Euro’s rally extends in the Asian session today as optimism continues. In particular, EUR/USD reaches new six months high as the greenback is troubled by political turmoil in Washington. But we’d like to point out that Dollar’s weakness is mainly centered against Euro, Swiss Franc and Yen. GBP/USD is held steady in range below 1.2987 resistance. While Aussie and Canadian are helped by commodity and energy prices, movements in AUD/USD and USD/CAD since last week are so far corrective looking. We’d continue to view the current theme in the markets as Euro strength rather than Dollar weakness.

Nonetheless, investors are getting more impatient on US President Donald Trump’s ability to implement his economic policies as he is constantly fighting fire at other fronts. The latest one started as the unexpected firing of James Comey as FBI director just ahead of Trump’s meeting with Russian officials. It’s reported on Monday that Trump shared highly classified intelligence information with Russia. Then yesterday, it’s reported that Trump intervened in FBI and asked Comey to drop investigation on National security adviser Michael Flynn. Also it’s reported that Trump has asked Comey to imprison journalists whole publish classified information.

Atlanta Fed GDPNow forecasts 4.1% growth in Q2

While the markets are getting doubtful on the economy, Atlanta Fed is having another view. According to the GDPNow forecasting model of the Atlanta Fed, US GDP is projected to grow 4.1% in Q2. That’s an upward revision from May 12’s forecast of 3.6%. In particular, real residential investment growth was revised to 8.3%, up from 6.0%, after yesterday’s housing data. Forecast on retail final sales to private domestic purchases was also revised to 3.6%, up from 3.3%, after release of industrial production data. Released yesterday from US, housing starts dropped to 1.17m annualized rate in April while building permits dropped to 1.23m. Industrial production, however, rose 1.0% and beat expectation of 0.4%.

Markets happy with political developments in Europe

Markets responded positively to French President Emmanuel Macron’s appointment of Edouard Philippe as the new prime minister. The role of PM is seen to be a key factor in helping Macron form a parliamentary majority in the election in June. And center-right Republican Philippe would likely boost support from the political right for Macron. The meeting between Macron and German Chancellor Angela Merkel also showed their common ground in preserving European unity. Both of them pledged to draw up a "common road map" for Europe. Merkel is also open to change in the European treaties, showing openness to the reform that Macron would like to push for.

ECB Coeure talked down surge in bond yields

ECB Executive Board member Benoit Coeure said yesterday that the central bank is not concerned with recent surge in Eurozone bond yields. There are talks that the 60bps jump in German bund since September could bother the central bank, which is trying to keep borrowing costs low. But Coeure said that "the recent measurable increase in long-term yields has not affected our monetary policy stance: current financial conditions remain highly supportive of the ongoing recovery." And, "we don’t want to over-interpret any uptick or downtick that we observe, but rather accept as a fact that some volatility is natural and healthy for the market to function."

Also, Coeure noted that "only around a quarter of the change in yields (since September) reflect changes in the expected future policy path." And, "expectations regarding our monetary policy have, on balance, had a stabilizing effect on yields, according to our analysis."

On the data front…

New Zealand PPI inputs rose 0.8% qoq in Q1, above expectation of 0.7% qoq. PPI outputs rose 1.4% qoq, above expectation of 1.1% qoq. Australia wage cost index rose 0.5% in qoq, meeting consensus. Westpac consumer sentiment dropped -1.1%. Japan machine orders rose 1.4% mom in March.

UK job data will be the main focus in European session while Eurozone release April CPI final. Canada will release manufacturing shipments later in the day.

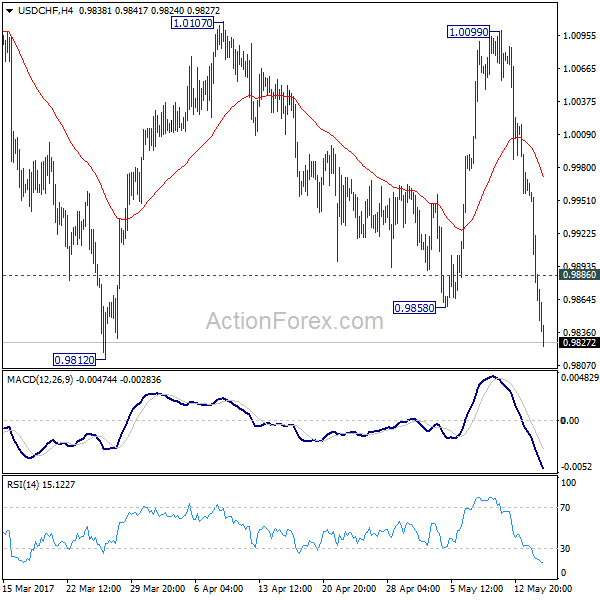

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9942; (P) 0.9980; (R1) 1.0003; More…..

USD/CHF’s decline continues today and reaches as low as 0.9824 so far. The break of 0.9858 support now argues that whole corrective fall from 1.0342 is resuming. Intraday bias stays on the downside for 0.9812 first. Break would target lower trend line support (now at 0.9762) and below. At this point, such decline from 1.0342 is still seen as a correction. Therefore, we’d expect strong support above 100% projection of 1.0342 to 0.9860 from 1.0099 at 0.9617 to contain downside. On the upside, above 0.9886 minor resistance will turn bias neutral and bring recovery before staging another fall.

In the bigger picture, USD/CHF is bounded in medium term range of 0.9443/1.0342 for the moment. Consolidative trading would likely continue and medium term outlook remains neutral. Break of 1.0342 key resistance is needed to confirm underlying bullish momentum in the pair. Meanwhile, downside attempts should be contained by 0.9443 key support level.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Inputs Q/Q Q1 | 0.80% | 0.70% | 1.00% | |

| 22:45 | NZD | PPI Outputs Q/Q Q1 | 1.40% | 1.10% | 1.50% | |

| 23:50 | JPY | Machine Orders M/M Mar | 1.40% | 2.50% | 1.50% | |

| 0:30 | AUD | Westpac Consumer Confidence May | -1.10% | -0.70% | ||

| 1:30 | AUD | Wage Cost Index Q/Q Q1 | 0.50% | 0.50% | 0.50% | |

| 4:30 | JPY | Industrial Production M/M Mar F | -2.10% | -2.10% | ||

| 8:30 | GBP | Jobless Claims Change Apr | 25.5K | |||

| 8:30 | GBP | Claimant Count Rate Apr | 2.20% | |||

| 8:30 | GBP | Average Weekly Earnings 3M/Y Mar | 2.40% | 2.30% | ||

| 8:30 | GBP | ILO Unemployment Rate 3M Mar | 4.70% | 4.70% | ||

| 9:00 | EUR | Eurozone CPI M/M Apr | 0.40% | 0.80% | ||

| 9:00 | EUR | Eurozone CPI Y/Y Apr F | 1.90% | 1.50% | ||

| 9:00 | EUR | Eurozone CPI – Core Y/Y Apr F | 1.20% | 1.20% | ||

| 12:30 | CAD | Manufacturing Shipments M/M Mar | 0.40% | -0.20% | ||

| 14:30 | USD | Crude Oil Inventories | -2.5M | -5.2M |