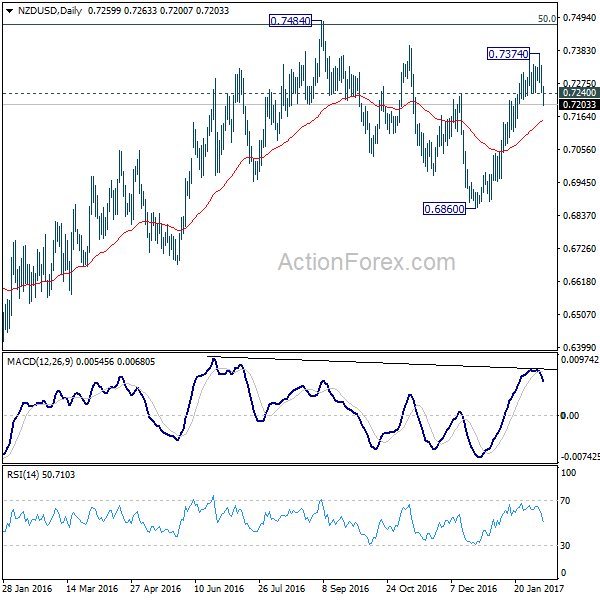

New Zealand Dollar weakens after RBNZ left the Official Cash Rate (OCR) unchanged at 1.75%. More importantly, the central bank adopted a more dovish outlook for the OCR. RBNZ now forecast interest rate to stay at around 1.8% through June 2019 and move up to 2.0% in 2020. The markets were nearly pricing in full chance of a rate hike by November this year. But after the release, such pricing dropped to around 50%. Meanwhile, RBNZ trimmed inflation forecast too. Inflation is projected to be at 1.5% this year, soften to 1.3% at the start of 2018 and then climb back to 2% by mid-2019. Technically, NZD/USD dips through 0.7240 support which now indicates near term reversal. Near term outlook in NZD/USD is now turned bearish for 55 day EMA (now at 0.7150).

Australia Business Confidence Firm

From Australia, NAB business confidence dropped slightly to 5 in Q4, down from 6. Current condition index dropped 2 points to 5. Capital expenditure plans dropped to 22, down from 24. NAB noted that "relative stability of business confidence gives us some comfort". However, "some of the trends could suggest a loss of momentum in the longer term, should they continue." Also, there is "little to no sign that inflation or wage pressures are picking up materially."

UK Businesses to Offer Lower Wage Increase

In UK, a BoE survey showed that businesses are prepared to offer less pay rise this year. Companies expected to offer 2.2% increase in wages, slowed from 2.7% in 2016. That is a reaction to rising costs due to Sterling’s depreciation since last year’s Brexit referendum. BoE also noted that "consumer spending growth had remained resilient, but was expected to ease during the year as prices rose." Wage growth would be a key factor for BoE to determine when to lift interest rate while policies are still tolerant for a spike in headline inflation in near term.

On the data front, New Zealand building consents dropped -7.2% mom in December. Japan M2 rose 4.1% yoy in January while machine orders rose 6.7% mom. UK RICS house price balance rose to 25 in January. Looking ahead, Swiss unemployment rate, German trade balance will be release in European session. Canada will release new housing price index. US will release jobless claims.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7614; (P) 0.7640; (R1) 0.7668; More…

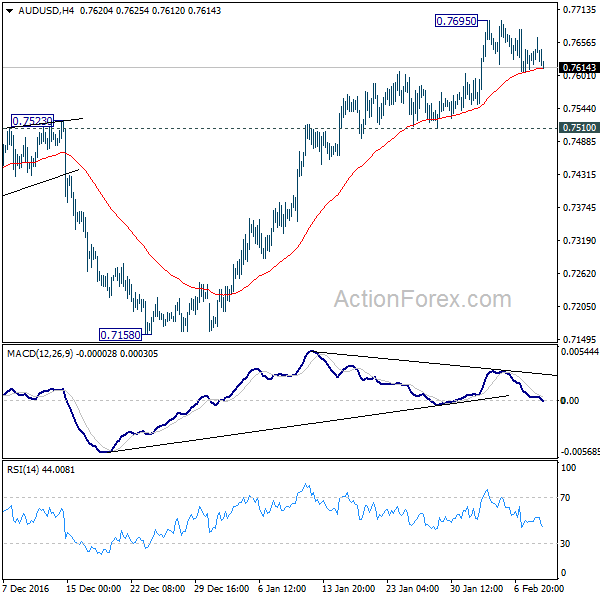

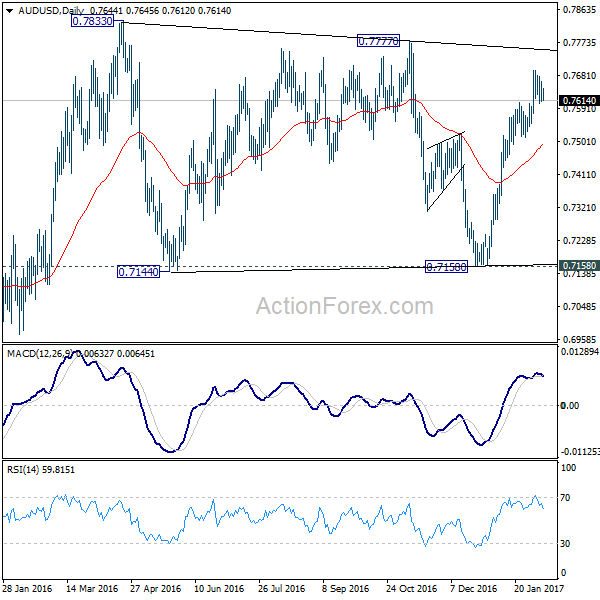

AUD/USD is staying in tight range below 0.7695 and intraday bias stays neutral. Lost up momentum is seen in bearish divergence condition in 4 hours MACD. While another rise cannot be ruled out, we’d expect strong resistance from 0.7777/7833 resistance zone to limit upside and bring near term reversal. On the downside, break of 0.7510 minor support will indicate that rise from 0.7158 has completed already and turn bias back to the downside for this key near term support level.

In the bigger picture, we’re still treading price actions from 0.6826 low as a correction. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seek to 55 month EMA (now at 0.8205) and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% | 1.75% | |

| 21:45 | NZD | Building Permits M/M Dec | -7.20% | -9.20% | -9.60% | |

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Jan | 4.10% | 4.00% | 4.00% | |

| 23:50 | JPY | Machine Orders M/M Dec | 6.70% | 3.10% | -5.10% | |

| 0:01 | GBP | RICS House Price Balance Jan | 25% | 22% | 24% | |

| 0:30 | AUD | NAB Business Confidence Q4 | 5 | 5 | 6 | |

| 6:00 | JPY | Machine Tool Orders Y/Y Jan P | 4.40% | |||

| 6:45 | CHF | Unemployment Rate Jan | 3.30% | 3.30% | ||

| 7:00 | EUR | German Trade Balance (EUR) Dec | 23.2B | 21.7B | ||

| 13:30 | CAD | New Housing Price Index M/M Dec | 0.20% | 0.20% | ||

| 13:30 | USD | Initial Jobless Claims (FEB 04) | 250k | 246k | ||

| 15:30 | USD | Natural Gas Storage | -87B |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box