The financial markets are generally steady ahead of holiday weekend. Dollar index is back below 103 handle but is staying in tight range between 102.50/103.50. Gold follows and stays in range between 1125/1140 for the moment. Meanwhile, crude oil is engaging in consolidative in a relatively wider range between 50/54. Trading in stock markets are also subdued with FTSE and DAX trading nearly flat in European morning. In the currency markets, bigger movement is found in Sterling today which trading broadly lower except versus Aussie and Lonnie. In particular, GBP/USD’s break of 1.2301 support should confirm completion of recent corrective rise from 1.1946. And deeper fall would likely be seen back to 1.1946 in near term.

On the data front, UK Q3 GDP growth was finalized at 0.6% qoq, revised up from prior estimate of 0.5% qoq. Current account deficit widened to GBP -25.5b in Q3. Index of services rose 1.0% 3mo3m in October. Swiss KOF leading indicator was unchanged at 102.2 in December, below expectation of 103.1. German Gfk consumer sentiment rose 0.1 pts to 9.9% in January.

Canada GDP, US new home sales and U of Michigan sentiment final will be released later today.

Happy holidays to our readers, we’ll be back on December 27.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2249; (P) 1.2313; (R1) 1.2350; More…

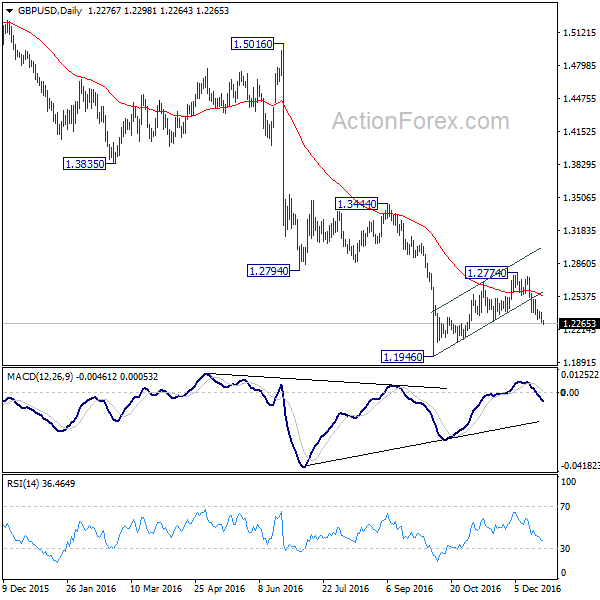

GBP/USD’s fall from 1.2774 continues day. Break of 1.2301 support confirms that corrective rise from 1.1946 has completed at 1.2774 already. Intraday bias stays on the downside for retesting 1.1946 first. Decisive break there will confirm larger down trend resumption. On the upside, above 1.2390 minor resistance will turn bias neutral and bring consolidations first, before staging another decline.

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term bottoming yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 7:00 | EUR | German GfK Consumer Confidence Jan | 9.9 | 9.8 | 9.8 | |

| 8:00 | CHF | KOF Leading Indicator Dec | 102.2 | 103.1 | 102.2 | |

| 9:30 | GBP | GDP Q/Q Q3 F | 0.60% | 0.50% | 0.50% | |

| 9:30 | GBP | Current Account (GBP) Q3 | -25.5B | -28.3B | -28.7B | -22.1B |

| 9:30 | GBP | Index of Services 3M/3M Oct | 1.00% | 0.90% | 0.80% | 1.00% |

| 9:30 | GBP | Total Business Investment Q/Q Q3 F | 0.40% | 0.90% | 0.90% | |

| 13:30 | CAD | GDP M/M Oct | 0.10% | 0.30% | ||

| 15:00 | USD | New Home Sales Nov | 575K | 563k | ||

| 15:00 | USD | U. of Michigan Confidence Dec F | 98.2 | 98 |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box