as at the previous election, but we think it is likely they will nevertheless be returned with an increased majority." But there is one key factor that analysts pointed out. The turnout of young voters is uncertain and they typically support Labour.

| Conservatives | Labour | Con. Lead | |

| ICM | 46 | 34 | 12 |

| ComRes | 44 | 34 | 10 |

| YouGov | 42 | 35 | 7 |

| Survation | 41.3 | 40.4 | 0.9 |

* Poll released on June 7

Technically, EUR/GBP, currently at 0.8680, is close to top of medium term range of 0.8303/8851. 0.8654 is an important near term suppot for the cross and a firm break there will indicate near term reversal. GBP/JPY is close to a near term fibonacci level at 140.35. Break there would pave the way to test on 135.58 support. But a break of 143.93 resistance will indciate near term reversal and target 148.09. GBP/USD’s recovery from 1.2768 is corrective looking so far and lacks decisive momentum. Key levels to watch are 1.3047 and 1.2768.

Euro holds breath ahead of ECB

Euro spiked lower overnight on talk that ECB would lower inflation forecasts in new staff economic projections to be released today. But the common currency quickly recovered. Bloomberg quoted unnamed source noting that ECB staff forecasts inflation to be at 1.5% in 2017, 2018 and 2019. That’s quite notable downward revision from prior forecasts of 1.7%, 1.6% and 1.7% respectively. Weakness in energy price is seen as a major factor for the change. This will add to the case for policymakers to be have more patience regarding any stimulus exit.

ECB is widely expected to keep key interest rate at 0% and deposit rate at -0.4% today. The asset purchase program will be left unchanged, at EUR 60b per month. ECB officials have generally expressed the view that it won’t raise interest rate before ending the asset purchase in December. It’s still generally expected that, due to receding political risks, the central bank will end the asset purchase after that, and there could be an announcement of some sort in September. The main focus is indeed on whether ECB would close the door for further stimulus by changing the language.

Markets shrugs Comey’s statement

US equities and treasury yields closed mildly higher yesterday, as markets seem to have taken ex-FBI Director James Comey’s written testimony well. Comey will appear in a hearing before Senate Intelligence Committee regarding US President Donald Trump’s intervention in FBI investigation. In Comey’s statement, he noted that Trump asked him to back off from a probe into former national secrutiy advisor Michael Flynn. And Trump told Comey, "I need loyalty. I expect loyalty". But it seems that the markets were expecting much worse from Comey and some noted that it’s not that "smoking gun" that some predicted.

10 year yield is trying to get support from 38.2% retracement of 1.336 to 2.621 at 2.130 for the moment. It remains to be seen if TNX will rebound from here and the key structure resistance is at 2.297. But a rebound from 2.130 would likely help lift up the greenback. And given then EUR/USD is close to 1.1298, a rebound in Dollar that sends EUR/USD through 1.1109 would trigger position squaring and accelerate the move.

Loonie lower as oil plunges

Canadian Dollar weakened following another sharp decline in oil price. WTI dived to as low as 45.65 after data showed unexpected surge in US stockpiles by 3.3m barrels in the week ended June 2. WTI is now set to have a test on 38.2% retracement of 26.05 to 55.24 at 44.09. Meawnwhile, near term outlook in USD/CAD will stay bearish as long as 1.3570 minor resitsance holds.

On the data front

Japan Q1 GDP growth was finalized at 0.3% qoq, below expectation of 0.6% qoq. GDP deflator dropped -0.8% yoy. Japan current account surplus widened to JPY 1.81T in April. China trade surplus widened to USD 40.8b, CNY 282b in May. AUstralia trade surplus narrowed sharply to AUD 0.56b in April. UK RICS house price balance dropped to 17 in May.

Looking ahead, Swiss will release unemployment rate and CPI in Europea session. Germany will release industrial production while Eurozone will release Q1 GDP final. Canada will release housing starts and new housing price index. US will releas initial jobless claims as usual on Thursdays.

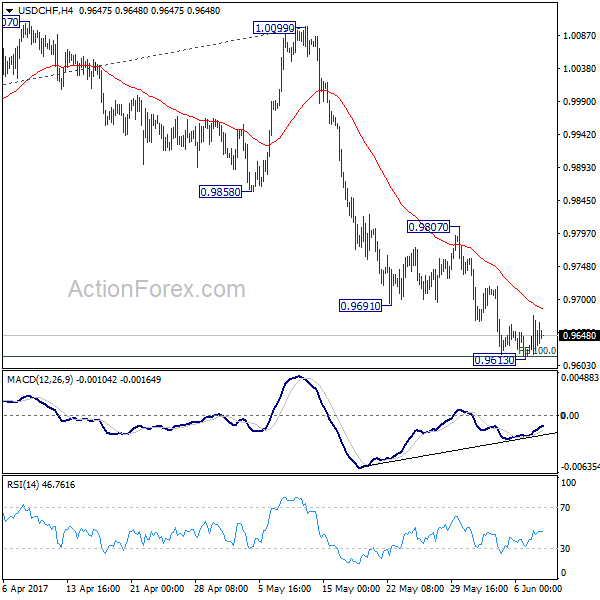

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9615; (P) 0.9646; (R1) 0.9676; More…..

USD/CHF is staying in tight range above 0.9613 temporary low for the moment and intraday bias stays neutral first. Deeper decline is still expected as long as 0.9807 resistance holds. But in case of deeper fall, we’d start to look for bottoming signal again as it approaches 0.9443 key support level. However, considering bullish convergence condition in 4 hour MACD, break of 0.9807 will indicate near term reversal and turn outlook bullish for 1.0099 resistance next.

In the bigger picture, USD/CHF is still bounded in medium term range of 0.9443/1.0342 for the moment. Consolidative trading would likely continue and medium term outlook remains neutral. Break of 1.0342 key resistance is needed to confirm underlying bullish momentum in the pair. Meanwhile, downside attempts should be contained by 0.9443 key support level. However, sustained break of 0.9443 will carry larger bearish implication and target 0.9 handle.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS House Price Balance May | 17.00% | 20.00% | 22.00% | |

| 23:50 | JPY | GDP Q/Q Q1 F | 0.30% | 0.60% | 0.50% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 F | -0.80% | -0.80% | -0.80% | |

| 23:50 | JPY | Current Account (JPY) Apr | 1.81T | 1.62T | 1.73T | |

| 1:30 | AUD | Trade Balance (AUD) Apr | 0.56B | 1.99B | 3.11B | 3.17B |

| 2:30 | CNY | Trade Balance (USD) May | 40.8B | 47.5B | 38.1B | |

| 2:30 | CNY | Trade Balance (CNY) May | 282B | 336B | 262B | |

| 5:00 | JPY | Eco Watchers Survey Current May | 48.5 | 48.1 | ||

| 5:45 | CHF | Unemployment Rate May | 3.30% | 3.30% | ||

| 6:00 | EUR | German Industrial Production M/M Apr | 0.50% | -0.40% | ||

| 7:15 | CHF | CPI M/M May | 0.00% | 0.20% | ||

| 7:15 | CHF | CPI Y/Y May | 0.30% | 0.40% | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q1 F | 0.50% | 0.50% | ||

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 12:15 | CAD | Housing Starts May | 205K | 213K | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | CAD | New Housing Price Index M/M Apr | 0.30% | 0.20% | ||

| 12:30 | USD | Initial Jobless Claims (JUN 03) | 241K | 248K | ||

| 14:30 | USD | Natural Gas Storage | 81B |