While oil prices and Canadian Dollar took headlines, it’s indeed the Euro that’s the outstanding one in the early part of the week. The common currency resumed recent rally against dollar is back above 1.1 handle. Markets are getting more optimistic that subsiding political risks in the Eurozone clear up uncertainties over economic outlook. And recent solid economic data also pointing to better momentum in the recovery. If the developments continue, it’s more likely that finally see the start of the end of ECB’s stimulus after the current asset purchase program ends at the end of the year. But for sure, it’s still too early to confirm anything, at least not before new staff economic projections from ECB to be published in June.

For now in short term, Euro is staying firm technically. EUR/USD took out 1.1020 to resume recent rise from 1.0339. Such rally is still seen as a correction, but there is room for more upside in near term for 1.1058 projection level. Outlook in Euro in crosses is actually more bullish. EUR/GBP’s break of 0.8529 today confirms resumption of rise from 0.8312 and further rally should be seen to 0.8786/8851 resistance zone at least. EUR/JPY also resumed recent rise from 109.20 and should be target 126.09 resistance. EUR/AUD’s is still kept below 1.4909 resistance but recent rise looks set to resume for 1.5094 resistance next.

BoJ Kuroda: Quite sure of enough tools for stimulus exit

BoJ Governor Haruhiko Kuroda said today that there "may be some challenging issues" regarding stimulus exit. But he is "quite sure" that the central bank has "enough tools" to manage it. Meanwhile, Kuroda also noted there will be lessons to be learned from Fed’s normalization of policies. But he also emphasized that "the United States is the United States, Japan is Japan. At this stage, we’re not exiting." There has been much concern over the size of BoJ’s balance, in particular that it already took out 40% of JGBs in the markets. But Kuroda talked it down and said there are still 60% left and there won’t be "any constraint" to the so called Yield Curve Control. Release from Japan, Tertiary industry index dropped -0.2% mom in March.

RBA Minutes: Reiterated concerns on housing and labor

The RBA minutes for the May meeting contained little news but reiterated policymakers’ the importance of the property market and the labor market conditions in its policy decision. The stance to leave the monetary policy unchanged was obviously due to the perceived uncertain outlook in these two areas. As noted in the concluding statement in the minutes, ‘the board continued to judge that developments in the labour and housing markets warranted careful monitoring’. More in RBA Reaffirmed Importance Of Housing And Labor Markets On Decision-Making, Defends The Trend Of Rising Part-Time Workers.

UK CPI a major focus today

Looking ahead, UK CPI is a major focus in European session. Headline CPI is expected to accelerate to 2.6% yoy in April. Last week’s BoE meeting argues that the central bank will hold their hands before conclusion of Brexit negotiations. But we’d be eager to see how surging inflation reading would stretch MPC members’ tolerance. UK will also release RPI, PPI and house price index. From Eurozone, GDP is expected to show 0.5% qoq growth in Q1. German ZEW economic sentiment and Eurozone trade balance will also be released. US will release housing starts and building permits, as well as industrial production later in the day.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 124.04; (P) 124.46; (R1) 125.30; More…

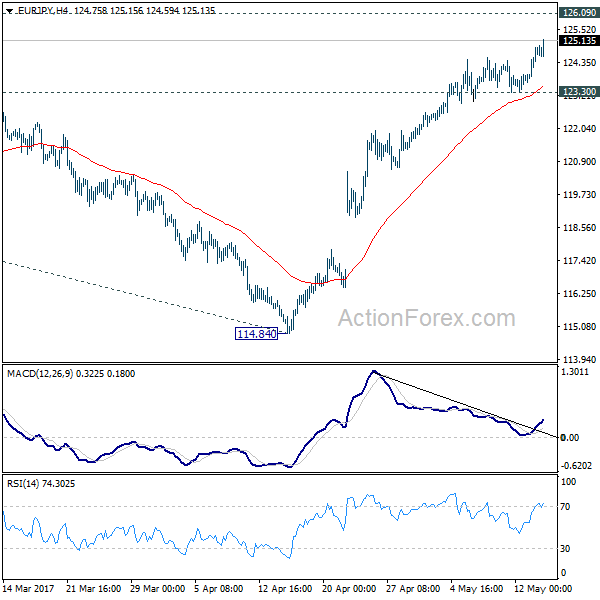

EUR/JPY’s rally resumed by taking out 124.53 and reaches as high as 125.15 so far. Intraday bias is back on the upside. Current rise from 114.84 is part of the medium term rebound from 109.03 and should target 126.09 resistance first. Decisive break there will extend the rise to 100% projection of 109.03 to 124.08 from 114.84 at 129.89. On the downside, break of 123.30 support is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

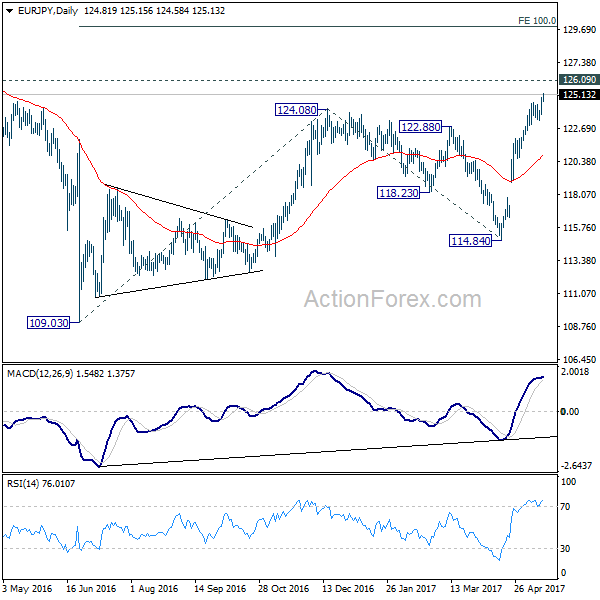

In the bigger picture, focus is back on 126.09 support turned resistance. Decisive break there will confirm completion of the down trend from 149.76. And in such case, rise from 109.20 is at the same degree and should target 141.04 resistance and above. Meanwhile, rejection from 126.09 and break of 114.84 will extend the fall from 149.76 through 109.20 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | RBA Minutes | ||||

| 4:30 | JPY | Tertiary Industry Index M/M Mar | -0.20% | 0.10% | 0.20% | |

| 8:00 | EUR | Italian GDP Q/Q Q1 P | 0.20% | 0.20% | ||

| 8:30 | GBP | CPI M/M Apr | 0.40% | 0.40% | ||

| 8:30 | GBP | CPI Y/Y Apr | 2.60% | 2.30% | ||

| 8:30 | GBP | Core CPI Y/Y Apr | 2.30% | 1.80% | ||

| 8:30 | GBP | RPI M/M Apr | 0.40% | 0.30% | ||

| 8:30 | GBP | RPI Y/Y Apr | 3.40% | 3.10% | ||

| 8:30 | GBP | PPI Input M/M Apr | 0.00% | 0.40% | ||

| 8:30 | GBP | PPI Input Y/Y Apr | 17.00% | 17.90% | ||

| 8:30 | GBP | PPI Output M/M Apr | 0.20% | 0.40% | ||

| 8:30 | GBP | PPI Output Y/Y Apr | 3.40% | 3.60% | ||

| 8:30 | GBP | PPI Output Core M/M Apr | 0.20% | 0.30% | ||

| 8:30 | GBP | PPI Output Core Y/Y Apr | 2.50% | 2.50% | ||

| 8:30 | GBP | House Price Index Y/Y Mar | 5.30% | 5.80% | ||

| 9:00 | EUR | Eurozone Trade Balance (EUR) Mar | 18.8B | 19.2B | ||

| 9:00 | EUR | German ZEW (Economic Sentiment) May | 22 | 19.5 | ||

| 9:00 | EUR | German ZEW (Current Situation) May | 82 | 80.1 | ||

| 9:00 | EUR | Eurozone ZEW (Economic Sentiment) May | 29.1 | 26.3 | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q1 P | 0.50% | 0.50% | ||

| 12:30 | USD | Housing Starts Apr | 1.26M | 1.22M | ||

| 12:30 | USD | Building Permits Apr | 1.27M | 1.27M | ||

| 13:15 | USD | Industrial Production Apr | 0.40% | 0.50% | ||

| 13:15 | USD | Capacity Utilization Apr | 76.30% | 76.10% |